Unveiling the $ERA Reversal A Deep Dive into the Chart Opportuni

Unveiling the

Price Action Description

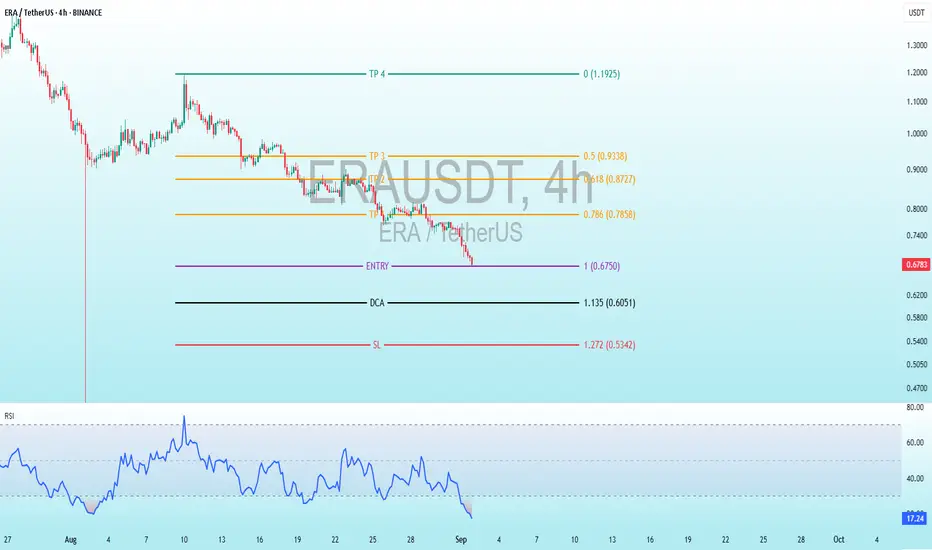

Historical Trend: The price began around 1.20 USDT in late July, with initial choppy movement. A sharp decline in early August dropped it to 0.50-0.60 USDT, followed by a brief recovery to 0.80-1.00 USDT in mid-August. Another steep fall occurred in late August/early September.

Recent Movement: A massive red candlestick around September 1 marks a vertical drop from 1.00-1.10 USDT to 0.60-0.70 USDT, suggesting a capitulation event or flash crash. The price has stabilized around 0.682 USDT as of 11:03 PM CEST, with smaller candles indicating reduced volatility or exhaustion.

Current Price: Approximately 0.682 USDT, down 40-50% from July highs, hinting at potential oversold conditions.

Volatility: High, evident from long wicks and large candle bodies, especially during drops, though volume data is absent.

Key Technical Levels

Entry: Set at 0.6750 USDT, the suggested point to enter a long position, slightly below the current price of 0.682 USDT, anticipating a small pullback before confirming the trade.

TP (Take Profit): Targets are 0.7858 USDT for the first profit take, followed by 0.8727 USDT, 0.9338 USDT, and the highest goal at 1.1925 USDT, offering a range of exit points for potential gains.

DCA: Positioned at 0.6051 USDT, a level to add to the trade if the price drops further, helping to average down the entry cost.

SL (Stop Loss): Placed at 0.5342 USDT, the cutoff to exit the trade if the price falls, limiting losses and protecting the position.

Fibonacci Context: These levels appear derived from a downward Fibonacci extension (e.g., -0.618, -0.786) based on the recent drop from 1.20 to 0.50 USDT, suggesting a potential reversal zone. The setup implies a long trade anticipating a bounce.

Risk-Reward: Risk from 0.6750 to 0.5342 is 0.1408 USDT, with rewards to 0.7858 (0.1108, RR 0.8:1) and up to 1.1925 (0.5175, RR ~3.7:1), indicating a favorable setup if the reversal occurs.

Indicators Analysis

RSI (Relative Strength Index): Current value is 17.87, well below 30, signaling oversold conditions and a potential rebound. The line has trended down sharply with the price drop, showing waning momentum without visible bullish divergence yet. The RSI scale (0-100) marks overbought above 70, irrelevant here.

Potential Trading Implications and Risks

Bullish Case: The marked levels suggest a bottom-fishing opportunity post-crash, supported by oversold RSI. A rebound to take-profit levels is plausible if the broader crypto market stabilizes (e.g., Bitcoin trends) or if positive news emerges for ERA (e.g., gaming ecosystem updates).

Bearish Case: The dominant downtrend and recent sharp drop indicate strong selling pressure. Breaking below 0.6051 (DCA) or 0.5342 (SL) could lead to further declines toward 0.40-0.50 USDT.

Market Context: As of 11:03 PM CEST on September 1, 2025, check for recent events—token unlocks, hacks, or macro factors like interest rate changes affecting risk assets.

Risks: High altcoin volatility, lack of volume data (limiting liquidity insight), and subjective Fib levels. Use risk management (e.g., 1-2% account risk).

Suggestions: Confirm with bullish patterns (e.g., hammer or engulfing) at 0.6750 or RSI crossing above 30.

Dagangan aktif

ENTRY 0.6750 TARGET SCALP ✅ +8.43% PROFIT

🏋️♂️ The harder you work for something, the greater you’ll feel when you achieve it.

Interested for Premium 👉 t.me/Altcoin_Piooners

Follow for signals! 🔥#Crypto #Trading #CryptoSignals #ERA #Altcoins

✅MY Free Signals Telegram

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

✅MY Free Signals Telegram

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.