SMC Trading point update

Technical analysis of Bitcoin (BTC/USDT) on the 4H timeframe.

---

Technical Breakdown – Bitcoin (4H)

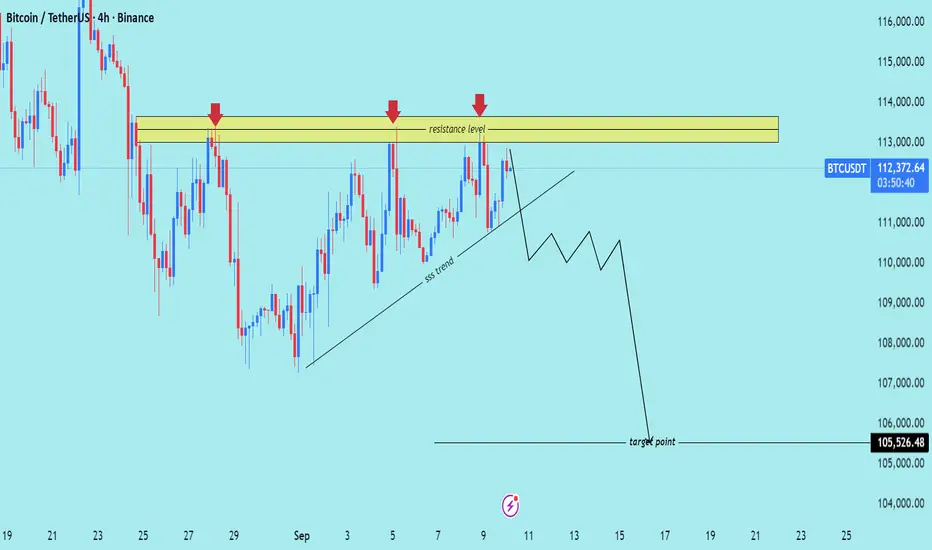

1. Resistance Zone

Strong resistance level between $113,000 – $114,000 (highlighted yellow).

Price has tested this zone three times (red arrows), showing clear seller strength and liquidity rejection.

2. Structure Trendline

Market is following a short-term ascending support trendline.

Current projection suggests this trendline may break, which would signal a shift in momentum to bearish.

3. Bearish Outlook

If resistance continues to hold, a trendline breakdown could trigger strong downside momentum.

Target Point: $105,526.48 – a major demand zone where liquidity sits.

4. Trading Plan Idea

Entry: On rejection at $113K–$114K zone or confirmation of trendline break.

Stop Loss: Above $114,500 (to protect from false breakouts).

Take Profit: $105,526.48

---

Summary

Bias: Bearish

Reason: Multiple resistance rejections + trendline vulnerability.

Setup: Look for shorts from resistance or after trendline break → Target $105.5K zone.

Mr SMC Trading point

---

This setup is a classic SMC bearish scenario: liquidity trapped at resistance → trendline break → expansion down to collect liquidity at lower demand.

Please support boost 🚀 this analysis

Technical analysis of Bitcoin (BTC/USDT) on the 4H timeframe.

---

Technical Breakdown – Bitcoin (4H)

1. Resistance Zone

Strong resistance level between $113,000 – $114,000 (highlighted yellow).

Price has tested this zone three times (red arrows), showing clear seller strength and liquidity rejection.

2. Structure Trendline

Market is following a short-term ascending support trendline.

Current projection suggests this trendline may break, which would signal a shift in momentum to bearish.

3. Bearish Outlook

If resistance continues to hold, a trendline breakdown could trigger strong downside momentum.

Target Point: $105,526.48 – a major demand zone where liquidity sits.

4. Trading Plan Idea

Entry: On rejection at $113K–$114K zone or confirmation of trendline break.

Stop Loss: Above $114,500 (to protect from false breakouts).

Take Profit: $105,526.48

---

Summary

Bias: Bearish

Reason: Multiple resistance rejections + trendline vulnerability.

Setup: Look for shorts from resistance or after trendline break → Target $105.5K zone.

Mr SMC Trading point

---

This setup is a classic SMC bearish scenario: liquidity trapped at resistance → trendline break → expansion down to collect liquidity at lower demand.

Please support boost 🚀 this analysis

(Services:✔️ JOIN Telegram channel

t.me/SMCTrading_point

Gold trading signals 🚀 99%

t.me/SMCTrading_point

Join my recommended broker , link 👇

World best broker exness ✅D

one.exnesstrack.org/a/l1t1rf3p6v

t.me/SMCTrading_point

Gold trading signals 🚀 99%

t.me/SMCTrading_point

Join my recommended broker , link 👇

World best broker exness ✅D

one.exnesstrack.org/a/l1t1rf3p6v

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

(Services:✔️ JOIN Telegram channel

t.me/SMCTrading_point

Gold trading signals 🚀 99%

t.me/SMCTrading_point

Join my recommended broker , link 👇

World best broker exness ✅D

one.exnesstrack.org/a/l1t1rf3p6v

t.me/SMCTrading_point

Gold trading signals 🚀 99%

t.me/SMCTrading_point

Join my recommended broker , link 👇

World best broker exness ✅D

one.exnesstrack.org/a/l1t1rf3p6v

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.