EUR/CHF Full Analysis

1. Seasonality

EUR: Historically weak in August–September. The 20y and 15y datasets confirm a negative seasonal bias in September.

CHF: Stronger tendency in August–September, historically supported as a safe-haven currency, with September statistically positive.

👉 Seasonal bias: short EUR/CHF (weak EUR vs strong CHF).

2. Retail Sentiment

55% of retail traders are long EUR/CHF, while 45% are short.

👉 Slight long retail positioning = contrarian bearish signal.

3. COT Report (19 August 2025)

Euro: Non-commercial net long at 252k vs 133k short (+6.4k new longs, +3.1k new shorts). Still bullish momentum, but slowing down as commercials are selling.

CHF: Non-commercial net short (6k longs vs 33k shorts). Strong bearish imbalance, but commercials are long CHF (hedging), reinforcing CHF’s safe-haven status in case of risk-off correction.

👉 COT shows overweight Euro longs and heavy CHF shorts, raising risk of a future reversal in favor of CHF.

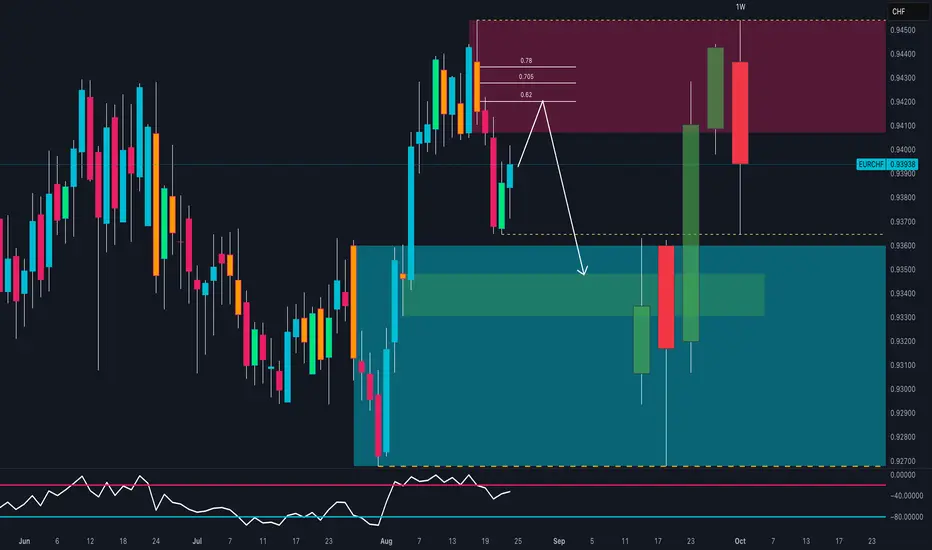

4. Technicals

Structure: Clear rejection from weekly supply zone 0.9435–0.9450 with a bearish engulfing.

Daily RSI cooling after strong impulse → room for further downside.

Possible pullback toward 0.9415–0.9425 (Fib 0.62–0.705) before continuation lower.

Technical targets: 0.9330–0.9315 (daily demand zone), extended to 0.9260.

Invalidation: Weekly close above 0.9450.

📌 Conclusion:

Seasonality, retail sentiment, and price action align for a bearish EUR/CHF bias. The COT highlights an overcrowded long Euro vs short CHF positioning, opening space for a structural rebound of the Swiss Franc. Technicals confirm: wait for a pullback to 0.9420 to short, targeting 0.9330/0.9260.

1. Seasonality

EUR: Historically weak in August–September. The 20y and 15y datasets confirm a negative seasonal bias in September.

CHF: Stronger tendency in August–September, historically supported as a safe-haven currency, with September statistically positive.

👉 Seasonal bias: short EUR/CHF (weak EUR vs strong CHF).

2. Retail Sentiment

55% of retail traders are long EUR/CHF, while 45% are short.

👉 Slight long retail positioning = contrarian bearish signal.

3. COT Report (19 August 2025)

Euro: Non-commercial net long at 252k vs 133k short (+6.4k new longs, +3.1k new shorts). Still bullish momentum, but slowing down as commercials are selling.

CHF: Non-commercial net short (6k longs vs 33k shorts). Strong bearish imbalance, but commercials are long CHF (hedging), reinforcing CHF’s safe-haven status in case of risk-off correction.

👉 COT shows overweight Euro longs and heavy CHF shorts, raising risk of a future reversal in favor of CHF.

4. Technicals

Structure: Clear rejection from weekly supply zone 0.9435–0.9450 with a bearish engulfing.

Daily RSI cooling after strong impulse → room for further downside.

Possible pullback toward 0.9415–0.9425 (Fib 0.62–0.705) before continuation lower.

Technical targets: 0.9330–0.9315 (daily demand zone), extended to 0.9260.

Invalidation: Weekly close above 0.9450.

📌 Conclusion:

Seasonality, retail sentiment, and price action align for a bearish EUR/CHF bias. The COT highlights an overcrowded long Euro vs short CHF positioning, opening space for a structural rebound of the Swiss Franc. Technicals confirm: wait for a pullback to 0.9420 to short, targeting 0.9330/0.9260.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.