Technical Outlook – Wall Street Index (30-Minute Chart)

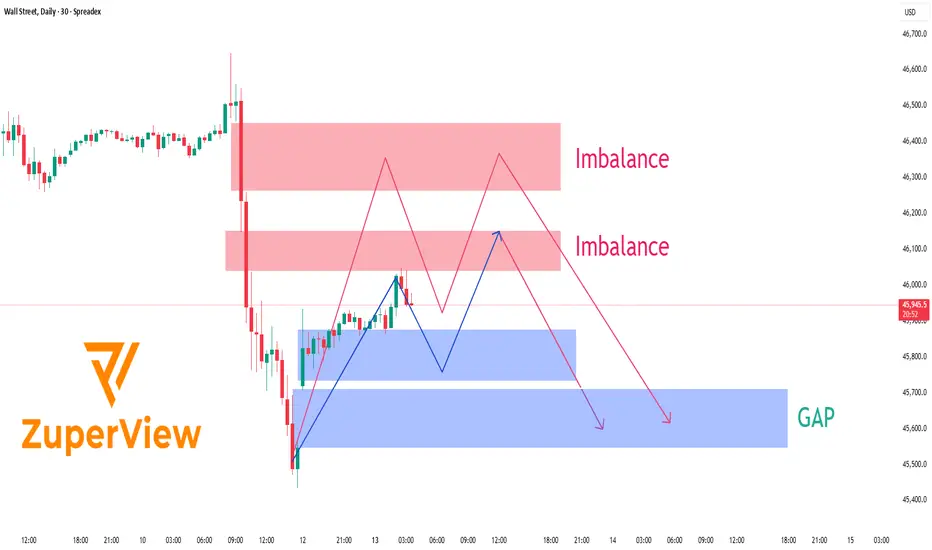

After the announcement that the U.S. will impose a 100 % tariff on Chinese imports, Wall Street ⚡ plunged sharply, leaving behind distinct Imbalance zones and an unfilled GAP lurking below current price levels.

At present, price is hovering around 45,950 💵, showing a modest rebound after tapping into a short-term demand zone. Above, two notable Imbalance areas stand out — around 46,000-46,150 and 46,250-46,450 - both formed as aggressive sell orders flooded the market following the latest wave of trade-war headlines 🌍.

The likely scenario 🎯:

Price could continue to retrace upward ↗️ to test one of these supply/imbalance zones before sellers re-enter the market. If selling pressure remains dominant, the index may resume its decline toward the GAP area around 45,500 - 45,650 📉, where liquidity is still unfilled and buyers may look to step back in.

Current price action indicates a corrective pullback rather than a full reversal. Trading volume is thinning 📉, candlestick patterns show signs of exhaustion 🕯️, and the upper imbalance zones remain untouched — all signaling that sellers still hold the upper hand.

________________________________________

🌍 Fundamental Context – U.S. vs. China Tensions Heating Up

On October 10, President Trump officially declared a 100 % additional tariff on Chinese goods, effective November 1, 2025 — the most aggressive move since the 2018-2019 trade war.

Beijing immediately condemned the plan, warning of “corresponding countermeasures”, including restrictions on rare-earth exports and higher port fees on U.S. vessels. While strong in tone, China has so far stopped short of announcing a direct tariff retaliation, signaling a cautious approach while keeping the door open for talks.

Washington, meanwhile, insists the measure aims to “protect American interests and reduce over-reliance on China’s supply chains,” but officials also noted that negotiations remain possible if China shows “substantive goodwill.”

Financial markets reacted swiftly 💥:

• U.S. and Asian equities dropped 2–3 % on average.

• USD strengthened, while gold and JPY rallied as safe-haven flows increased.

• Tech and industrial stocks with strong China exposure saw the largest losses.

Overall, risk sentiment remains fragile as investors brace for a prolonged phase of trade uncertainty.

________________________________________

💡 Trading Summary

Short-term structure favors a sell-the-rally approach. The market may retest upper imbalance zones before resuming its downtrend toward the 45,500 USD GAP area.

If U.S.–China tensions intensify further, downside momentum could accelerate. Conversely, any sign of renewed dialogue or tariff delay could trigger a short-term rebound — but bias remains bearish until the market reclaims 46,300 USD convincingly.

In short: patience, risk control, and reaction to headlines are key this week. ⚖️

Harry Andrew @ ZuperView

After the announcement that the U.S. will impose a 100 % tariff on Chinese imports, Wall Street ⚡ plunged sharply, leaving behind distinct Imbalance zones and an unfilled GAP lurking below current price levels.

At present, price is hovering around 45,950 💵, showing a modest rebound after tapping into a short-term demand zone. Above, two notable Imbalance areas stand out — around 46,000-46,150 and 46,250-46,450 - both formed as aggressive sell orders flooded the market following the latest wave of trade-war headlines 🌍.

The likely scenario 🎯:

Price could continue to retrace upward ↗️ to test one of these supply/imbalance zones before sellers re-enter the market. If selling pressure remains dominant, the index may resume its decline toward the GAP area around 45,500 - 45,650 📉, where liquidity is still unfilled and buyers may look to step back in.

Current price action indicates a corrective pullback rather than a full reversal. Trading volume is thinning 📉, candlestick patterns show signs of exhaustion 🕯️, and the upper imbalance zones remain untouched — all signaling that sellers still hold the upper hand.

________________________________________

🌍 Fundamental Context – U.S. vs. China Tensions Heating Up

On October 10, President Trump officially declared a 100 % additional tariff on Chinese goods, effective November 1, 2025 — the most aggressive move since the 2018-2019 trade war.

Beijing immediately condemned the plan, warning of “corresponding countermeasures”, including restrictions on rare-earth exports and higher port fees on U.S. vessels. While strong in tone, China has so far stopped short of announcing a direct tariff retaliation, signaling a cautious approach while keeping the door open for talks.

Washington, meanwhile, insists the measure aims to “protect American interests and reduce over-reliance on China’s supply chains,” but officials also noted that negotiations remain possible if China shows “substantive goodwill.”

Financial markets reacted swiftly 💥:

• U.S. and Asian equities dropped 2–3 % on average.

• USD strengthened, while gold and JPY rallied as safe-haven flows increased.

• Tech and industrial stocks with strong China exposure saw the largest losses.

Overall, risk sentiment remains fragile as investors brace for a prolonged phase of trade uncertainty.

________________________________________

💡 Trading Summary

Short-term structure favors a sell-the-rally approach. The market may retest upper imbalance zones before resuming its downtrend toward the 45,500 USD GAP area.

If U.S.–China tensions intensify further, downside momentum could accelerate. Conversely, any sign of renewed dialogue or tariff delay could trigger a short-term rebound — but bias remains bearish until the market reclaims 46,300 USD convincingly.

In short: patience, risk control, and reaction to headlines are key this week. ⚖️

Please like and comment below to support our traders. Your reactions motivate us to do more analysis in the future 🙏✨

Harry Andrew @ ZuperView

👉 Explore all indicators & systems: zuperview.com/

👉 Join our Discord: discord.gg/YKE6ujrw59

All content provided by ZuperView is for informational & educational purposes only. Past performance does not guarantee future results.

👉 Join our Discord: discord.gg/YKE6ujrw59

All content provided by ZuperView is for informational & educational purposes only. Past performance does not guarantee future results.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

👉 Explore all indicators & systems: zuperview.com/

👉 Join our Discord: discord.gg/YKE6ujrw59

All content provided by ZuperView is for informational & educational purposes only. Past performance does not guarantee future results.

👉 Join our Discord: discord.gg/YKE6ujrw59

All content provided by ZuperView is for informational & educational purposes only. Past performance does not guarantee future results.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.