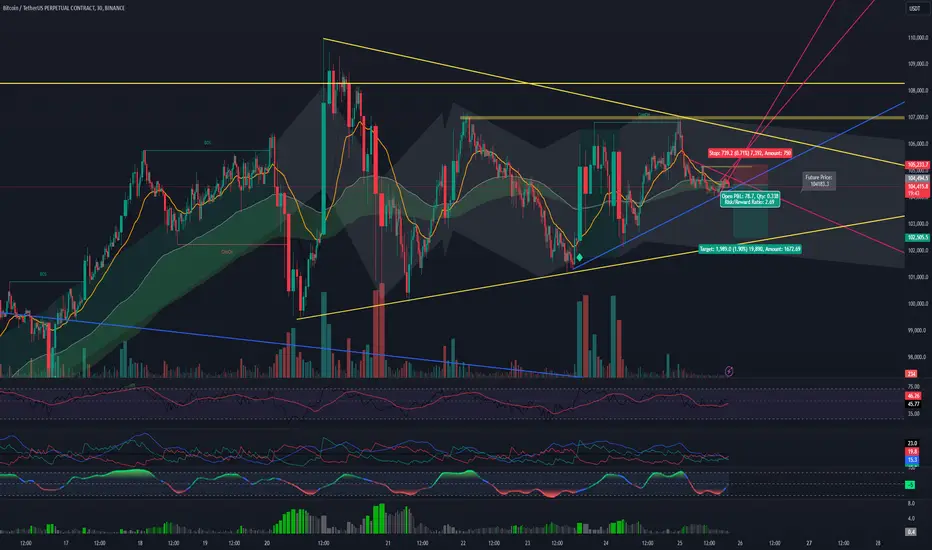

Resistance Rejection: Price rejected at a horizontal resistance zone, showing bearish pressure with wick formations indicating seller dominance.

Trendline Respect: Price respects a descending trendline, supporting bearish continuation probabilities.

EMA Confluence: Below the 50 EMA, signaling weakening bullish momentum.

Volume Decline: Reduced buying volume suggests fading demand, aligning with bearish sentiment.

Indicators Align Bearish:

RSI trending downward near midline.

MACD showing a potential bearish crossover.

Risk/Reward: Favorable 2.09 ratio, with clear invalidation above resistance and significant downside potential.

Cloud Base Test: A break below the Ichimoku Cloud base could accelerate bearish movement.

Probabilities:

Bearish Continuation: ~65%.

Bullish Recovery: ~35%.

Plan:

Entry: On a breakdown below horizontal support.

Stop Loss: Above resistance.

Target: Next support zone or lower trendline.

Multiple confirmations favor a short trade setup. Manage risk effectively.

Trendline Respect: Price respects a descending trendline, supporting bearish continuation probabilities.

EMA Confluence: Below the 50 EMA, signaling weakening bullish momentum.

Volume Decline: Reduced buying volume suggests fading demand, aligning with bearish sentiment.

Indicators Align Bearish:

RSI trending downward near midline.

MACD showing a potential bearish crossover.

Risk/Reward: Favorable 2.09 ratio, with clear invalidation above resistance and significant downside potential.

Cloud Base Test: A break below the Ichimoku Cloud base could accelerate bearish movement.

Probabilities:

Bearish Continuation: ~65%.

Bullish Recovery: ~35%.

Plan:

Entry: On a breakdown below horizontal support.

Stop Loss: Above resistance.

Target: Next support zone or lower trendline.

Multiple confirmations favor a short trade setup. Manage risk effectively.

A Haque

Founder | MyTradingJournal

📊 Financial Market Analyst | Trader | Educator

🐦 Twitter: @MyTradingJnl6th

📺 YouTube: @MyTradingJournal6th

Founder | MyTradingJournal

📊 Financial Market Analyst | Trader | Educator

🐦 Twitter: @MyTradingJnl6th

📺 YouTube: @MyTradingJournal6th

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

A Haque

Founder | MyTradingJournal

📊 Financial Market Analyst | Trader | Educator

🐦 Twitter: @MyTradingJnl6th

📺 YouTube: @MyTradingJournal6th

Founder | MyTradingJournal

📊 Financial Market Analyst | Trader | Educator

🐦 Twitter: @MyTradingJnl6th

📺 YouTube: @MyTradingJournal6th

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.