Friday’s CME report showed a surge in large option blocks in gold — two of them stand out.

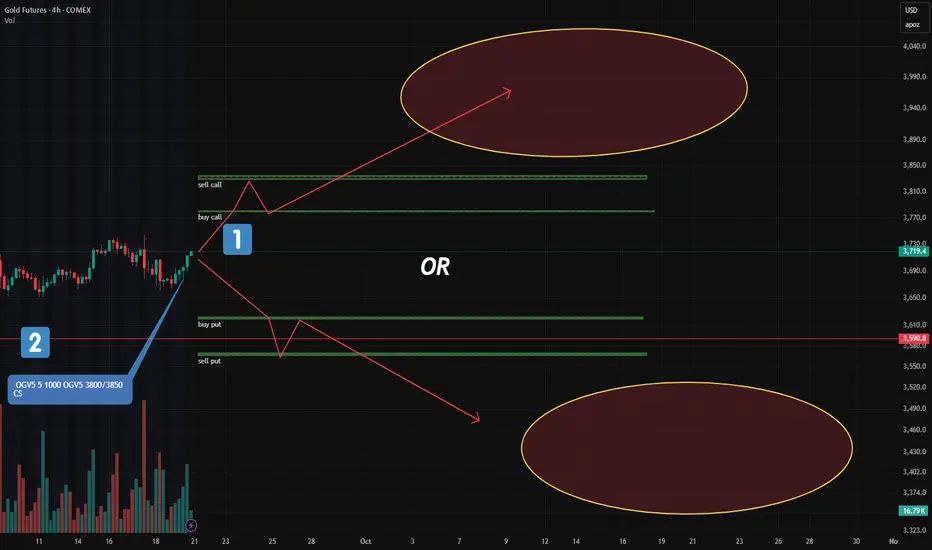

🔹 1. "Long Condor" on December Futures (GCZ24)

This is the most significant structure added:

Targets a move below $3,620 or above $3,780

In other words: a breakout is expected, not consolidation

📌 Key point:

A "Long Condor" profits from volatility, not direction.

It wins if price moves sharply — up OR down — but loses if it stays flat.

🔹 2. Bull Call Spread (Oct Series): $3800–$3850

Another key play:

A classic bullish call spread at 3800/3850

Target: upside beyond current levels

But here’s the difference:

Unlike the "Long Condor", this one needs a clear upward move — and soon. Within a few days.

This isn’t about volatility.

It’s a directional bet that gold will rise.

🧠 Bottom Line:

One portfolio says: "Breakout coming — no matter which way."

Another says: "Gold goes up — and soon."

Are they aligned?

Contradictory?

Or could both win?

Trade smarter, not harder! Looking to boost your profits with valuable market insights and data-driven entry points? Join us or keep moving!

🔹 1. "Long Condor" on December Futures (GCZ24)

This is the most significant structure added:

Targets a move below $3,620 or above $3,780

In other words: a breakout is expected, not consolidation

📌 Key point:

A "Long Condor" profits from volatility, not direction.

It wins if price moves sharply — up OR down — but loses if it stays flat.

🔹 2. Bull Call Spread (Oct Series): $3800–$3850

Another key play:

A classic bullish call spread at 3800/3850

Target: upside beyond current levels

But here’s the difference:

Unlike the "Long Condor", this one needs a clear upward move — and soon. Within a few days.

This isn’t about volatility.

It’s a directional bet that gold will rise.

🧠 Bottom Line:

One portfolio says: "Breakout coming — no matter which way."

Another says: "Gold goes up — and soon."

Are they aligned?

Contradictory?

Or could both win?

Trade smarter, not harder! Looking to boost your profits with valuable market insights and data-driven entry points? Join us or keep moving!

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.