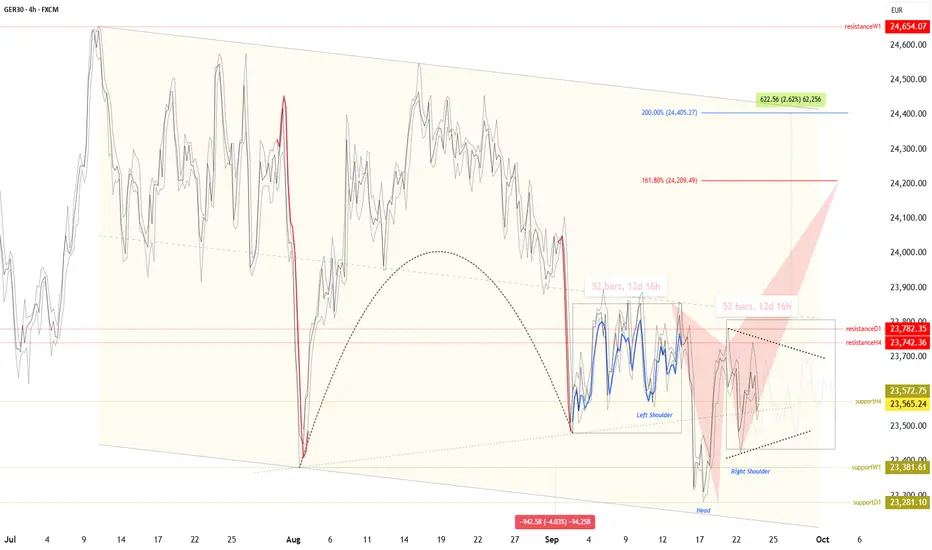

The  GER30 continues to trade around critical technical levels, where multiple patterns are competing to determine the index’s next direction.

GER30 continues to trade around critical technical levels, where multiple patterns are competing to determine the index’s next direction.

In the short term, the main risk remains with the inverted cup and handle pattern, formed above the weekly fractal support at €23,381, which could project a drop toward €22,483 (around -4%). A new daily fractal support has emerged at €23,281, adding pressure just below the previous support/neckline.

On the other hand, the index is also building the base of a potential inverted head and shoulders pattern, with its trigger lying in a breakout above the daily resistance at €23,782. If this breakout is confirmed, it opens the door for strong bullish momentum toward €24,400 (200% Fibonacci extension and the classical target of the pattern). This move could also validate a parallel consolidation channel, suggesting the formation of a bullish flag.

Key fractals to monitor

Weekly resistance: €24,654

Daily resistance: €23,782 (H&S neckline/resistance)

Intraday resistance: €23,742

Intraday support: €23,572

Weekly support: €23,381

Daily support: €23,281

The DAX is at a decision point:

Clear break below €23,281 → activates bearish scenario (target €22,483).

Sustained breakout above €23,782 → validates bullish scenario (target €24,400).

Safe Trades,

André Cardoso

In the short term, the main risk remains with the inverted cup and handle pattern, formed above the weekly fractal support at €23,381, which could project a drop toward €22,483 (around -4%). A new daily fractal support has emerged at €23,281, adding pressure just below the previous support/neckline.

On the other hand, the index is also building the base of a potential inverted head and shoulders pattern, with its trigger lying in a breakout above the daily resistance at €23,782. If this breakout is confirmed, it opens the door for strong bullish momentum toward €24,400 (200% Fibonacci extension and the classical target of the pattern). This move could also validate a parallel consolidation channel, suggesting the formation of a bullish flag.

Key fractals to monitor

Weekly resistance: €24,654

Daily resistance: €23,782 (H&S neckline/resistance)

Intraday resistance: €23,742

Intraday support: €23,572

Weekly support: €23,381

Daily support: €23,281

The DAX is at a decision point:

Clear break below €23,281 → activates bearish scenario (target €22,483).

Sustained breakout above €23,782 → validates bullish scenario (target €24,400).

Safe Trades,

André Cardoso

Harmonic Patterns | Market Analyst | Forex Analytix | Porto, Portugal

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Harmonic Patterns | Market Analyst | Forex Analytix | Porto, Portugal

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.