Greetings, fellow traders! Let's dive into the exciting world of forex trading and explore a promising opportunity in the EUR/NZD currency pair.

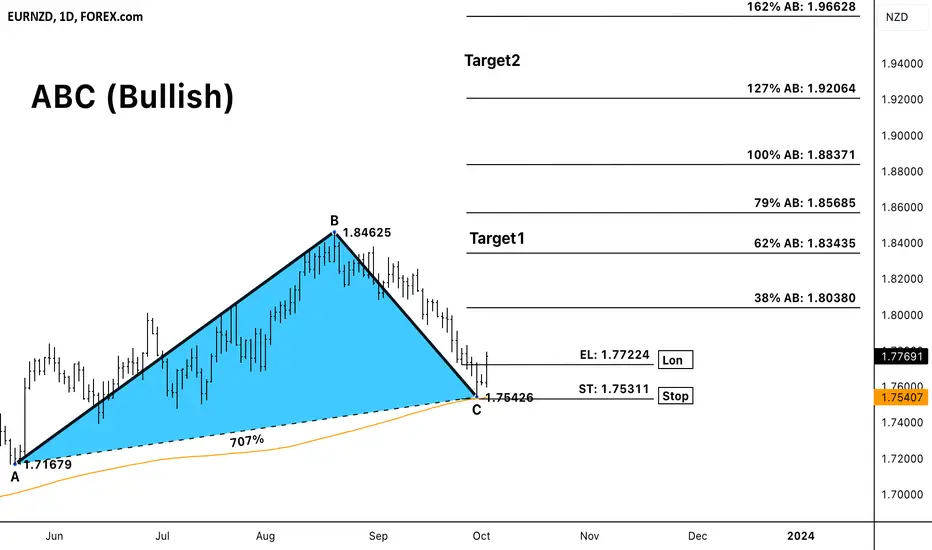

Our focus today is on EUR/NZD, which has displayed a compelling ABC bullish pattern on its daily chart. This pattern presents a potential pathway for traders to capitalize on.

As we analyze this setup, we can observe that the price is currently trading above the critical level of support at EL: 1.77224. To manage risk, it's advisable to set your stop-loss just below point C at ST: 1.75311.

Now, let's talk about potential targets. The ABC pattern suggests some interesting levels to consider:

Target 1: Aim for the 62% retracement of the AB leg, which sits at 1.83435.

Target 2: For a more ambitious goal, look at the 79% retracement of the AB leg, at 1.85685.

Target 3: If the market really starts to run, consider the 127% extension of the AB leg, which is at 1.92064.

Target 4: For those with an appetite for further gains, the 162% extension of the AB leg could be your ultimate destination, reaching 1.96628.

Happy trading, and may the pips be ever in your favor!

Our focus today is on EUR/NZD, which has displayed a compelling ABC bullish pattern on its daily chart. This pattern presents a potential pathway for traders to capitalize on.

As we analyze this setup, we can observe that the price is currently trading above the critical level of support at EL: 1.77224. To manage risk, it's advisable to set your stop-loss just below point C at ST: 1.75311.

Now, let's talk about potential targets. The ABC pattern suggests some interesting levels to consider:

Target 1: Aim for the 62% retracement of the AB leg, which sits at 1.83435.

Target 2: For a more ambitious goal, look at the 79% retracement of the AB leg, at 1.85685.

Target 3: If the market really starts to run, consider the 127% extension of the AB leg, which is at 1.92064.

Target 4: For those with an appetite for further gains, the 162% extension of the AB leg could be your ultimate destination, reaching 1.96628.

Happy trading, and may the pips be ever in your favor!

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.