Brief Description:

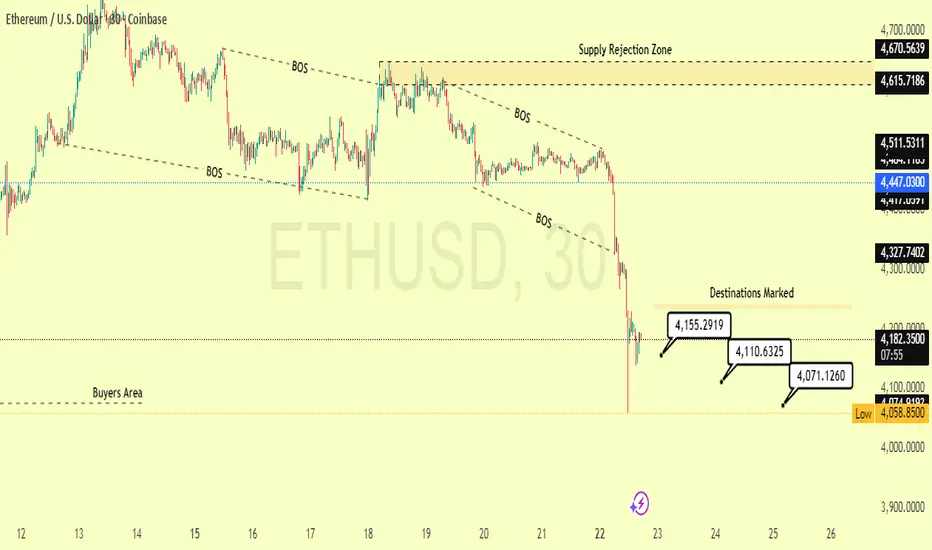

Ethereum faced a decisive rejection from the **Supply Rejection Zone near $4,615– $4,670**, where previous institutional sell-offs occurred. Price structure showed consistent signs of weakness leading up to this, including multiple Break of Structure (BOS) confirmations on lower highs. The rejection triggered aggressive selling pressure, causing a near 6% drop in a single session — a clear indication of supply absorption and lack of bullish momentum at the top. This move likely flushed leveraged longs, opening the door for liquidity grabs toward demand zones.

Following the sharp dump, ETH is now showing signs of a short-term relief move. The chart outlines a corrective bounce setup with clear intraday targets, acting as potential resistance levels on the way up:

Target 1: $4,155.29 – Strong reaction level, aligned with structural breakdown point.

Target 2: $4,110.63 – Mid-level reaction zone; watch for volume behavior here.

Target 3: $4,071.13 – Near-term resistance, potential pullback zone.

Traders should monitor lower timeframes for signs of reversal or continuation near these levels. The Buyers Area around \$4,000 remains critical if price continues lower.

This setup aligns with broader market weakness and reflects typical behavior following rejection from a strong supply zone — remain cautious and trade with discipline.

Ethereum faced a decisive rejection from the **Supply Rejection Zone near $4,615– $4,670**, where previous institutional sell-offs occurred. Price structure showed consistent signs of weakness leading up to this, including multiple Break of Structure (BOS) confirmations on lower highs. The rejection triggered aggressive selling pressure, causing a near 6% drop in a single session — a clear indication of supply absorption and lack of bullish momentum at the top. This move likely flushed leveraged longs, opening the door for liquidity grabs toward demand zones.

Following the sharp dump, ETH is now showing signs of a short-term relief move. The chart outlines a corrective bounce setup with clear intraday targets, acting as potential resistance levels on the way up:

Target 1: $4,155.29 – Strong reaction level, aligned with structural breakdown point.

Target 2: $4,110.63 – Mid-level reaction zone; watch for volume behavior here.

Target 3: $4,071.13 – Near-term resistance, potential pullback zone.

Traders should monitor lower timeframes for signs of reversal or continuation near these levels. The Buyers Area around \$4,000 remains critical if price continues lower.

This setup aligns with broader market weakness and reflects typical behavior following rejection from a strong supply zone — remain cautious and trade with discipline.

Dagangan aktif

Quick update on the ETH short-term corrective bounce setup:✅ Target 1 (\$4,155) has been reached, with price reacting and pulling back after tapping the zone.

🔄 Minor bounce observed around $4,120, confirming it as an interim reaction area.

At this point, the move is playing out as expected — traders should closely monitor volume and price behavior between $4,100–$4,155 for clues on whether momentum can sustain toward Target 2 ($4,110.63) and Target 3 ($4,071.13)**.

⚠️ Remain cautious — this is still a corrective move within broader market weakness. Watch for potential lower-high formations or signs of bearish continuation on lower timeframes.

Will keep this setup updated if conditions change.

Nota

Current Note:* The short trade has played out as anticipated.

* With Targets 1 & 2 hit, and Target 3 nearly met (within \$5), we consider this move largely fulfilled.

* $4,071 remains a key reaction level; any deeper push into this zone may trigger minor short covering or temporary support.

* Maintain bearish bias unless ETH reclaims and holds above \$4,155 with strong volume.

📌 **Risk Management:** Tighten stops or consider partial profit booking if still in the trade. Watch for lower high formations on any further bounce attempts.

-

#Professional_Account_Manager

t.me/+xQ3gKJ30gXAwZTA0

Reliable Forex Signal Provider

Full-Time Trader | Market Analyst

Committed to consistent, profitable trading for our community.

t.me/+xQ3gKJ30gXAwZTA0

Daily High-Accuracy Signals

t.me/+xQ3gKJ30gXAwZTA0

Reliable Forex Signal Provider

Full-Time Trader | Market Analyst

Committed to consistent, profitable trading for our community.

t.me/+xQ3gKJ30gXAwZTA0

Daily High-Accuracy Signals

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

#Professional_Account_Manager

t.me/+xQ3gKJ30gXAwZTA0

Reliable Forex Signal Provider

Full-Time Trader | Market Analyst

Committed to consistent, profitable trading for our community.

t.me/+xQ3gKJ30gXAwZTA0

Daily High-Accuracy Signals

t.me/+xQ3gKJ30gXAwZTA0

Reliable Forex Signal Provider

Full-Time Trader | Market Analyst

Committed to consistent, profitable trading for our community.

t.me/+xQ3gKJ30gXAwZTA0

Daily High-Accuracy Signals

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.