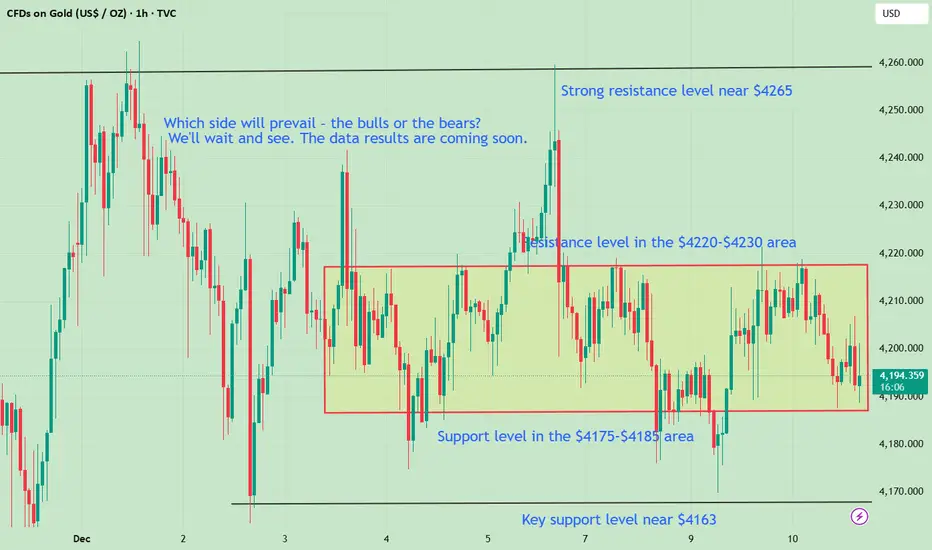

Gold, lacking significant fundamental guidance, remains stuck in a range-bound trading pattern between 4185 and 4215. The upcoming Federal Reserve interest rate decision in the latter half of the US session may provide directional guidance. Until then, the market will likely continue to fluctuate, with gold still trading within a range on the 4-hour chart. The Fed's rate decision will most likely result in a rate cut. If gold tests the 4160 level before or after the rate decision, it could present a buying opportunity. However, if gold can break through 4265, further upside potential may open up. We await to see which side, the bulls or the bears, will prevail.

In the short term, the market remains range-bound. However, there are trading strategies for range-bound markets. Our recent trading based on support and resistance levels has been quite successful. Markets are constantly changing, and trading strategies need to be adjusted accordingly. Gold has been consolidating recently, awaiting significant news for guidance. Avoid chasing the market before data releases. Without fundamental changes, consolidation is a consolidation phase, a transitional phase before a trend takes off. The market anticipates a 25 basis point rate cut by the Federal Reserve. If gold prices bottom out after the news, it will be an opportunity to go long. We are now waiting for confirmation.

Dagangan aktif

Our analysis was correct; gold bottomed out and rebounded, with an overall bullish outlook. Unfortunately, it didn't reach the level we indicated for our buy signal. Secondly, the Fed's interest rate decision was in line with our predictions, with a 25 basis point rate cut as expected. Fed Chairman Powell's speech was dovish, leading to gold's significant initial volatility before breaking upwards again. Gold is now in a consolidation phase with an upward bias.Gold is likely to remain in a consolidation phase with a slight upward bias in the short term. Since gold has chosen an upward trend, it may continue to test higher levels. Currently, it's still in a consolidation phase, and we need to wait for a correction before considering further opportunities. Our trading strategy is to buy on dips to 4205-15, with initial resistance at 4255-65. This is just our overall strategy for the Asian session.

Dagangan ditutup: sasaran tercapai

After the gold price pullback, our long positions bought in batches at the support level are currently profitable. Please pay attention to your current positions. The current rise in gold is driven by interest rate cuts, leading to a short-term bullish bias. However, it has not yet broken through the double-top resistance zone around 4265 points. Therefore, despite the bullish outlook, we should not chase the rally excessively and need to be wary of a potential pullback. Even if a breakout occurs, there may be an initial pullback to accumulate momentum before continuing to rise. Today's strategy might be to buy in batches on dips, focusing on 4200-10, with resistance around 4150, and then 4165.I love trading, I have a successful mindset, I have the best trading strategies, and I have sound money management.

t.me/Henorylau_01z

t.me/Henorylau_01z

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

I love trading, I have a successful mindset, I have the best trading strategies, and I have sound money management.

t.me/Henorylau_01z

t.me/Henorylau_01z

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.