GER40 (DAX) Technical Forecast: Bullish Momentum Faces Key Resistance

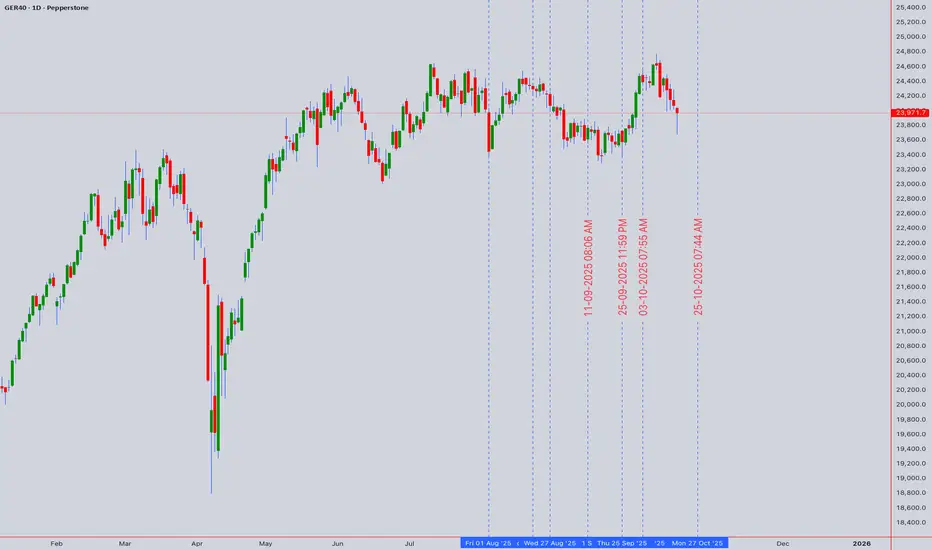

Analysis as of 18th Oct 2025 (Close: 23,971.7)

Market Context: The DAX exhibits robust bullish momentum, but is now testing a critical juncture. A confluence of technical factors on higher timeframes suggests the next move will be decisive for both intraday and swing traders.

Multi-Timeframe Analysis (Top-Down View)

Swing Bias (D1/4H): Bullish Above 23.7k

The daily chart reveals a strong uptrend, with price holding firmly above key moving averages (50 & 200 EMA). However, we are approaching a significant Wyckoffian Supply Zone and a potential Bullish Crab Harmonic pattern completion near the 24,200 - 24,300 resistance cluster. The RSI on the D1 is in bullish territory but not yet overbought, leaving room for further upside.

Intraday Bias (1H/30M): Cautiously Bullish

The 4H and 1H charts show price consolidating in a bullish flag formation. The Ichimoku Cloud on the 1H acts as dynamic support, while the Anchored VWAP from the recent low confirms a strong bullish trend. A break above the 24,050 level could trigger the next leg up.

Key Chart Patterns & Theories in Play

Elliott Wave: We are likely in a Wave 3 extension on the daily chart. A pullback to the 23,700 support would be a healthy Wave 4 before a final Wave 5 push.

Gann Analysis: The Square of 9 highlights 24,200 and 24,450 as potential time/price resistance targets for this swing.

Head and Shoulders? No traditional pattern is present. The primary risk is a Bull Trap if price rejects from the 24.3k resistance without a significant volume breakout.

Actionable Trade Setups

🟢 Swing Trade (Buy the Dip)

Entry: 23,700 - 23,800 (Zone of confluence with 50 EMA & Fibonacci 0.382 retracement)

Stop Loss: 23,500

Take Profit 1: 24,200

Take Profit 2: 24,450

🔴 Intraday Long (Momentum Break)

Trigger: A confirmed break and close above 24,050 on the 1H chart.

Entry: On retest of 24,000 as support.

Stop Loss: 23,900

Take Profit: 24,250

⚫ Intraday Short (Counter-Trend)

Trigger: A clear bearish rejection (e.g., Bearish Engulfing candle) at the 24,200 resistance with RSI divergence.

Entry: Upon rejection signal on the 30M chart.

Stop Loss: 24,350

Take Profit: 23,900

Key Levels

Conclusion

The DAX remains in a firm uptrend. The optimal strategy is to seek long entries on pullbacks towards key support. Be vigilant for a potential reversal at the 24.2k-24.3k resistance zone. Trade what you see, not what you hope.

Risk Warning: Trading carries significant risk. This analysis is for educational purposes and does not constitute financial advice. Always manage your risk and conduct your own due diligence.

Analysis as of 18th Oct 2025 (Close: 23,971.7)

Market Context: The DAX exhibits robust bullish momentum, but is now testing a critical juncture. A confluence of technical factors on higher timeframes suggests the next move will be decisive for both intraday and swing traders.

Multi-Timeframe Analysis (Top-Down View)

Swing Bias (D1/4H): Bullish Above 23.7k

The daily chart reveals a strong uptrend, with price holding firmly above key moving averages (50 & 200 EMA). However, we are approaching a significant Wyckoffian Supply Zone and a potential Bullish Crab Harmonic pattern completion near the 24,200 - 24,300 resistance cluster. The RSI on the D1 is in bullish territory but not yet overbought, leaving room for further upside.

Intraday Bias (1H/30M): Cautiously Bullish

The 4H and 1H charts show price consolidating in a bullish flag formation. The Ichimoku Cloud on the 1H acts as dynamic support, while the Anchored VWAP from the recent low confirms a strong bullish trend. A break above the 24,050 level could trigger the next leg up.

Key Chart Patterns & Theories in Play

Elliott Wave: We are likely in a Wave 3 extension on the daily chart. A pullback to the 23,700 support would be a healthy Wave 4 before a final Wave 5 push.

Gann Analysis: The Square of 9 highlights 24,200 and 24,450 as potential time/price resistance targets for this swing.

Head and Shoulders? No traditional pattern is present. The primary risk is a Bull Trap if price rejects from the 24.3k resistance without a significant volume breakout.

Actionable Trade Setups

🟢 Swing Trade (Buy the Dip)

Entry: 23,700 - 23,800 (Zone of confluence with 50 EMA & Fibonacci 0.382 retracement)

Stop Loss: 23,500

Take Profit 1: 24,200

Take Profit 2: 24,450

🔴 Intraday Long (Momentum Break)

Trigger: A confirmed break and close above 24,050 on the 1H chart.

Entry: On retest of 24,000 as support.

Stop Loss: 23,900

Take Profit: 24,250

⚫ Intraday Short (Counter-Trend)

Trigger: A clear bearish rejection (e.g., Bearish Engulfing candle) at the 24,200 resistance with RSI divergence.

Entry: Upon rejection signal on the 30M chart.

Stop Loss: 24,350

Take Profit: 23,900

Key Levels

- Resistance 3: 24,450 (Gann Target)

- Resistance 2: 24,300 (Harmonic Completion)

- Resistance 1: 24,050 - 24,100 (Immediate Hurdle)

- Support 1: 23,850 (Recent Swing Low)

- Support 2: 23,700 (Critical Bullish Defense)

- Support 3: 23,500 (Trend Invalidation)

Conclusion

The DAX remains in a firm uptrend. The optimal strategy is to seek long entries on pullbacks towards key support. Be vigilant for a potential reversal at the 24.2k-24.3k resistance zone. Trade what you see, not what you hope.

Risk Warning: Trading carries significant risk. This analysis is for educational purposes and does not constitute financial advice. Always manage your risk and conduct your own due diligence.

I am nothing @shunya.trade

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

I am nothing @shunya.trade

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.