CAD/JPY Profit Plan – How to Layer Entries Professionally!

🎯 CADJPY: The Maple Syrup Robbery Setup 🍁💴 | Multi-Layer Entry Zone Active!

📊 Market Overview

Asset: CAD/JPY (Canadian Dollar vs Japanese Yen)

Trade Type: Swing/Day Trade Hybrid

Strategy: "The Thief Method" - Multi-Layer Limit Order Accumulation

Bias: 🐂 BULLISH

🔍 Technical Analysis

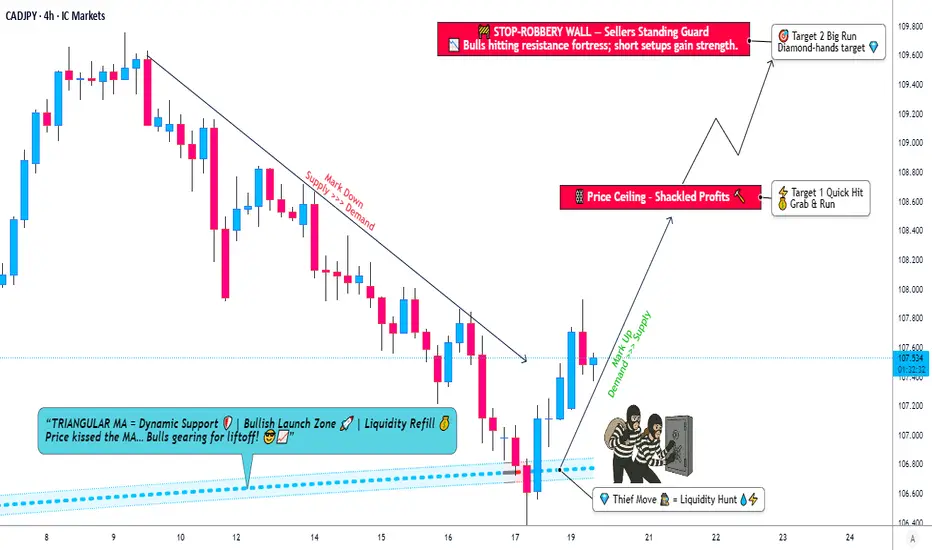

The CADJPY pair is showing bullish confirmation following a textbook triangular moving average pullback and successful retest. The price structure suggests accumulation before the next leg up, making this an optimal zone for strategic layered entries.

Key Technical Confluences:

✅ Triangular MA pullback completed

✅ Support zone retest confirmed

✅ Higher lows forming on the daily timeframe

✅ Bullish momentum building above key support

💰 The Thief's Playbook: Multi-Layer Entry Strategy

Instead of a single entry point, this setup utilizes multiple limit orders (layering strategy) to build positions at favorable levels while managing risk.

🎯 Entry Layers (Limit Orders):

Layer 1: 106.800

Layer 2: 107.000

Layer 3: 107.250

Layer 4: 107.500

Layer 5: 107.750

Note: You can add more layers or adjust based on your account size and risk appetite. The beauty of this method is flexibility—enter at ANY price level within this range.

🛡️ Risk Management:

Stop Loss: 106.500

⚠️ Disclaimer: This is the Thief's suggested SL. However, YOU are the captain of your own ship! Set your stop loss based on YOUR risk tolerance. Trade at your own risk and never risk more than you can afford to lose.

🎯 Profit Targets:

Primary Target (TP1): 108.600 (+100 to +180 pips depending on entry)

Secondary Target (TP2): 109.600 (+190 to +280 pips depending on entry)

💡 Pro Tip: Consider scaling out at TP1 (take 50-70% profit) and letting the rest ride to TP2 with a trailing stop.

⚠️ Reminder: These are suggested targets. Lock in profits when YOU feel comfortable. It's YOUR money—make money, take money! 💸

🔗 Correlated Pairs to Watch

Keep an eye on these related pairs for confluence and broader market context:

USDCAD 🇺🇸🇨🇦 - Inverse correlation (CAD strength indicator)

USDCAD 🇺🇸🇨🇦 - Inverse correlation (CAD strength indicator)

USDJPY 🇺🇸🇯🇵 - Direct correlation (Yen weakness/strength gauge)

USDJPY 🇺🇸🇯🇵 - Direct correlation (Yen weakness/strength gauge)

AUDJPY 🇦🇺🇯🇵 - Similar risk-on/risk-off dynamic

AUDJPY 🇦🇺🇯🇵 - Similar risk-on/risk-off dynamic

EURJPY 🇪🇺🇯🇵 - Cross-yen pair sentiment

EURJPY 🇪🇺🇯🇵 - Cross-yen pair sentiment

WTI Crude Oil 🛢️ (

WTI Crude Oil 🛢️ ( CL1!) - Strong positive correlation with CAD (Canada = oil exporter)

CL1!) - Strong positive correlation with CAD (Canada = oil exporter)

Gold ( XAUUSD) - Safe-haven correlation with JPY (inverse to CADJPY)

XAUUSD) - Safe-haven correlation with JPY (inverse to CADJPY)

Key Point: If crude oil rallies and USD/JPY shows strength, it confirms the bullish CADJPY thesis. Watch for risk sentiment—risk-on = JPY weakness = CADJPY strength! 🚀

📈 Trade Summary

ParameterValueEntry Zone106.800 - 107.750 (Multi-layer)Stop Loss106.500TP1108.600TP2109.600Risk/RewardApproximately 1:2 to 1:4+

🎬 Final Words from The Thief

Dear Ladies & Gentlemen (Thief OG's) 🎩✨,

This setup is about patience, precision, and proper position sizing. Layer in, manage risk, and let the market come to you. Remember: professional thieves don't rush—they plan, they execute, and they disappear with the bag! 💼💨

Stay sharp, stay strategic, and happy hunting! 🎯

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#CADJPY #Forex #ForexTrading #TechnicalAnalysis #SwingTrading #DayTrading #CAD #JPY #MultiLayerEntry #TheThiefMethod #ForexSignals #TradingStrategy #RiskManagement #PriceAction #ForexSetup #CurrencyTrading #ForexCommunity #TradingView #ForexAnalysis #BullishSetup

📊 Market Overview

Asset: CAD/JPY (Canadian Dollar vs Japanese Yen)

Trade Type: Swing/Day Trade Hybrid

Strategy: "The Thief Method" - Multi-Layer Limit Order Accumulation

Bias: 🐂 BULLISH

🔍 Technical Analysis

The CADJPY pair is showing bullish confirmation following a textbook triangular moving average pullback and successful retest. The price structure suggests accumulation before the next leg up, making this an optimal zone for strategic layered entries.

Key Technical Confluences:

✅ Triangular MA pullback completed

✅ Support zone retest confirmed

✅ Higher lows forming on the daily timeframe

✅ Bullish momentum building above key support

💰 The Thief's Playbook: Multi-Layer Entry Strategy

Instead of a single entry point, this setup utilizes multiple limit orders (layering strategy) to build positions at favorable levels while managing risk.

🎯 Entry Layers (Limit Orders):

Layer 1: 106.800

Layer 2: 107.000

Layer 3: 107.250

Layer 4: 107.500

Layer 5: 107.750

Note: You can add more layers or adjust based on your account size and risk appetite. The beauty of this method is flexibility—enter at ANY price level within this range.

🛡️ Risk Management:

Stop Loss: 106.500

⚠️ Disclaimer: This is the Thief's suggested SL. However, YOU are the captain of your own ship! Set your stop loss based on YOUR risk tolerance. Trade at your own risk and never risk more than you can afford to lose.

🎯 Profit Targets:

Primary Target (TP1): 108.600 (+100 to +180 pips depending on entry)

Secondary Target (TP2): 109.600 (+190 to +280 pips depending on entry)

💡 Pro Tip: Consider scaling out at TP1 (take 50-70% profit) and letting the rest ride to TP2 with a trailing stop.

⚠️ Reminder: These are suggested targets. Lock in profits when YOU feel comfortable. It's YOUR money—make money, take money! 💸

🔗 Correlated Pairs to Watch

Keep an eye on these related pairs for confluence and broader market context:

Gold (

Key Point: If crude oil rallies and USD/JPY shows strength, it confirms the bullish CADJPY thesis. Watch for risk sentiment—risk-on = JPY weakness = CADJPY strength! 🚀

📈 Trade Summary

ParameterValueEntry Zone106.800 - 107.750 (Multi-layer)Stop Loss106.500TP1108.600TP2109.600Risk/RewardApproximately 1:2 to 1:4+

🎬 Final Words from The Thief

Dear Ladies & Gentlemen (Thief OG's) 🎩✨,

This setup is about patience, precision, and proper position sizing. Layer in, manage risk, and let the market come to you. Remember: professional thieves don't rush—they plan, they execute, and they disappear with the bag! 💼💨

Stay sharp, stay strategic, and happy hunting! 🎯

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#CADJPY #Forex #ForexTrading #TechnicalAnalysis #SwingTrading #DayTrading #CAD #JPY #MultiLayerEntry #TheThiefMethod #ForexSignals #TradingStrategy #RiskManagement #PriceAction #ForexSetup #CurrencyTrading #ForexCommunity #TradingView #ForexAnalysis #BullishSetup

Dagangan aktif

Dagangan ditutup: sasaran tercapai

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.