🎯 EUR/JPY: "Euro vs. Yen" Wealth Heist Strategy 🤑 (Swing/Day Trade)

🚨 Thieves aka (Smart traders) of the Forex Market, Assemble! 🚨Get ready to pull off a slick bullish heist on EUR/JPY with this Thief-Style Trading Plan! We're leveraging a Kijun-Sen pullback to spot a juicy demand zone where the bulls are loading up to push prices higher. Let’s break into the market with style, precision, and a sprinkle of humor! 😎

📈 The Setup: Bullish Breakout Plan 🐂

Asset: EUR/JPY (Euro vs. Japanese Yen)

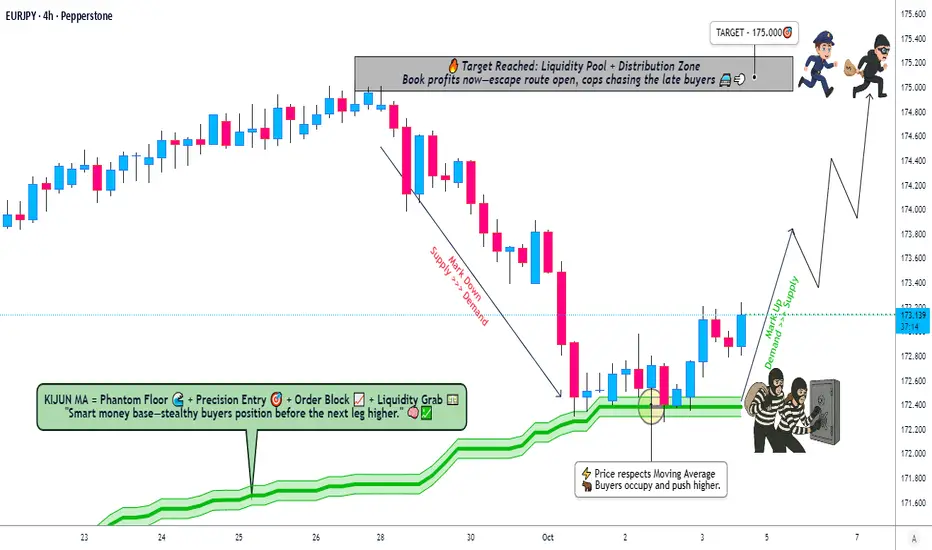

Market Context: The Kijun-Sen moving average (Ichimoku Cloud) has confirmed a bullish pullback, creating a demand zone at key support levels. Bulls are gathering strength to drive prices upward! 🚀

Trend: Swing/Day Trade with a bullish bias.

🕵️♂️ The Thief’s Entry Plan (Layered Limit Orders)

Our Thief Strategy uses multiple buy limit orders to layer entries like a mastermind stacking the deck. Here’s the plan:

Entry Levels:

🧳 172.400 (First layer, dip-buying opportunity)

🧳 172.600

🧳 172.800

🧳 173.000

Pro Tip: Feel free to add more layers based on your risk appetite and account size. Stack those orders like a pro! 📊

Entry Flexibility: You can enter at any price level within this demand zone, but layering ensures you maximize your position while managing risk.

🛑 Stop Loss: The Thief’s Escape Route

Stop Loss: Set at 172.000 (a tight, calculated exit to protect your loot).

Note: Dear Thieves (OGs and newbies alike), this SL is my suggestion, but it’s your heist, your rules. Adjust based on your risk tolerance and don’t get caught by the market police! 👮♂️

🎯 Take Profit: The Grand Getaway

Target: 175.000 (just shy of a strong resistance zone at 175.200).

Why?: The 175.200 level is a Police Barricade—a combo of strong resistance, overbought conditions, and a potential bear trap. Grab your profits at 175.000 to escape safely! 💰

Note: This TP is my call, but you’re the mastermind here. Take profits at your own discretion and secure the bag! 🤑

💡 Related Pairs to Watch (Correlations & Opportunities)

To make this heist even smoother, keep an eye on these correlated pairs for confirmation or additional setups:

USDJPY: A strong bullish move in USD/JPY often supports EUR/JPY strength due to JPY weakness. Watch for similar demand zones or breakout patterns.

USDJPY: A strong bullish move in USD/JPY often supports EUR/JPY strength due to JPY weakness. Watch for similar demand zones or breakout patterns.

EURUSD: If EUR is strong across the board, EUR/USD breakouts can reinforce our bullish bias on EUR/JPY. Check for alignment in trend direction.

EURUSD: If EUR is strong across the board, EUR/USD breakouts can reinforce our bullish bias on EUR/JPY. Check for alignment in trend direction.

GBPJPY: Another JPY pair with high volatility. If GBP/JPY is also showing bullish momentum, it could signal broader JPY weakness, boosting our EUR/JPY play.

GBPJPY: Another JPY pair with high volatility. If GBP/JPY is also showing bullish momentum, it could signal broader JPY weakness, boosting our EUR/JPY play.

Key Correlation Insight: JPY tends to weaken in risk-on environments, so monitor global risk sentiment (e.g., equity indices like S&P 500 or Nikkei 225) for clues.

🔍 Key Points to Understand the Setup

Demand Zone Strength: The Kijun-Sen pullback aligns with historical support, making this a high-probability zone for bulls to step in.

Layered Entries: Using multiple limit orders reduces risk by averaging your entry price, perfect for volatile forex markets.

Risk Management: The tight stop loss at 172.000 keeps your downside limited, while the 175.000 target offers a solid risk-reward ratio (~1:10).

Market Traps: Be cautious at 175.200—overbought conditions and resistance could trigger a reversal. Exit early to avoid getting caught!

⚠️ Disclaimer

This is a Thief-Style Trading Strategy designed for fun and educational purposes. Trading involves risks, and you’re responsible for your own decisions. Always do your own analysis and manage your risk like a pro! 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#EURJPY #ForexTrading #SwingTrading #DayTrading #ThiefStrategy #BullishBreakout #TradingView

🚨 Thieves aka (Smart traders) of the Forex Market, Assemble! 🚨Get ready to pull off a slick bullish heist on EUR/JPY with this Thief-Style Trading Plan! We're leveraging a Kijun-Sen pullback to spot a juicy demand zone where the bulls are loading up to push prices higher. Let’s break into the market with style, precision, and a sprinkle of humor! 😎

📈 The Setup: Bullish Breakout Plan 🐂

Asset: EUR/JPY (Euro vs. Japanese Yen)

Market Context: The Kijun-Sen moving average (Ichimoku Cloud) has confirmed a bullish pullback, creating a demand zone at key support levels. Bulls are gathering strength to drive prices upward! 🚀

Trend: Swing/Day Trade with a bullish bias.

🕵️♂️ The Thief’s Entry Plan (Layered Limit Orders)

Our Thief Strategy uses multiple buy limit orders to layer entries like a mastermind stacking the deck. Here’s the plan:

Entry Levels:

🧳 172.400 (First layer, dip-buying opportunity)

🧳 172.600

🧳 172.800

🧳 173.000

Pro Tip: Feel free to add more layers based on your risk appetite and account size. Stack those orders like a pro! 📊

Entry Flexibility: You can enter at any price level within this demand zone, but layering ensures you maximize your position while managing risk.

🛑 Stop Loss: The Thief’s Escape Route

Stop Loss: Set at 172.000 (a tight, calculated exit to protect your loot).

Note: Dear Thieves (OGs and newbies alike), this SL is my suggestion, but it’s your heist, your rules. Adjust based on your risk tolerance and don’t get caught by the market police! 👮♂️

🎯 Take Profit: The Grand Getaway

Target: 175.000 (just shy of a strong resistance zone at 175.200).

Why?: The 175.200 level is a Police Barricade—a combo of strong resistance, overbought conditions, and a potential bear trap. Grab your profits at 175.000 to escape safely! 💰

Note: This TP is my call, but you’re the mastermind here. Take profits at your own discretion and secure the bag! 🤑

💡 Related Pairs to Watch (Correlations & Opportunities)

To make this heist even smoother, keep an eye on these correlated pairs for confirmation or additional setups:

Key Correlation Insight: JPY tends to weaken in risk-on environments, so monitor global risk sentiment (e.g., equity indices like S&P 500 or Nikkei 225) for clues.

🔍 Key Points to Understand the Setup

Demand Zone Strength: The Kijun-Sen pullback aligns with historical support, making this a high-probability zone for bulls to step in.

Layered Entries: Using multiple limit orders reduces risk by averaging your entry price, perfect for volatile forex markets.

Risk Management: The tight stop loss at 172.000 keeps your downside limited, while the 175.000 target offers a solid risk-reward ratio (~1:10).

Market Traps: Be cautious at 175.200—overbought conditions and resistance could trigger a reversal. Exit early to avoid getting caught!

⚠️ Disclaimer

This is a Thief-Style Trading Strategy designed for fun and educational purposes. Trading involves risks, and you’re responsible for your own decisions. Always do your own analysis and manage your risk like a pro! 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#EURJPY #ForexTrading #SwingTrading #DayTrading #ThiefStrategy #BullishBreakout #TradingView

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.