Delhivery is a promising logistics stock showing recent operational turnaround, but currently trades at a stretched valuation with moderate growth prospects. Analysts recommend cautious accumulation or holding, rather than aggressive buying at current levels.

Target Projection

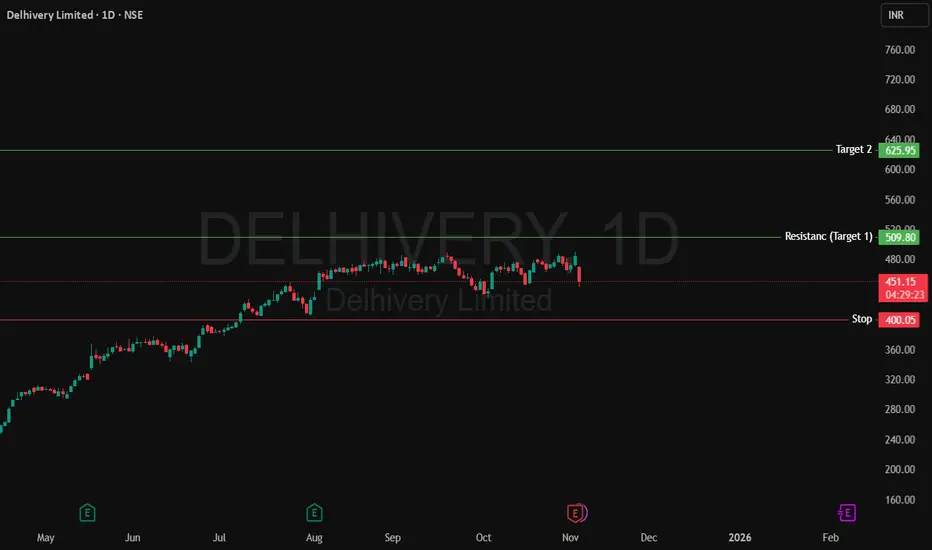

Target zones: ₹500–₹625

Current Price: ₹465

Upside potential: 6–29% if targets are met, but valuation leaves limited margin for aggressive entry.

Growth & Profitability

Q2 FY25 revenue: ₹2,190 crore (13% YoY growth)

PAT: ₹10 crore (second consecutive profitable quarter; signals gradual turnaround)

EBITDA margin: Improved (₹57 crore), net profit margin remains low (2.2%).

Valuation Analysis

PE (TTM): ~175.79 (high vs industry, reflects premium pricing)

Price/Book: ~3.7 (also on higher side)

Intrinsic value models suggest stock is overvalued by ₹215–₹158 above fair value estimates

Key Risks

Overvaluation risk: Stock prices significantly above many fair value models

Competitive risk: Sector heating up, may impact growth/margins

Volatility risk: Possible for sharp corrections in the short term.

Suggested Strategy

Accumulate only on dips toward ₹350–₹420 zone (closer to fair value)

Hold if already invested; consider profit booking if price sharply rallies beyond target zones

Aggressive buying is not advised at current valuation.

Disclaimer: lnkd.in/ge86Wx-X

Target Projection

Target zones: ₹500–₹625

Current Price: ₹465

Upside potential: 6–29% if targets are met, but valuation leaves limited margin for aggressive entry.

Growth & Profitability

Q2 FY25 revenue: ₹2,190 crore (13% YoY growth)

PAT: ₹10 crore (second consecutive profitable quarter; signals gradual turnaround)

EBITDA margin: Improved (₹57 crore), net profit margin remains low (2.2%).

Valuation Analysis

PE (TTM): ~175.79 (high vs industry, reflects premium pricing)

Price/Book: ~3.7 (also on higher side)

Intrinsic value models suggest stock is overvalued by ₹215–₹158 above fair value estimates

Key Risks

Overvaluation risk: Stock prices significantly above many fair value models

Competitive risk: Sector heating up, may impact growth/margins

Volatility risk: Possible for sharp corrections in the short term.

Suggested Strategy

Accumulate only on dips toward ₹350–₹420 zone (closer to fair value)

Hold if already invested; consider profit booking if price sharply rallies beyond target zones

Aggressive buying is not advised at current valuation.

Disclaimer: lnkd.in/ge86Wx-X

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.