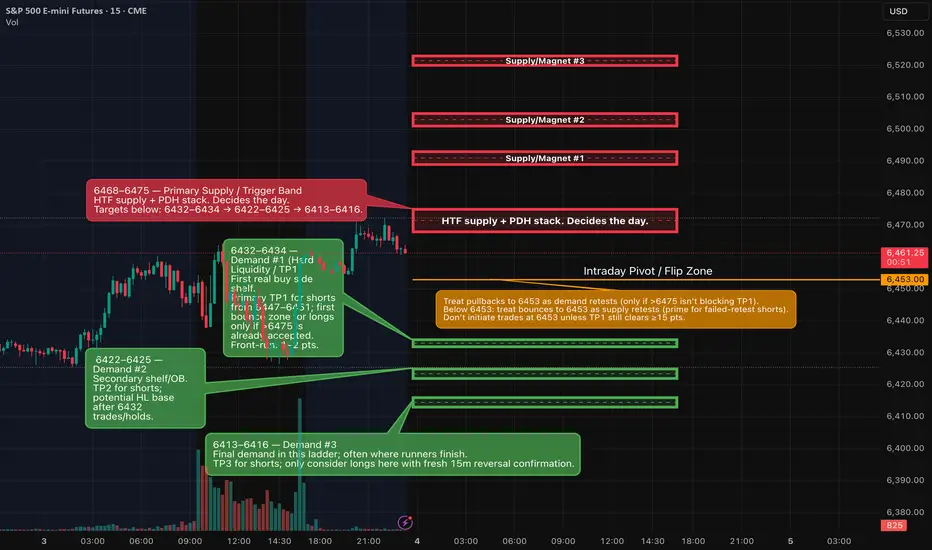

We’re parked beneath a well-defined 6468–6475 ceiling. Tomorrow the clean A++ is either: (A) Breakout-acceptance long > 6475 (retest holds), or (B) Rejection short after a test of 6468–6475 that sends price back through 6453 with 15-minute bearish confirmation. TP ladders are mapped to ~6490 / 6501 / 6520 above and ~6432 / 6422 / 6413 below. Trigger-Lock is ON: numbers are frozen once posted.

Weekly/Daily: Pressing prior distribution highs; repeated supply above ~6470–6485; upside extensions show 1.618 ≈ 6489 and 2.000 ≈ 6504 as next magnets.

4H/1H: Recovery from the 6.43k shelf, printing HLs into the ceiling; momentum constructive but unresolved under 6475.

30m/15m: Rangebound day resolved late; resistance band 6468–6475 capped advances; 6453 (Monday Low pivot) is your intraday toggle.

Hard levels to respect

• Ceiling / Trigger band: 6468–6475

• Pivot: 6453 (lose/reclaim toggles bias)

• First downside shelves: 6432–6434, 6422–6425, 6413–6416

• Upside magnets if accepted: 6489–6493, 6501–6505, 6520–6523

A++ Setups

1) Breakout-Acceptance LONG

• Trigger: First 5-minute close > 6475, then a quick retest that holds 6472–6475 (no reclaim < 6470).

• Entry: 6472–6479 on the hold.

• Initial SL: 6466–6468 (≤ 6–8 pts).

• TP1: 6490–6493 (≥ +15 from 6475 → 2.5R with 6-pt risk).

• TP2: 6501–6505

• TP3: 6520–6523

Invalidation: Any 15m close back inside 6468–6475 after acceptance.

2) Rejection-Failure SHORT

• Precondition: Price tests 6468–6475 and rejects.

• Confirm: 15m bearish close < 6466, then a 5m failed retest 6447–6451 (lower high).

• Entry: 6447–6451 on the failed retest.

• Initial SL: 6454–6456 (≤ 6–8 pts).

• TP1: 6432–6434 (≥ +15 from 6449).

• TP2: 6422–6425

• TP3: 6413–6416

Flip: Any 30m acceptance > 6475 cancels shorts and re-arms the long.

Tomorrow’s U.S. calendar (key times, ET)

• ADP National Employment Report: 8:15 am.

• Initial Jobless Claims: 8:30 am (weekly, DOL).

• S&P Global U.S. Services PMI (final): 9:45 am (standard PMI schedule).

• ISM Services PMI: 10:00 am (third business day rule → Sep 4).

• EIA Weekly Petroleum Status (holiday schedule): 12:00 pm ET (Labor Day shift).

Weekly/Daily: Pressing prior distribution highs; repeated supply above ~6470–6485; upside extensions show 1.618 ≈ 6489 and 2.000 ≈ 6504 as next magnets.

4H/1H: Recovery from the 6.43k shelf, printing HLs into the ceiling; momentum constructive but unresolved under 6475.

30m/15m: Rangebound day resolved late; resistance band 6468–6475 capped advances; 6453 (Monday Low pivot) is your intraday toggle.

Hard levels to respect

• Ceiling / Trigger band: 6468–6475

• Pivot: 6453 (lose/reclaim toggles bias)

• First downside shelves: 6432–6434, 6422–6425, 6413–6416

• Upside magnets if accepted: 6489–6493, 6501–6505, 6520–6523

A++ Setups

1) Breakout-Acceptance LONG

• Trigger: First 5-minute close > 6475, then a quick retest that holds 6472–6475 (no reclaim < 6470).

• Entry: 6472–6479 on the hold.

• Initial SL: 6466–6468 (≤ 6–8 pts).

• TP1: 6490–6493 (≥ +15 from 6475 → 2.5R with 6-pt risk).

• TP2: 6501–6505

• TP3: 6520–6523

Invalidation: Any 15m close back inside 6468–6475 after acceptance.

2) Rejection-Failure SHORT

• Precondition: Price tests 6468–6475 and rejects.

• Confirm: 15m bearish close < 6466, then a 5m failed retest 6447–6451 (lower high).

• Entry: 6447–6451 on the failed retest.

• Initial SL: 6454–6456 (≤ 6–8 pts).

• TP1: 6432–6434 (≥ +15 from 6449).

• TP2: 6422–6425

• TP3: 6413–6416

Flip: Any 30m acceptance > 6475 cancels shorts and re-arms the long.

Tomorrow’s U.S. calendar (key times, ET)

• ADP National Employment Report: 8:15 am.

• Initial Jobless Claims: 8:30 am (weekly, DOL).

• S&P Global U.S. Services PMI (final): 9:45 am (standard PMI schedule).

• ISM Services PMI: 10:00 am (third business day rule → Sep 4).

• EIA Weekly Petroleum Status (holiday schedule): 12:00 pm ET (Labor Day shift).

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

Email: info@algoindex.com

Email: info@algoindex.com

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

Email: info@algoindex.com

Email: info@algoindex.com

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.