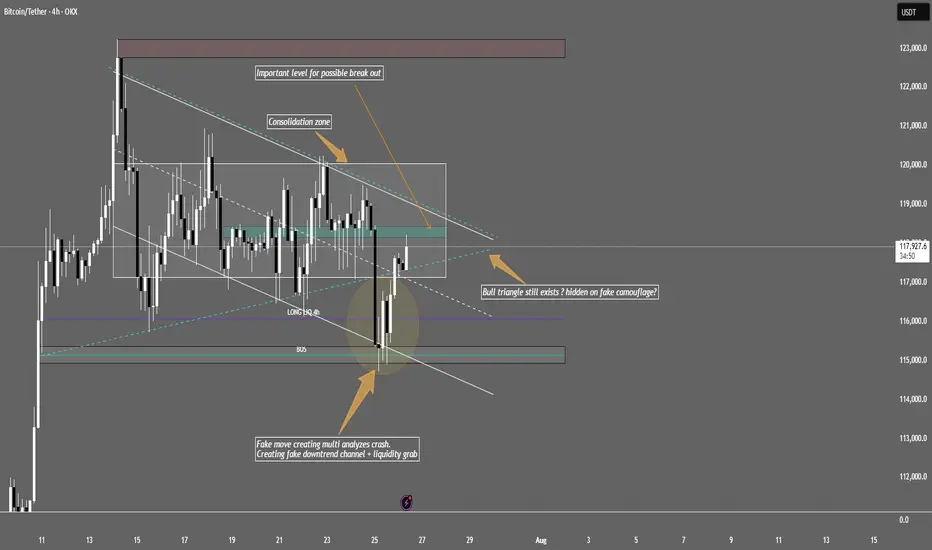

Bitcoin is moving sideways in a tight consolidation range between $117,000–$120,000 . Institutional players are accumulating positions here based on recent on-chain whale inflows, positive funding, and OI increase.

Key points with real chart zones:

The big drop down was likely a "fake out": Price wicked down to ~$115,000, triggering stop losses below this support, letting smart money buy cheaper.

Strong bounce back:

After the sweep, price quickly reclaimed the range, returning above ~$117,300–$118,000 , indicating strong buyer presence.

Bullish triangle is still valid:

Structure holds as long as price trades inside/bounces between $117,000 (lower zone/fake-out base) and $120,000 (upper resistance/consolidation top). Watch for volume spikes around $118,000–$120,000 as signs of institutional accumulation or breakout intent.

If price breaks above the range:

If we see a proper H1/H4 close above $120,000, expect a strong move to the next resistance: $123,000–$124,000 zone.

If price breaks down and holds below:

Sustained price action below $117,000, especially after another fake-out, could lead to a drop toward previous demand/stop zones at $115,000, and if that fails, further down to $110,000–$113,000.

Bottom line:

BTC sits in a “make-or-break” zone between $117,000–$120,000. Break out above $120k opens the path to $124k+. Loss of $117k/115k support risks further downside. Order flow and on-chain favor bulls for now, but always use stops – low volatility ranges can quickly resolve with liquidity grabs.

Tip:

Don’t chase every breakout or drop. Watch closely how price reacts near $120,000 (upside) and $117,000/$115,000 (downside). It is crucial to follow macroeconomic news, especially FED updates – trade safely and always do your own research!

This is not financial advice!

Key points with real chart zones:

The big drop down was likely a "fake out": Price wicked down to ~$115,000, triggering stop losses below this support, letting smart money buy cheaper.

Strong bounce back:

After the sweep, price quickly reclaimed the range, returning above ~$117,300–$118,000 , indicating strong buyer presence.

Bullish triangle is still valid:

Structure holds as long as price trades inside/bounces between $117,000 (lower zone/fake-out base) and $120,000 (upper resistance/consolidation top). Watch for volume spikes around $118,000–$120,000 as signs of institutional accumulation or breakout intent.

If price breaks above the range:

If we see a proper H1/H4 close above $120,000, expect a strong move to the next resistance: $123,000–$124,000 zone.

If price breaks down and holds below:

Sustained price action below $117,000, especially after another fake-out, could lead to a drop toward previous demand/stop zones at $115,000, and if that fails, further down to $110,000–$113,000.

Bottom line:

BTC sits in a “make-or-break” zone between $117,000–$120,000. Break out above $120k opens the path to $124k+. Loss of $117k/115k support risks further downside. Order flow and on-chain favor bulls for now, but always use stops – low volatility ranges can quickly resolve with liquidity grabs.

Tip:

Don’t chase every breakout or drop. Watch closely how price reacts near $120,000 (upside) and $117,000/$115,000 (downside). It is crucial to follow macroeconomic news, especially FED updates – trade safely and always do your own research!

This is not financial advice!

Nota

Current Status: Bitcoin sitting at $117,959 and testing $118,000 resistance. Price bounced from $116,260 and broke above that bearish trendline - bulls fighting back.

Whale Action:

Massive accumulation happening. Whales vacuumed up 248,000 BTC in July - worth around $30 billion. That's biggest buying spree since 2024 halving. These "permanent holders" aren't selling - they're stacking hard.

Triangle Still Valid:

Price holding between $117,000-$120,000 range. Bitcoin about 75% through the triangle pattern, which means breakout coming soon. Usually breaks before reaching the end.

Key Levels Updated:

Immediate resistance: $118,500-$119,000

Big resistance: $120,000-$120,200

Targets if break higher: $122,500 then $123,200

Support if fails: $117,000 then $115,000

Market Internals

Funding rate:

Around 0.01% - not crazy high, room to run.

Open Interest:

Hit $42-45 billion - elevated but manageable.

Volume:

Decent but needs spike for real breakout.

What Changed:

right at the $118,000 zone that's been key resistance. Bulls need to clear this cleanly with volume to target $120,000+. Bears need to push below $117,000 to kill the triangle.

Bottom Line:

Same setup, just higher in the range. Break above $118,500 with conviction = moon mission. Fail here = back to $115,000-117,000. Whales are betting on the breakout.

Dagangan aktif

Current Status:BTC is trading at $118,750 this morning, sitting at the upper end of the recent consolidation range.

Key Levels:

Immediate resistance: $119,000 then $120,000 (crucial breakout zone)

Support: $117,000 (short-term base), next at $115,000 if fails

Breakout targets: If $120,000 is cleared with a strong close, look for $122,500 up to $124,000

Trendline support: Still holding around $117,000–$117,300

Market Action:

Price is still locked sideways between $117,000–$120,000

Bulls continue to defend every dip; no major sell pressure seen from whales or large holders

Funding rate remains slightly positive (~0.01%)—healthy, not overheated

Open Interest stays high around $43–45B; elevated, supports potential for an explosive move if breakout triggers

Volume is steady, but we still lack a decisive spike—watch for this as a sign of real breakout momentum

What’s Changed:

Price confirmed another bounce from the lower zone, and is now pushing up against resistance

No big whale exits—accumulation trend still stands

Market remains sensitive to macro events—FOMC and FED still potential catalysts

Bottom Line:

The setup is unchanged: triangle pattern and range are both intact. A clean break and close above $120,000 is still needed to confirm the move toward $122,500–$124,000. Failure at resistance risks another retest of $117,000 or $115,000. Whales continue to position for a breakout, but until volume confirms, don’t anticipate—let price action lead.

Watch:

$119,000–$120,000 for a proper breakout

$117,000 as key support

Sudden volume spikes for confirmation

Macro Snapshot: What Matters Now

FED in the Spotlight:

The Federal Reserve meets this week. No rate change is expected, but all eyes are on Chair Powell’s press conference. Hints at a September rate cut could pump risk assets—including BTC. Any new hawkish tone may weigh on markets.

Tariff Tension = Inflation Risk:

Fresh US tariffs are pushing up inflation, showing up in June/July data. This complicates the Fed’s decision; stickier inflation means rate cuts might come later than bulls hope.

Real Yields & BTC:

10-year Treasury yields stay above 4.3%. Historically, falling yields have fueled BTC rallies—so any move down post-FED is bullish.

Institutional Flows Still Strong:

Big money continues rotating into crypto, even as traditional risk assets wobble. ETH spot ETF demand and whale accumulation in BTC signal strong, longer-term hands.

Bottom Line:

Macro remains mixed, but potential Fed rate cut signals and ongoing institutional demand are the key bullish catalysts to watch. Make-or-break zone: If Bitcoin breaks above $120k on a dovish macro shift, upside could accelerate fast.

Stay tuned for volatility around major macro news.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.