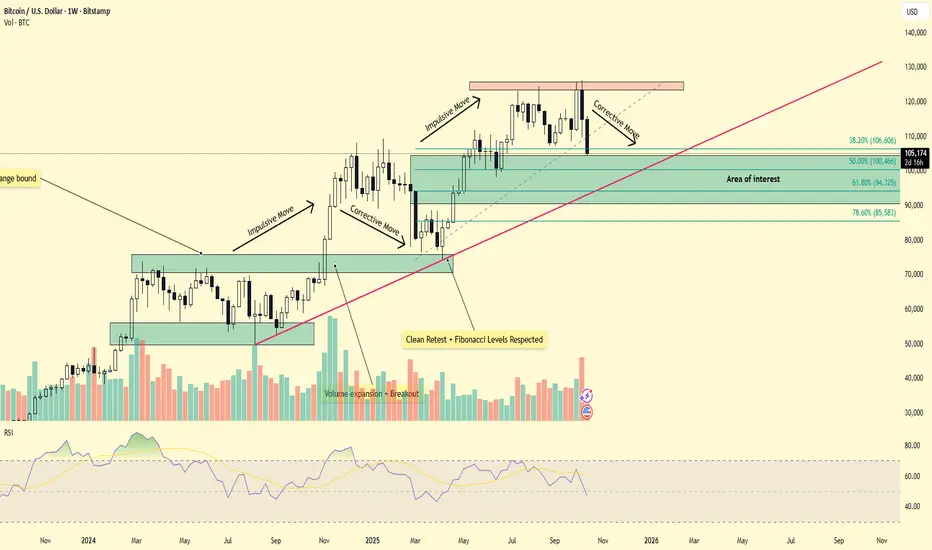

In my previous published idea, I mentioned that BTC was due for a corrective phase following an extended period of bullish momentum to the upside. That projection appears to be unfolding, as Bitcoin’s recent uptrend has started to cool off after several euphoric weeks of gains.

The weekly chart now shows price consolidating below the highs, indicating reduced buying pressure and potential exhaustion at elevated levels.

A weekly close below the 38.2% Fibonacci retracement level (≈106,000) could open the door for a deeper pullback toward the 50% retracement zone around 100,530, an area that previously acted as a strong demand zone and launch point for the last rally.

If the correction extends further, the 61.8% retracement level near 94,000 becomes the next key structural support — aligning closely with the ascending trendline that has guided BTC’s broader move.

Overall, Bitcoin remains within a macro bullish structure, but sustained weakness below the 100K region could mark the early signs of trend exhaustion and a potential sentiment shift.

The weekly chart now shows price consolidating below the highs, indicating reduced buying pressure and potential exhaustion at elevated levels.

A weekly close below the 38.2% Fibonacci retracement level (≈106,000) could open the door for a deeper pullback toward the 50% retracement zone around 100,530, an area that previously acted as a strong demand zone and launch point for the last rally.

If the correction extends further, the 61.8% retracement level near 94,000 becomes the next key structural support — aligning closely with the ascending trendline that has guided BTC’s broader move.

Overall, Bitcoin remains within a macro bullish structure, but sustained weakness below the 100K region could mark the early signs of trend exhaustion and a potential sentiment shift.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.