Deepak fertilizer is ready to blast....

🔍 Thesis on Deepak Fertilisers (DEEPAKFERT): Technical + Fundamental Snapshot

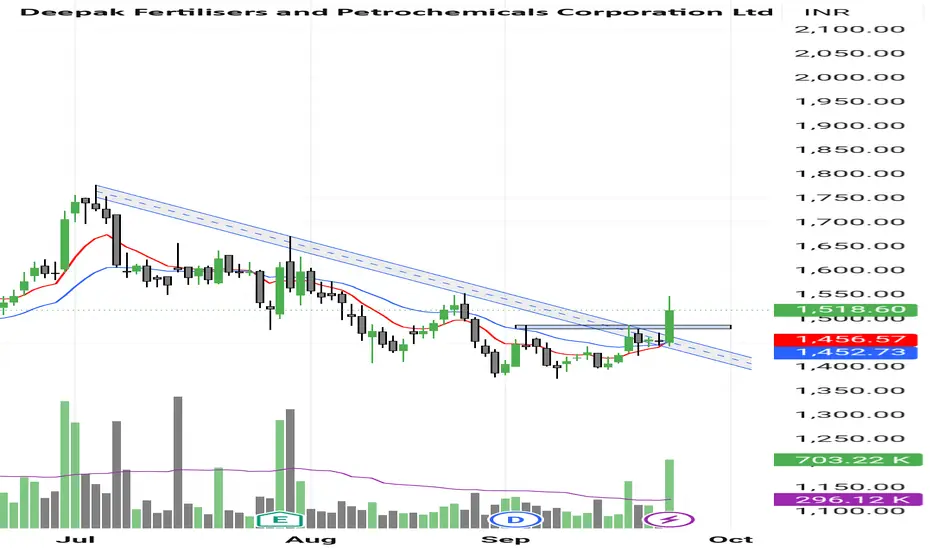

Technical outlook: The stock is showing bullish momentum—recent breakouts above key levels (e.g. around ₹1,450) have been met with confirmation. Indicators like moving averages and MACD lean positive, with many charts/screeners rating it a “Strong Buy” or “Buy.”

Support / Resistance context: Current price is below its 52-week high (₹888), indicating a favourable range captured with decent upside. The pullbacks have found support at prior breakout zones, which could now act as support.

Fundamentals: The company has been growing sales and profits robustly — revenue & net profit CAGR over recent years are in healthy double digits. Return on Equity (ROE) ~15-17%, debt to equity moderate (~0.6-0.7) giving some leverage but manageable.

Valuation & Risks: P/E ratio of ~18-20× is not cheap but not outrageously high relative to growth and sector peers. There are some risks: Operating margins have seen pressure; the chemicals segment has had weak demand at times. Also, while debt is manageable, interest coverage and cost pressures (input, energy etc.) remain variables.

Conclusion (balanced): Overall, Deepak Fertilisers appears to have a positive long-term fundamental base plus a bullish technical setup. Short-term, there is room for upside if the price can sustain above the breakout levels; downside risks exist if market sentiment turns or input costs rise sharply / demand softens.

Technical outlook: The stock is showing bullish momentum—recent breakouts above key levels (e.g. around ₹1,450) have been met with confirmation. Indicators like moving averages and MACD lean positive, with many charts/screeners rating it a “Strong Buy” or “Buy.”

Support / Resistance context: Current price is below its 52-week high (₹888), indicating a favourable range captured with decent upside. The pullbacks have found support at prior breakout zones, which could now act as support.

Fundamentals: The company has been growing sales and profits robustly — revenue & net profit CAGR over recent years are in healthy double digits. Return on Equity (ROE) ~15-17%, debt to equity moderate (~0.6-0.7) giving some leverage but manageable.

Valuation & Risks: P/E ratio of ~18-20× is not cheap but not outrageously high relative to growth and sector peers. There are some risks: Operating margins have seen pressure; the chemicals segment has had weak demand at times. Also, while debt is manageable, interest coverage and cost pressures (input, energy etc.) remain variables.

Conclusion (balanced): Overall, Deepak Fertilisers appears to have a positive long-term fundamental base plus a bullish technical setup. Short-term, there is room for upside if the price can sustain above the breakout levels; downside risks exist if market sentiment turns or input costs rise sharply / demand softens.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.