The term death cross often sends shivers through markets, but in the case of the US Dollar Index (DXY), it’s proven to be quite the opposite.

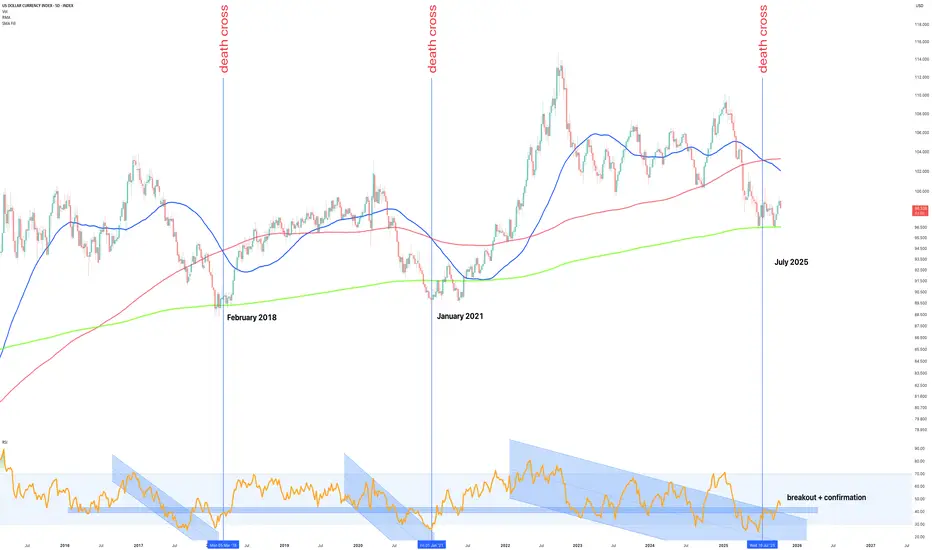

History tells us that every major death cross on the 5-day chart where the short-term 50 day simple moving average (SMA) crosses below the 200 day long term simple moving average (SMA), has in fact marked the end of a dollar downtrend, not the start of one. This is especially true after a test of the annual Rolling Moving Average (green line), as has just confirmed.

Look left:

We can keep looking left if those last three dates do not satisfy, the story does not change, there is no “this time is different” while the DXY is in a macro uptrend.

Now, in October 2025, the RSI confirms a breakout from its multi-year descending channel, adding technical weight to what the moving averages are already signalling: the bear phase is likely over, and the next dollar bull market is quietly beginning. The 50 line is marked out, once it climbs above the rest is history.

What’s Next

Conclusions

The data is clear: every major death cross in recent DXY history has aligned with the start of a new bullish cycle. The 5-day structure, RSI breakout, and confirmation from the rolling annual average all point toward a macro reversal is underway.

The irony of the name death cross is not lost here, for the dollar, it often signals the exact opposite. If history rhymes once again, October 2025 will be remembered as the quiet beginning of the next US Dollar bull market.

Ww

==============================

Disclaimer

This post is for educational and informational purposes only and represents personal market analysis, not financial advice.

Currency markets are inherently volatile and influenced by complex macroeconomic factors. Always perform your own research, manage risk responsibly, and rely on confirmation, not emotion, when making trading or investment decisions.

Patience, data, and confirmation, the real currency of trading.

History tells us that every major death cross on the 5-day chart where the short-term 50 day simple moving average (SMA) crosses below the 200 day long term simple moving average (SMA), has in fact marked the end of a dollar downtrend, not the start of one. This is especially true after a test of the annual Rolling Moving Average (green line), as has just confirmed.

Look left:

- February 2018, Death cross printed at the macro low. The dollar rallied for nearly two years.

- January 2021, Death cross printed again, just before the dollar began its next sustained advance.

- July 2025, Another death cross appears, once again coinciding with price touching the RMA, the same long-term structural support that has historically defined the beginning of each dollar bull cycle.

We can keep looking left if those last three dates do not satisfy, the story does not change, there is no “this time is different” while the DXY is in a macro uptrend.

Now, in October 2025, the RSI confirms a breakout from its multi-year descending channel, adding technical weight to what the moving averages are already signalling: the bear phase is likely over, and the next dollar bull market is quietly beginning. The 50 line is marked out, once it climbs above the rest is history.

What’s Next

Each of the prior bullish reversals began the same way:

1. Death cross, triggering capitulation sentiment.

2. Support test of the annual rolling moving average

3. RSI breakout and confirmation of trend reversal

That structure is now repeating almost perfectly.

If momentum follows prior cycles, the next 6–18 months could see the DXY recover toward the 105–110 zone, with potential for extension beyond 115 over the full bull phase.

A break and hold above 104 would confirm trend strength, while a close below the annual average around 96 would invalidate the structure and delay the signal.

This setup isn’t about calling tops or bottoms, it’s about recognising that death crosses on this timeframe have repeatedly marked strong uptrends for the dollar, not endings as the gold folks would have us believe.

Conclusions

The data is clear: every major death cross in recent DXY history has aligned with the start of a new bullish cycle. The 5-day structure, RSI breakout, and confirmation from the rolling annual average all point toward a macro reversal is underway.

The irony of the name death cross is not lost here, for the dollar, it often signals the exact opposite. If history rhymes once again, October 2025 will be remembered as the quiet beginning of the next US Dollar bull market.

Ww

==============================

Disclaimer

This post is for educational and informational purposes only and represents personal market analysis, not financial advice.

Currency markets are inherently volatile and influenced by complex macroeconomic factors. Always perform your own research, manage risk responsibly, and rely on confirmation, not emotion, when making trading or investment decisions.

Patience, data, and confirmation, the real currency of trading.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.