The MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator. It uses two EMAs to generate signals via crossovers and histogram shifts.

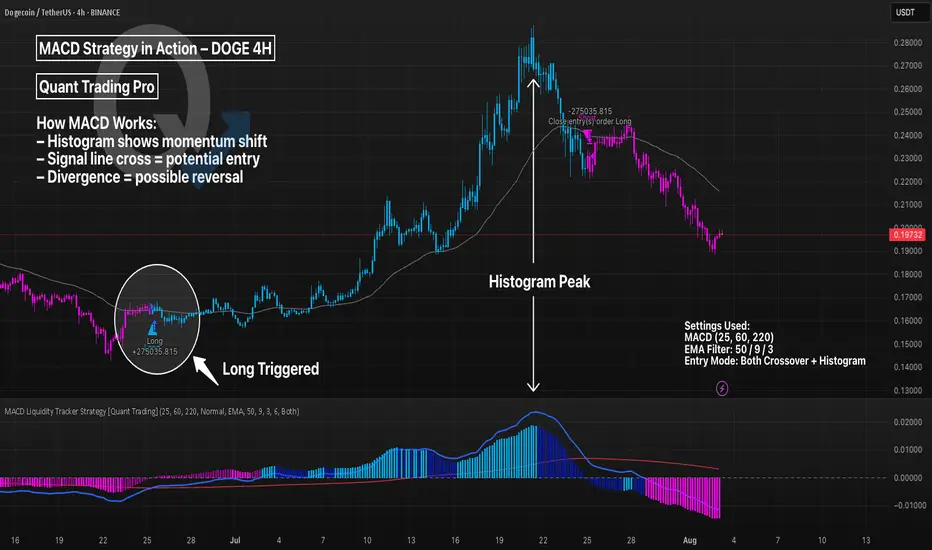

This chart shows DOGE 4H with a long-only MACD Liquidity Tracker Strategy, using:

Fast EMA: 25

Slow EMA: 60

Signal Line: 220

These longer settings reduce noise and provide higher-conviction swing entries, though at the cost of late signals.

💡 Tweak Tip:

Lower values (e.g. 12/26/9) = more signals, better for scalping

Higher values (e.g. 25/60/220) = fewer signals, better trend filtering

Adjust the EMA filter (50/9/3 here) to match asset volatility

📊 Use MACD for:

Trend continuation confirmation

Exit timing via histogram fading

Divergence spotting (momentum vs price)

This chart shows DOGE 4H with a long-only MACD Liquidity Tracker Strategy, using:

Fast EMA: 25

Slow EMA: 60

Signal Line: 220

These longer settings reduce noise and provide higher-conviction swing entries, though at the cost of late signals.

💡 Tweak Tip:

Lower values (e.g. 12/26/9) = more signals, better for scalping

Higher values (e.g. 25/60/220) = fewer signals, better trend filtering

Adjust the EMA filter (50/9/3 here) to match asset volatility

📊 Use MACD for:

Trend continuation confirmation

Exit timing via histogram fading

Divergence spotting (momentum vs price)

Explore 5,000 Strategies at quanttradingpro.com

Search for the most profitable, lowest risk by symbol!

Search by indicators like Supertrend, Ichimoku, macd.

Join our discord discord.gg/2systG9frc

We provide education & tools.

Search for the most profitable, lowest risk by symbol!

Search by indicators like Supertrend, Ichimoku, macd.

Join our discord discord.gg/2systG9frc

We provide education & tools.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Explore 5,000 Strategies at quanttradingpro.com

Search for the most profitable, lowest risk by symbol!

Search by indicators like Supertrend, Ichimoku, macd.

Join our discord discord.gg/2systG9frc

We provide education & tools.

Search for the most profitable, lowest risk by symbol!

Search by indicators like Supertrend, Ichimoku, macd.

Join our discord discord.gg/2systG9frc

We provide education & tools.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.