Date 10.08.2025

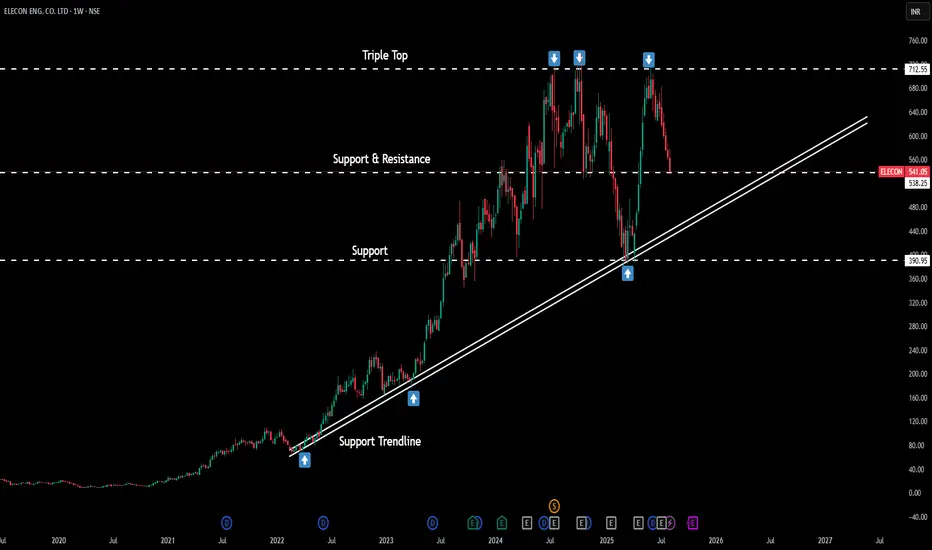

Elecon Engineering

Timeframe : Weekly Chart

About :

Company manufactures and sells power transmission and material handling equipment in India and internationally. In addition, it engages in the steel and non-ferrous foundry business.

Business Segment :

(1) Gear Division 72%

(2) Bulk Material Handling Equipment Solutions 28%

Products & Projects :

(1) Coal Handling Plants

(2) Stockyard machines

(3) Wagon Tipplers

(4) Over 2,000 Crushers/Feeders

(5) Pipe Conveyors and specialised belt conveyor systems

(6) Feeders

Foundry Division:

It caters to the machining and foundry needs of Elecon Engineering, providing casting and machining services to several companies other than the Elecon group.

Capacity of 8400 MTPA

Market Position :

Market Share for Industrial gear in India at ~39%

Geographical Revenue Split

India - 77%

Outside India - 23%

Clientele :

Ultratech cement, British Steel, HAYLEY, Tetra Pak, adani, LT, NMDC,SAIL, BHEL etc.

Order Book :

New order intake for FY25 is 2,380 crores

Valuations :

(1) Roce = 28.5%

(2) Roe = 23%

(3) Book Value = 6X

(4) Pe Ratio = 27

(5) Opm = 25%

(6) Promoter Holding = 60%

(7) Sales Growth = 20% (YoY last 3 years)

Regards,

Ankur Singh

Elecon Engineering

Timeframe : Weekly Chart

About :

Company manufactures and sells power transmission and material handling equipment in India and internationally. In addition, it engages in the steel and non-ferrous foundry business.

Business Segment :

(1) Gear Division 72%

(2) Bulk Material Handling Equipment Solutions 28%

Products & Projects :

(1) Coal Handling Plants

(2) Stockyard machines

(3) Wagon Tipplers

(4) Over 2,000 Crushers/Feeders

(5) Pipe Conveyors and specialised belt conveyor systems

(6) Feeders

Foundry Division:

It caters to the machining and foundry needs of Elecon Engineering, providing casting and machining services to several companies other than the Elecon group.

Capacity of 8400 MTPA

Market Position :

Market Share for Industrial gear in India at ~39%

Geographical Revenue Split

India - 77%

Outside India - 23%

Clientele :

Ultratech cement, British Steel, HAYLEY, Tetra Pak, adani, LT, NMDC,SAIL, BHEL etc.

Order Book :

New order intake for FY25 is 2,380 crores

Valuations :

(1) Roce = 28.5%

(2) Roe = 23%

(3) Book Value = 6X

(4) Pe Ratio = 27

(5) Opm = 25%

(6) Promoter Holding = 60%

(7) Sales Growth = 20% (YoY last 3 years)

Regards,

Ankur Singh

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.