This Wednesday, October 29, 2025, could mark a decisive turning point for U.S. monetary policy and, by extension, for global markets.

All eyes are on the Federal Reserve (Fed), which is expected to announce a cut to its main interest rate.

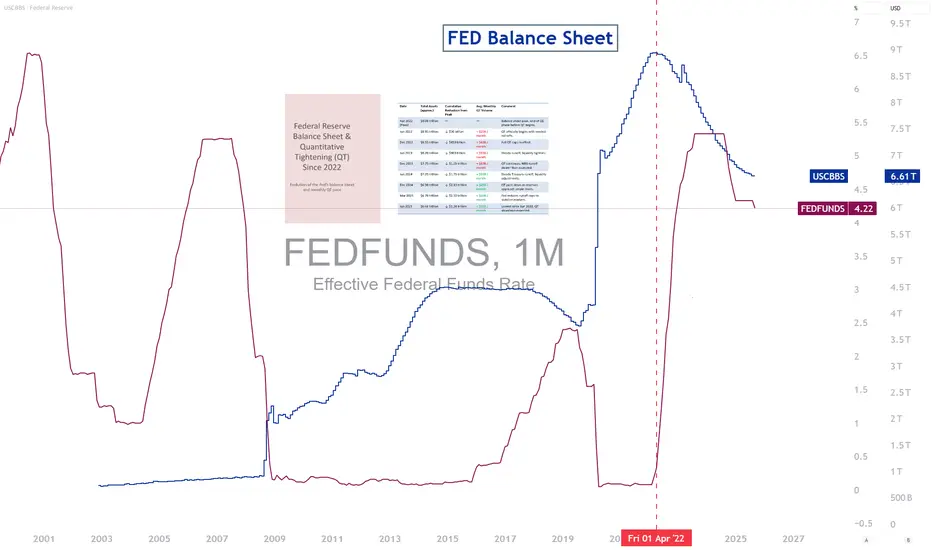

But investors are paying even closer attention to another key question: the potential end of Quantitative Tightening (QT) — the process through which the Fed reduces the size of its balance sheet.

1) What is QT, and why might the Fed slow it down again?

Since 2022, the Fed has been implementing QT to gradually withdraw the excess liquidity injected during the post-Covid period.

In practice, this means allowing part of its Treasury and mortgage-backed securities holdings to mature without reinvesting the proceeds.

As a result, the amount of dollars in circulation declines, credit conditions tighten, and global liquidity contracts.

Several signals now point toward a shift in stance.

The U.S. economy is slowing, some regional banks are showing renewed signs of stress, and inflationary pressures are easing.

In this environment, the Fed may conclude that it’s time to ease financial conditions to avoid an excessive economic slowdown.

Ending QT — or even slowing its pace further — would effectively inject liquidity back into the financial system.

This would mean bank reserves rising again, facilitating credit flows and encouraging risk-taking in the markets.

2) A positive impact on risk assets

Historically, each time the Fed stopped shrinking its balance sheet, equity markets rebounded.

The logic is straightforward: more liquidity in the system typically leads to higher asset prices.

A slower QT would likely come alongside lower bond yields and a weaker U.S. dollar — two factors that generally favor stock market rallies and risk asset performance.

This support seems all the more crucial today, as the S&P 500 remains near its all-time high valuations.

The chart below shows the QT program since 2022, with a gradually declining monthly pace since 2024.

3) Jerome Powell’s key message

Finally, Jerome Powell’s speech will be critical.

Markets will react not only to the policy decisions themselves but also to the tone:

• What pace for balance sheet reduction?

• What flexibility in responding to inflation?

• What outlook for 2026?

If Powell hints that the Fed is preparing to end QT, the message will be clear: liquidity is returning, and with it, a renewed appetite for risk across financial markets.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

All eyes are on the Federal Reserve (Fed), which is expected to announce a cut to its main interest rate.

But investors are paying even closer attention to another key question: the potential end of Quantitative Tightening (QT) — the process through which the Fed reduces the size of its balance sheet.

1) What is QT, and why might the Fed slow it down again?

Since 2022, the Fed has been implementing QT to gradually withdraw the excess liquidity injected during the post-Covid period.

In practice, this means allowing part of its Treasury and mortgage-backed securities holdings to mature without reinvesting the proceeds.

As a result, the amount of dollars in circulation declines, credit conditions tighten, and global liquidity contracts.

Several signals now point toward a shift in stance.

The U.S. economy is slowing, some regional banks are showing renewed signs of stress, and inflationary pressures are easing.

In this environment, the Fed may conclude that it’s time to ease financial conditions to avoid an excessive economic slowdown.

Ending QT — or even slowing its pace further — would effectively inject liquidity back into the financial system.

This would mean bank reserves rising again, facilitating credit flows and encouraging risk-taking in the markets.

2) A positive impact on risk assets

Historically, each time the Fed stopped shrinking its balance sheet, equity markets rebounded.

The logic is straightforward: more liquidity in the system typically leads to higher asset prices.

A slower QT would likely come alongside lower bond yields and a weaker U.S. dollar — two factors that generally favor stock market rallies and risk asset performance.

This support seems all the more crucial today, as the S&P 500 remains near its all-time high valuations.

The chart below shows the QT program since 2022, with a gradually declining monthly pace since 2024.

3) Jerome Powell’s key message

Finally, Jerome Powell’s speech will be critical.

Markets will react not only to the policy decisions themselves but also to the tone:

• What pace for balance sheet reduction?

• What flexibility in responding to inflation?

• What outlook for 2026?

If Powell hints that the Fed is preparing to end QT, the message will be clear: liquidity is returning, and with it, a renewed appetite for risk across financial markets.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.