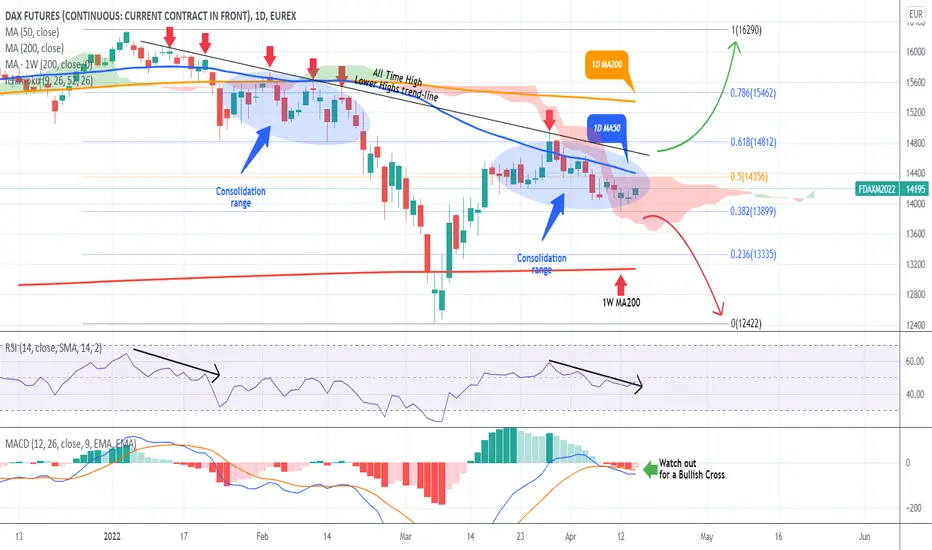

Not much have changed on the German stock market (DAX) as the price is still consolidating within the All Time High Lower Highs trend-line of January (Resistance) and the 0.382 Fibonacci retracement level (Support).

Being below the 1D MA50 (blue trend-line) as well, scalpers may find some value trading the 1D MA50 - 0.382 Fib Zone but a lower risk trade lies on the break-out, either above the Lower Highs trend-line (bullish targeting the 1D MA200 (orang trend-line) and then the All Time High) or below the 0.382 Fib (bearish towards the 0.236 Fib/ 1W MA200 (red trend-line) and then the March lows.

While the 1D RSI favors the downside, keep an eye on the MACD for a Bullish Cross, which will shift the sentiment upwards. Also on a longer-term horizon, this looks like an Inverse Head and Shoulders on a declining trend with the ATH Lower Highs trend-line as the Resistance to break. And that is typically a bottom pattern calling for a trend reversal to the upside.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

Being below the 1D MA50 (blue trend-line) as well, scalpers may find some value trading the 1D MA50 - 0.382 Fib Zone but a lower risk trade lies on the break-out, either above the Lower Highs trend-line (bullish targeting the 1D MA200 (orang trend-line) and then the All Time High) or below the 0.382 Fib (bearish towards the 0.236 Fib/ 1W MA200 (red trend-line) and then the March lows.

While the 1D RSI favors the downside, keep an eye on the MACD for a Bullish Cross, which will shift the sentiment upwards. Also on a longer-term horizon, this looks like an Inverse Head and Shoulders on a declining trend with the ATH Lower Highs trend-line as the Resistance to break. And that is typically a bottom pattern calling for a trend reversal to the upside.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.