📊 GBPUSD Forecast | Intraday & Swing 📉📈

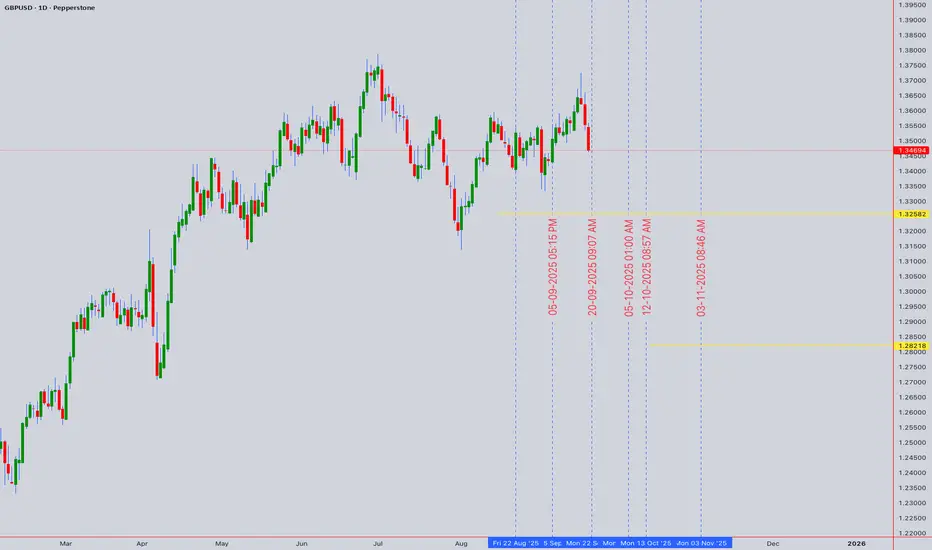

Asset: GBPUSD (CFD) Closing Price: 1.34694 (20th Sept 2025, 12:50 AM UTC+4)

🔎 Market Snapshot

Cable is trading around 1.3469, with mixed sentiment between dollar strength 🦅 and sterling resilience 💂♂️. Volatility is expected this week as traders eye macroeconomic updates & central bank cues.

🕯️ Chart Patterns & Signals

📈 Indicators Check

⏱️ Intraday Strategy

📆 Swing Outlook (Days–Weeks)

🎯 Key Levels to Watch

🧭 Final Take

⚖️ GBPUSD is at a decision point:

Intraday → play the range 1.3420–1.3520

Swing → favor shorts below 1.3565, longs only on deep pullbacks near 1.3360.

Trade safe & adapt to volatility! 🚀📉

For individuals seeking to enhance their trading abilities based on the analyses provided, I recommend exploring the mentoring program offered by Shunya Trade. (Website: shunya dot trade)

I would appreciate your feedback on this analysis, as it will serve as a valuable resource for future endeavors.

Sincerely,

Shunya.Trade

Website: shunya dot trade

📝 TRADING CHECKLIST

Before entering any position:

- ✅ Confirm volume supports move

- ✅ Check RSI for divergences

- ✅ Verify multiple timeframe alignment

- ✅ Set stop loss before entry

- ✅ Calculate position size

- ✅ Review correlation with DXY

- ✅ Check economic calendar

- ✅ Assess market sentiment

⚠️Disclaimer: This post is intended solely for educational purposes and does not constitute investment advice, financial advice, or trading recommendations. The views expressed herein are derived from technical analysis and are shared for informational purposes only. The stock market inherently carries risks, including the potential for capital loss. Therefore, readers are strongly advised to exercise prudent judgment before making any investment decisions. We assume no liability for any actions taken based on this content. For personalized guidance, it is recommended to consult a certified financial advisor.

Asset: GBPUSD (CFD) Closing Price: 1.34694 (20th Sept 2025, 12:50 AM UTC+4)

🔎 Market Snapshot

Cable is trading around 1.3469, with mixed sentiment between dollar strength 🦅 and sterling resilience 💂♂️. Volatility is expected this week as traders eye macroeconomic updates & central bank cues.

🕯️ Chart Patterns & Signals

🟢 Bullish Hints: Possible inverse H&S on 4H + support at 1.3420.

🔴 Bearish Pressure: Lower-high structure intact since 1.3620 peak.

⚡ Trap Risk: Watch for a bull trap near 1.3520 resistance.

📐 Harmonic AB=CD projection aligns with 1.3400 zone (support).

📈 Indicators Check

RSI (H4): Neutral → 48 (room for breakout).

BB: Price squeezed ⚠️ → volatility incoming.

MA Cross: 20 EMA < 50 EMA (short-term bearish bias).

VWAP: Anchored VWAP from September high sits at 1.3500.

⏱️ Intraday Strategy

Buy Zone: 1.3420–1.3440 (support test, scalps).

Sell Zone: 1.3520–1.3550 (resistance rejection).

🎯 Targets:

Upside: 1.3490 / 1.3520 / 1.3565

Downside: 1.3400 / 1.3360 / 1.3325

🛡️ Stops:

Longs below 1.3390

Shorts above 1.3575

📆 Swing Outlook (Days–Weeks)

Trend: Bearish bias unless daily closes above 1.3565.

📉 Swing Sell Setup:

Entry: 1.3520–1.3550

TP: 1.3400 → 1.3325

SL: 1.3590

📈 Swing Buy Setup (Aggressive):

Entry: 1.3360–1.3400

TP: 1.3490 → 1.3560

SL: 1.3320

🎯 Key Levels to Watch

Resistance: 1.3520 / 1.3565 / 1.3620

Support: 1.3420 / 1.3360 / 1.3325

🧭 Final Take

⚖️ GBPUSD is at a decision point:

Intraday → play the range 1.3420–1.3520

Swing → favor shorts below 1.3565, longs only on deep pullbacks near 1.3360.

Trade safe & adapt to volatility! 🚀📉

For individuals seeking to enhance their trading abilities based on the analyses provided, I recommend exploring the mentoring program offered by Shunya Trade. (Website: shunya dot trade)

I would appreciate your feedback on this analysis, as it will serve as a valuable resource for future endeavors.

Sincerely,

Shunya.Trade

Website: shunya dot trade

📝 TRADING CHECKLIST

Before entering any position:

- ✅ Confirm volume supports move

- ✅ Check RSI for divergences

- ✅ Verify multiple timeframe alignment

- ✅ Set stop loss before entry

- ✅ Calculate position size

- ✅ Review correlation with DXY

- ✅ Check economic calendar

- ✅ Assess market sentiment

⚠️Disclaimer: This post is intended solely for educational purposes and does not constitute investment advice, financial advice, or trading recommendations. The views expressed herein are derived from technical analysis and are shared for informational purposes only. The stock market inherently carries risks, including the potential for capital loss. Therefore, readers are strongly advised to exercise prudent judgment before making any investment decisions. We assume no liability for any actions taken based on this content. For personalized guidance, it is recommended to consult a certified financial advisor.

I am nothing @shunya.trade

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

I am nothing @shunya.trade

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.