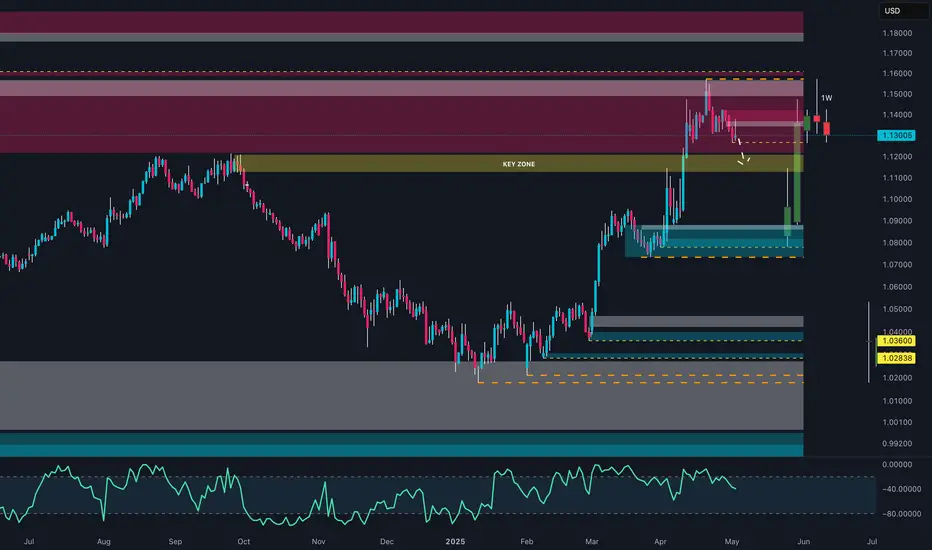

After an explosive bounce from the 1.0800–1.0850 demand zone, EUR/USD is now in a key structural retest around 1.1300. The COT data shows a net increase in long positions by Non-Commercials, but with the Dollar still holding structural strength in its own COT report and an RSI showing bearish divergence, this area may act as a key zone for price discovery.

📊 WHAT THE DATA SAYS:

📉 Price Action: Clear rejection from the 1.1450–1.1550 supply zone. Retest at key structure near 1.1300.

📑 COT (EURO): Net long positions up by +183 (196,388 long vs 120,591 short) = bullish tone.

📑 COT (USD): Still balanced, but Non-Commercials are reducing net longs → potential weakening.

📊 Retail Sentiment (MyFXBook): 70% retail traders are short = contrarian long bias remains.

🌱 Seasonality (May): Historically negative for EUR/USD (–0.0088) = potential downside pressure ahead.

📌 Key Levels:

Resistance: 1.1450 / 1.1550 (Supply Zone)

Support: 1.1300 (Structural retest) — 1.0850 (Strong demand)

📉 BASE SCENARIO: Pullback toward 1.1100–1.1050 before renewed long accumulation.

📈 ALTERNATIVE SCENARIO: Break above 1.1450 could target 1.1600–1.1720 zone.

🔍 Watch out for May's seasonal inversion and extreme speculative positioning — fakeouts may precede real directional moves.

📊 WHAT THE DATA SAYS:

📉 Price Action: Clear rejection from the 1.1450–1.1550 supply zone. Retest at key structure near 1.1300.

📑 COT (EURO): Net long positions up by +183 (196,388 long vs 120,591 short) = bullish tone.

📑 COT (USD): Still balanced, but Non-Commercials are reducing net longs → potential weakening.

📊 Retail Sentiment (MyFXBook): 70% retail traders are short = contrarian long bias remains.

🌱 Seasonality (May): Historically negative for EUR/USD (–0.0088) = potential downside pressure ahead.

📌 Key Levels:

Resistance: 1.1450 / 1.1550 (Supply Zone)

Support: 1.1300 (Structural retest) — 1.0850 (Strong demand)

📉 BASE SCENARIO: Pullback toward 1.1100–1.1050 before renewed long accumulation.

📈 ALTERNATIVE SCENARIO: Break above 1.1450 could target 1.1600–1.1720 zone.

🔍 Watch out for May's seasonal inversion and extreme speculative positioning — fakeouts may precede real directional moves.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.