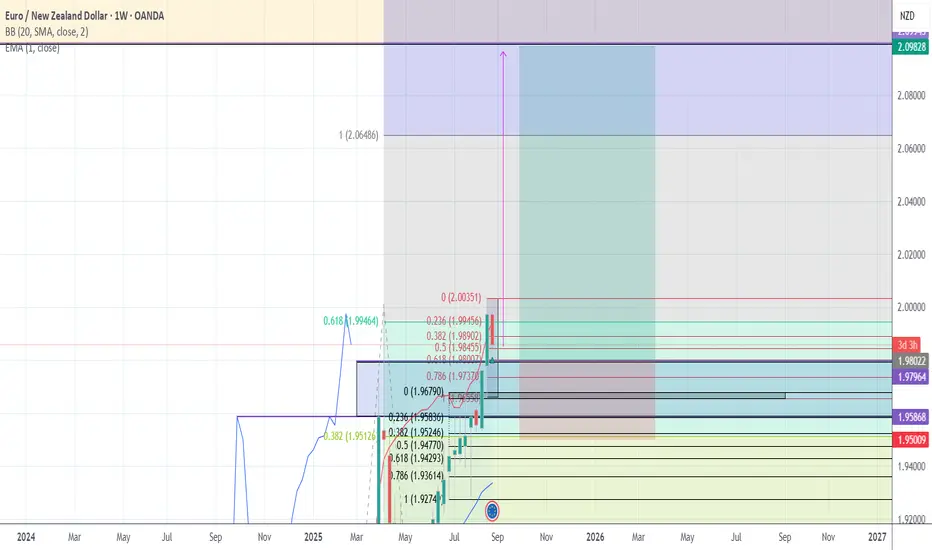

Multi-timeframe analysis using Fibonacci retracement.

The black Fibonacci is drawn from the monthly closed candle (higher timeframe trend).

The red Fibonacci is drawn from the weekly closed candle (shorter-term retracement).

Key Levels:

0.236 (1.9945) → first resistance

0.382 (1.9890) & 0.5 (1.9850) → intermediate support zones

0.618 (1.9804) → main support level

0.786 (1.9737) → critical support; a break below may extend towards 1.9670 – 1.9520

If support holds, the next bullish target is around 2.00 – 2.0648 (Fibo extension)

Position Management:

Stop Loss is placed just below the previous closed weekly candle (weekly spike).

A trailing stop of 1–1.5 ATR is used, always adjusted below the latest weekly spike.

This provides protection while letting the trend run.

Partial profits can be taken near 2.00, while the main bullish target remains 2.06 (Fibo extension).

The black Fibonacci is drawn from the monthly closed candle (higher timeframe trend).

The red Fibonacci is drawn from the weekly closed candle (shorter-term retracement).

Key Levels:

0.236 (1.9945) → first resistance

0.382 (1.9890) & 0.5 (1.9850) → intermediate support zones

0.618 (1.9804) → main support level

0.786 (1.9737) → critical support; a break below may extend towards 1.9670 – 1.9520

If support holds, the next bullish target is around 2.00 – 2.0648 (Fibo extension)

Position Management:

Stop Loss is placed just below the previous closed weekly candle (weekly spike).

A trailing stop of 1–1.5 ATR is used, always adjusted below the latest weekly spike.

This provides protection while letting the trend run.

Partial profits can be taken near 2.00, while the main bullish target remains 2.06 (Fibo extension).

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.