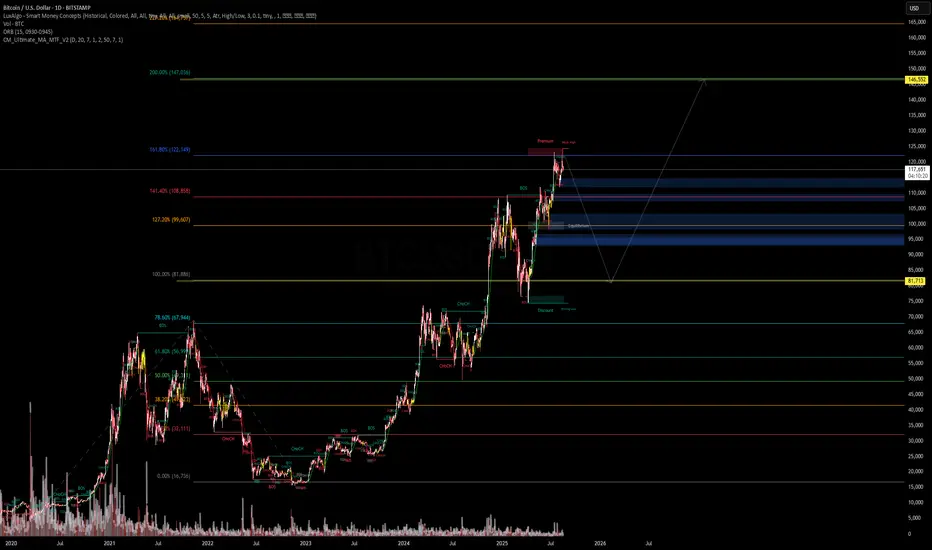

🚨 Bitcoin Macro Outlook – Fibonacci Expansion Targets 🚨

BTC/USD is currently trading around $117K after a strong premium rally. Price has reached the 127% – 141% Fibonacci extension zone ($109K–$116K), which historically acts as a major supply region.

🔹 Key Observations:

Premium Zone: Current highs show exhaustion signs with potential corrective pullback.

Retracement Zone: Watch the $95K–$100K region (equilibrium + demand block) as the most probable correction target.

Continuation: If this zone holds, upside expansion points to $146K (200% Fib) as the next macro objective.

📈 Strategy View:

Short-term: Expect correction into the $95K–$100K range.

Mid-term: Accumulation in discount zone offers asymmetric long setups.

Long-term: Next expansion target at $146K+ if bullish structure remains intact.

⚖️ Risk management is critical here — chasing highs in the premium zone carries poor R/R, but planned entries in equilibrium zones offer favorable setups.

#Bitcoin #BTC #CryptoTrading #TechnicalAnalysis #SmartMoneyConcepts

BTC/USD is currently trading around $117K after a strong premium rally. Price has reached the 127% – 141% Fibonacci extension zone ($109K–$116K), which historically acts as a major supply region.

🔹 Key Observations:

Premium Zone: Current highs show exhaustion signs with potential corrective pullback.

Retracement Zone: Watch the $95K–$100K region (equilibrium + demand block) as the most probable correction target.

Continuation: If this zone holds, upside expansion points to $146K (200% Fib) as the next macro objective.

📈 Strategy View:

Short-term: Expect correction into the $95K–$100K range.

Mid-term: Accumulation in discount zone offers asymmetric long setups.

Long-term: Next expansion target at $146K+ if bullish structure remains intact.

⚖️ Risk management is critical here — chasing highs in the premium zone carries poor R/R, but planned entries in equilibrium zones offer favorable setups.

#Bitcoin #BTC #CryptoTrading #TechnicalAnalysis #SmartMoneyConcepts

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.