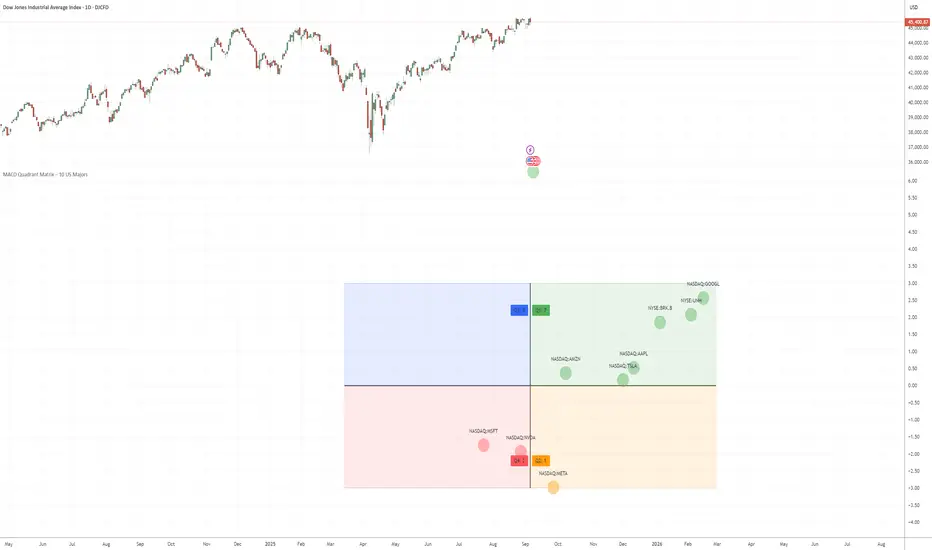

Based on the MACD Quadrant Matrix – 10 US Majors, we are seeing clear evidence of rotation between mega-cap tech stocks and large-cap value leaders.

🔹 Quadrant 1 (Leading – MACD Positive, Momentum Positive):

Strong performers remain in this quadrant: GOOGL, BRK.B, UNH, AAPL, TSLA. These stocks show sustained buying pressure and positive momentum.

🔸 Quadrant 2 (Weakening – MACD Positive, Momentum Negative):

META is starting to lose momentum despite a positive MACD → this could signal either consolidation or early weakness.

🔻 Quadrant 3 (Lagging – MACD Negative, Momentum Negative):

MSFT and NVDA are under pressure with both MACD and momentum turning negative. These names face higher downside risk if weakness continues.

🟢 Quadrant 4 (Improving – MACD Negative, Momentum Positive):

AMZN is in recovery mode, showing early signs of improvement. A breakout from this quadrant could push it into leadership.

Market Takeaway:

Rotation suggests select tech leaders (MSFT, NVDA) are moving into a corrective phase.

GOOGL, AAPL, TSLA remain strong leadership candidates.

Defensive large caps (BRK.B, UNH) continue to act as stable outperformers.

Trading Strategy:

Favor holdings in Quadrant 1 leaders (GOOGL, AAPL, TSLA, BRK.B, UNH).

Watch AMZN in Quadrant 4 for a potential breakout.

Be cautious with MSFT, NVDA in Quadrant 3 due to continued downside risk.

Risk Management:

Use stop-loss levels on weakening names.

Diversify between growth and defensive leaders to balance exposure.

🔹 Quadrant 1 (Leading – MACD Positive, Momentum Positive):

Strong performers remain in this quadrant: GOOGL, BRK.B, UNH, AAPL, TSLA. These stocks show sustained buying pressure and positive momentum.

🔸 Quadrant 2 (Weakening – MACD Positive, Momentum Negative):

META is starting to lose momentum despite a positive MACD → this could signal either consolidation or early weakness.

🔻 Quadrant 3 (Lagging – MACD Negative, Momentum Negative):

MSFT and NVDA are under pressure with both MACD and momentum turning negative. These names face higher downside risk if weakness continues.

🟢 Quadrant 4 (Improving – MACD Negative, Momentum Positive):

AMZN is in recovery mode, showing early signs of improvement. A breakout from this quadrant could push it into leadership.

Market Takeaway:

Rotation suggests select tech leaders (MSFT, NVDA) are moving into a corrective phase.

GOOGL, AAPL, TSLA remain strong leadership candidates.

Defensive large caps (BRK.B, UNH) continue to act as stable outperformers.

Trading Strategy:

Favor holdings in Quadrant 1 leaders (GOOGL, AAPL, TSLA, BRK.B, UNH).

Watch AMZN in Quadrant 4 for a potential breakout.

Be cautious with MSFT, NVDA in Quadrant 3 due to continued downside risk.

Risk Management:

Use stop-loss levels on weakening names.

Diversify between growth and defensive leaders to balance exposure.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.