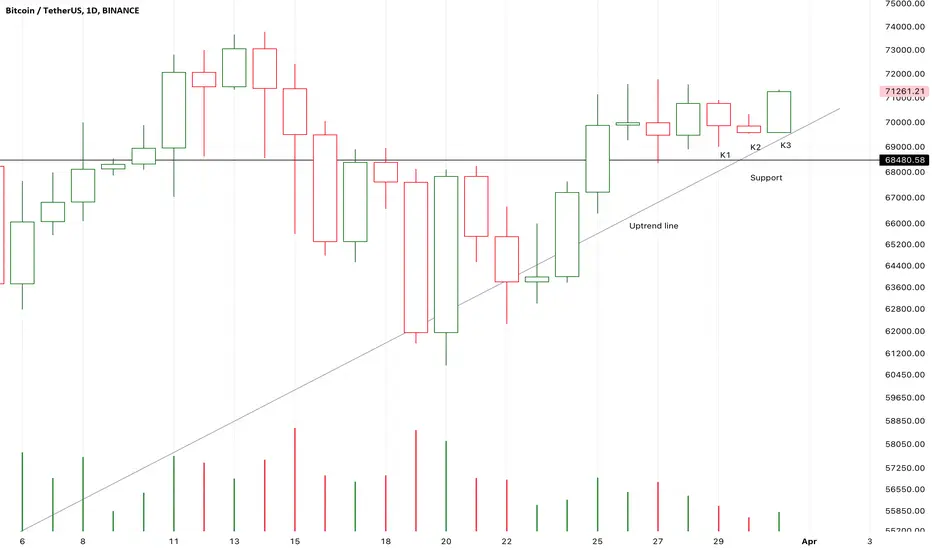

K3 is breaking up the dead corner.

The market chose a direction to climb up.

From K1 to K3, it is a strong bullish morning star pattern.

It is likely that K3 will close upon K1.

So, it still worth to buy in.

The historic highest price 69K and the nearest uptrend line is the potential support.

It is still worth to hold for a long time.

The market is healthy.

Nota

K6 couldn’t close below K5 under a sharply increased volume,

It verified that the support is effective.

If K7 break up K6,

It still worth to buy in.

On the other hand,

K5 and K6 is also a bearish dark cloud cover pattern.

If the following candles couldn’t close below K2 to verify it,

K6 will be a final test to the support,

And the supply pressure will be exhausted here.

I think there is nothing to worry here.

Perhaps I was wrong,

I hope so,

And it will be a good lesson for me.

Nota

My previous analysis was totally wrong.

It is really a big loss for me.

I can do nothing here but waiting for more signals.

K2 break down and close below K1,

It verified a short-term downtrend.

If the following candles keep dropping to close below the support,

The risk will sharply increase.

If the following candles could stay here and consolidate for days,

The bearish momentum will be interrupted.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.