Hello Traders!

Gold often makes sharp one-sided moves, trapping traders who enter too late. But if you know how to combine a simple moving average with a momentum indicator, you can spot high-probability reversal setups.

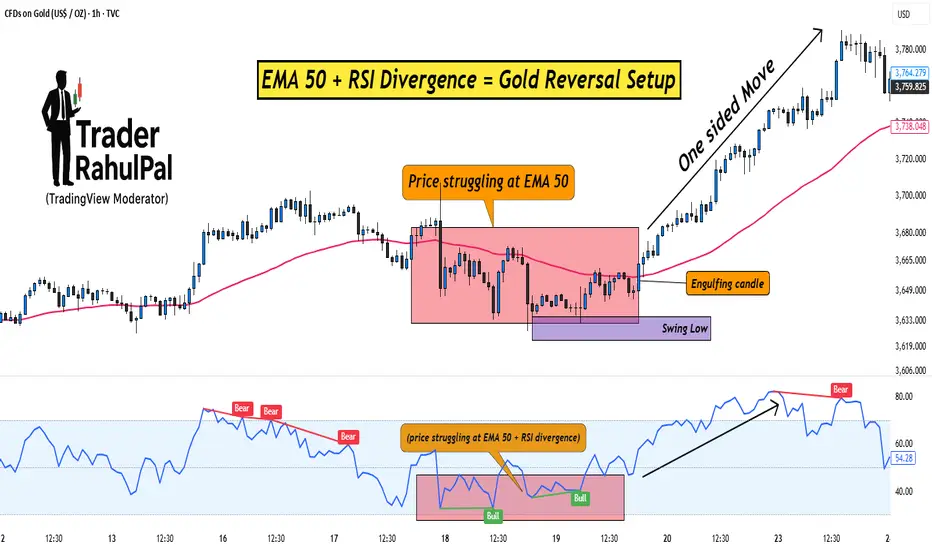

One such method is using the EMA 50 together with RSI Divergence. Let’s break down how it works.

1. Why EMA 50?

2. What is RSI Divergence?

3. Combining EMA 50 with RSI Divergence

4. Entry & Risk Management

Rahul’s Tip:

Don’t use divergence alone, combine it with EMA 50 for structure and you’ll filter out most false signals. This setup works best on higher timeframes like 1H or 4H for gold.

Conclusion:

EMA 50 gives you the trend filter, and RSI divergence reveals momentum weakness.

Together, they form a reliable reversal setup that helps you enter gold trades at the right time instead of chasing moves.

This Educational Idea By TraderRahulPal (TradingView Moderator) | More analysis & educational content on my profile

If this post gave you a new setup idea, like it, share your thoughts in comments, and follow for more practical trading strategies!

Gold often makes sharp one-sided moves, trapping traders who enter too late. But if you know how to combine a simple moving average with a momentum indicator, you can spot high-probability reversal setups.

One such method is using the EMA 50 together with RSI Divergence. Let’s break down how it works.

1. Why EMA 50?

- The 50-period EMA acts as a dynamic trend filter.

- When gold trades above it, the short-term trend is bullish; below it, bearish.

- Price often retests the EMA 50 during pullbacks, making it a key level to watch for reversals.

2. What is RSI Divergence?

- Divergence happens when price makes a new high/low, but RSI doesn’t confirm it.

- Example: Price makes a higher high, but RSI makes a lower high → bearish divergence.

- This signals that momentum is weakening, even if price is still moving strongly.

3. Combining EMA 50 with RSI Divergence

- First, check where price is relative to EMA 50.

- Next, look for divergence on RSI near that zone.

- If both align (price struggling at EMA 50 + RSI divergence), chances of a reversal increase sharply.

4. Entry & Risk Management

- Wait for a confirmation candle near EMA 50 (like engulfing or pin bar).

- Place stop loss just above recent swing high/low.

- Target the next support/resistance zone for exits.

Rahul’s Tip:

Don’t use divergence alone, combine it with EMA 50 for structure and you’ll filter out most false signals. This setup works best on higher timeframes like 1H or 4H for gold.

Conclusion:

EMA 50 gives you the trend filter, and RSI divergence reveals momentum weakness.

Together, they form a reliable reversal setup that helps you enter gold trades at the right time instead of chasing moves.

This Educational Idea By TraderRahulPal (TradingView Moderator) | More analysis & educational content on my profile

If this post gave you a new setup idea, like it, share your thoughts in comments, and follow for more practical trading strategies!

Rahul Pal | BD Manager @CoinW Exchange Dubai

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Penerbitan berkaitan

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Rahul Pal | BD Manager @CoinW Exchange Dubai

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Penerbitan berkaitan

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.