Policy/Scope: Informational market commentary. Not financial advice. No guarantees. Manage your own risk. Please, as always, DYOFR.

Snapshot (USD, approx.)

• BTC: ~112,400 (recent ATH ~125,000)

• ETH: ~3,838 (recent peak ~4,780)

• SOL: ~184 (weekly high ~224)

Volatility remains high after the Oct 10 tariff-headline shock and large derivatives liquidations.

Sentiment & Macro (neutral summary)

• Early October optimism (“Uptober”) flipped to caution after the Oct 10 risk-off event. Fear & Greed moved from Greed to Fear intraday.

• Rates: Market implies further Fed easing in 2025; a hawkish surprise is a downside risk.

• USD: 2025 USD softness has coincided with stronger crypto; renewed USD strength can pressure prices.

• Equities: Index swings continue to bleed into crypto via positioning and liquidity.

Technical Maps & If/Then Plans

Levels = areas of interest, not market orders. “Invalidation” = close beyond level on your execution timeframe.

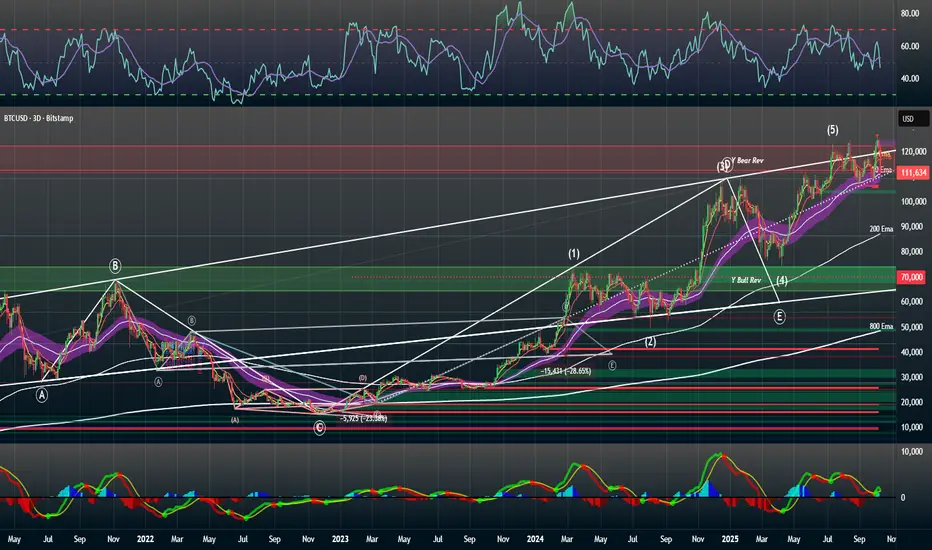

Bitcoin (BTC) — ~112,400

• Support: 110,000; 100,000.

• Resistance: 113,500; 120,000; 125,000.

• Mean-reversion: Confirmed holds 108,000–110,000 → TP 120,000 → 125,000 → 135,000. SL <108,000.

• Breakout: 4H/D close >113,500 with volume → 118,000 → 122,000. SL ~111,000.

• Invalidation: D close <110,000 weakens; <100,000 = deeper risk.

Ethereum (ETH) — ~3,838

• Support: 3,600; 3,400.

• Resistance: 4,000; 4,300; 4,780–4,865 (ATH zone).

• Mean-reversion: Hold 3,600 → TP 4,000 → 4,300 → 4,800. SL ~3,350.

• Breakout: D close >4,000 with volume → 4,300 → 4,600. SL <3,900.

• Invalidation: D close <3,300.

Solana (SOL) — ~184

• Support: 176–175; 150.

• Resistance: 200; 224; 250.

• Mean-reversion: Retest/hold 170–175 → TP 200 → 224 → 250. SL ~165.

• Breakout: Close >200 with volume → 210 → 224. SL <190.

• Invalidation: D close <150.

Altcoins (concise setups; USD)

• PENGU (~0.023): Support 0.020; Resistance 0.030 → 0.040.

Idea: Mean-revert near 0.020 (if tagged) → TP 0.030 / 0.040. SL <0.018. High risk.

• JUP (~0.34): Support 0.30 / 0.25; Resistance 0.40 / 0.46.

Idea: Breakout >0.40 → TP 0.46 / 0.55. SL ~0.36. Or buy deeper retrace ~0.25 with tight risk.

• ME (~0.40): Support 0.30; Resistance 0.50 / 0.64.

Idea: Speculative swing toward 0.50 / 0.60. SL <0.29. New token; unlock risk.

• S (Sonic, ~0.18): Support 0.10; Resistance 0.27 / 0.50.

Idea: High-beta mean-reversion 0.12–0.15 → TP 0.27 / 0.50. SL 0.09. Very high risk.

• LTC (~120): Support 115 / 100; Resistance 130 / 145–150.

Idea: Swing near 110–115 → TP 130 / 145. SL <99.

• SNS (~0.00223): Support 0.0020; Resistance 0.0028 / 0.0035.

Idea: Small-size accumulation near 0.0020 → TP 0.0028 / 0.0035. SL 0.0015.

• GRASS (~0.55): Support 0.50 / 0.30; Resistance 0.70 / 0.84 / 1.00.

Idea: Mean-revert 0.45–0.50 → TP 0.70 / 0.85. SL 0.40. Extreme volatility.

• DOGE (~0.19): Support 0.16 / 0.13; Resistance 0.22 / 0.25 / 0.30.

Idea: Buy dips 0.16–0.17 → TP 0.22 / 0.25 / 0.30. SL 0.14.

• AVAX (~28): Support 25 / 22; Resistance 30 / 35 / 40.

Idea: Accumulate 25–26 → TP 30 / 35 / 40. SL 22.

• ADA (~0.80): Support 0.75 / 0.67 / 0.60; Resistance 0.93 / 1.00.

Idea: Dip buy ~0.70 → TP 0.90 / 1.00 / 1.10. SL 0.62. Breakout >0.93 → 1.00.

Solana NFT Floors (informational; floors in SOL ≈ USD using SOL~$184)

NFT TA is illiquid and imprecise. Use wider mental stops. Consider fees/royalties.

• DeGods (Solana): Floor ~6.1 SOL (~$1,120).

Context: Legacy Solana stub after migration; very low liquidity.

Levels: Support ~5 SOL; Resistance ~10 SOL then 20 SOL.

Idea: Mean-reversion only; tiny size. Break <5 SOL = caution.

• y00ts (Solana “reveal” stub): Floor ~0.85 SOL (~$162).

Context: Chain-migrated; minimal activity.

Levels: Support 0.75; Resistance 1.0 then 1.5.

Idea: Technical scalps only; liquidity risk is high.

• Cets on Creck (CETS): Floor ~0.30 SOL (~$67).

Levels: Support 0.25; Resistance 0.50 then 1.0.

Idea: Base-range mean-reversion; SL if floor <0.25.

• Udder Chaos: Floor ~1.06 SOL (~$197).

Levels: Support 0.90 / 0.75; Resistance 1.2 then 1.5.

Idea: Relative-strength candidate; swing toward 1.3 / 1.8 / 2.2 if market stabilizes.

• Primates: Floor ~0.18 SOL (~$40).

Levels: Support 0.15; Resistance 0.30 then 0.4–0.5.

Idea: Lotto-style mean-reversion; tiny size; pre-list targets.

Risk framework (for all sections)

• Risk 1–3% of account to the hard stop per idea.

• Scale out 40% / 40% / 20% at TP1 / TP2 / runner; move stop to breakeven after TP1.

• Pause alt exposure if BTC closes below 110,000 or if USD strength spikes materially.

• Revalidate levels after policy data, tariff headlines, or outsized equity moves.

Pine Script®

Snapshot (USD, approx.)

• BTC: ~112,400 (recent ATH ~125,000)

• ETH: ~3,838 (recent peak ~4,780)

• SOL: ~184 (weekly high ~224)

Volatility remains high after the Oct 10 tariff-headline shock and large derivatives liquidations.

Sentiment & Macro (neutral summary)

• Early October optimism (“Uptober”) flipped to caution after the Oct 10 risk-off event. Fear & Greed moved from Greed to Fear intraday.

• Rates: Market implies further Fed easing in 2025; a hawkish surprise is a downside risk.

• USD: 2025 USD softness has coincided with stronger crypto; renewed USD strength can pressure prices.

• Equities: Index swings continue to bleed into crypto via positioning and liquidity.

Technical Maps & If/Then Plans

Levels = areas of interest, not market orders. “Invalidation” = close beyond level on your execution timeframe.

Bitcoin (BTC) — ~112,400

• Support: 110,000; 100,000.

• Resistance: 113,500; 120,000; 125,000.

• Mean-reversion: Confirmed holds 108,000–110,000 → TP 120,000 → 125,000 → 135,000. SL <108,000.

• Breakout: 4H/D close >113,500 with volume → 118,000 → 122,000. SL ~111,000.

• Invalidation: D close <110,000 weakens; <100,000 = deeper risk.

Ethereum (ETH) — ~3,838

• Support: 3,600; 3,400.

• Resistance: 4,000; 4,300; 4,780–4,865 (ATH zone).

• Mean-reversion: Hold 3,600 → TP 4,000 → 4,300 → 4,800. SL ~3,350.

• Breakout: D close >4,000 with volume → 4,300 → 4,600. SL <3,900.

• Invalidation: D close <3,300.

Solana (SOL) — ~184

• Support: 176–175; 150.

• Resistance: 200; 224; 250.

• Mean-reversion: Retest/hold 170–175 → TP 200 → 224 → 250. SL ~165.

• Breakout: Close >200 with volume → 210 → 224. SL <190.

• Invalidation: D close <150.

Altcoins (concise setups; USD)

• PENGU (~0.023): Support 0.020; Resistance 0.030 → 0.040.

Idea: Mean-revert near 0.020 (if tagged) → TP 0.030 / 0.040. SL <0.018. High risk.

• JUP (~0.34): Support 0.30 / 0.25; Resistance 0.40 / 0.46.

Idea: Breakout >0.40 → TP 0.46 / 0.55. SL ~0.36. Or buy deeper retrace ~0.25 with tight risk.

• ME (~0.40): Support 0.30; Resistance 0.50 / 0.64.

Idea: Speculative swing toward 0.50 / 0.60. SL <0.29. New token; unlock risk.

• S (Sonic, ~0.18): Support 0.10; Resistance 0.27 / 0.50.

Idea: High-beta mean-reversion 0.12–0.15 → TP 0.27 / 0.50. SL 0.09. Very high risk.

• LTC (~120): Support 115 / 100; Resistance 130 / 145–150.

Idea: Swing near 110–115 → TP 130 / 145. SL <99.

• SNS (~0.00223): Support 0.0020; Resistance 0.0028 / 0.0035.

Idea: Small-size accumulation near 0.0020 → TP 0.0028 / 0.0035. SL 0.0015.

• GRASS (~0.55): Support 0.50 / 0.30; Resistance 0.70 / 0.84 / 1.00.

Idea: Mean-revert 0.45–0.50 → TP 0.70 / 0.85. SL 0.40. Extreme volatility.

• DOGE (~0.19): Support 0.16 / 0.13; Resistance 0.22 / 0.25 / 0.30.

Idea: Buy dips 0.16–0.17 → TP 0.22 / 0.25 / 0.30. SL 0.14.

• AVAX (~28): Support 25 / 22; Resistance 30 / 35 / 40.

Idea: Accumulate 25–26 → TP 30 / 35 / 40. SL 22.

• ADA (~0.80): Support 0.75 / 0.67 / 0.60; Resistance 0.93 / 1.00.

Idea: Dip buy ~0.70 → TP 0.90 / 1.00 / 1.10. SL 0.62. Breakout >0.93 → 1.00.

Solana NFT Floors (informational; floors in SOL ≈ USD using SOL~$184)

NFT TA is illiquid and imprecise. Use wider mental stops. Consider fees/royalties.

• DeGods (Solana): Floor ~6.1 SOL (~$1,120).

Context: Legacy Solana stub after migration; very low liquidity.

Levels: Support ~5 SOL; Resistance ~10 SOL then 20 SOL.

Idea: Mean-reversion only; tiny size. Break <5 SOL = caution.

• y00ts (Solana “reveal” stub): Floor ~0.85 SOL (~$162).

Context: Chain-migrated; minimal activity.

Levels: Support 0.75; Resistance 1.0 then 1.5.

Idea: Technical scalps only; liquidity risk is high.

• Cets on Creck (CETS): Floor ~0.30 SOL (~$67).

Levels: Support 0.25; Resistance 0.50 then 1.0.

Idea: Base-range mean-reversion; SL if floor <0.25.

• Udder Chaos: Floor ~1.06 SOL (~$197).

Levels: Support 0.90 / 0.75; Resistance 1.2 then 1.5.

Idea: Relative-strength candidate; swing toward 1.3 / 1.8 / 2.2 if market stabilizes.

• Primates: Floor ~0.18 SOL (~$40).

Levels: Support 0.15; Resistance 0.30 then 0.4–0.5.

Idea: Lotto-style mean-reversion; tiny size; pre-list targets.

Risk framework (for all sections)

• Risk 1–3% of account to the hard stop per idea.

• Scale out 40% / 40% / 20% at TP1 / TP2 / runner; move stop to breakeven after TP1.

• Pause alt exposure if BTC closes below 110,000 or if USD strength spikes materially.

• Revalidate levels after policy data, tariff headlines, or outsized equity moves.

Disclosure: Educational only. Not investment advice. No solicitations or performance claims. Data reflects the provided context and can change rapidly. Verify with real-time sources before acting.

imaCŁ◎NΞ.x | TA & Market Analysis | x.com/DJC4ndyM4n | imacl.one | https://imaclone.x

PGP Public Key: pastebin.com/aYgSg6m6

PGP Public Key: pastebin.com/aYgSg6m6

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

imaCŁ◎NΞ.x | TA & Market Analysis | x.com/DJC4ndyM4n | imacl.one | https://imaclone.x

PGP Public Key: pastebin.com/aYgSg6m6

PGP Public Key: pastebin.com/aYgSg6m6

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.