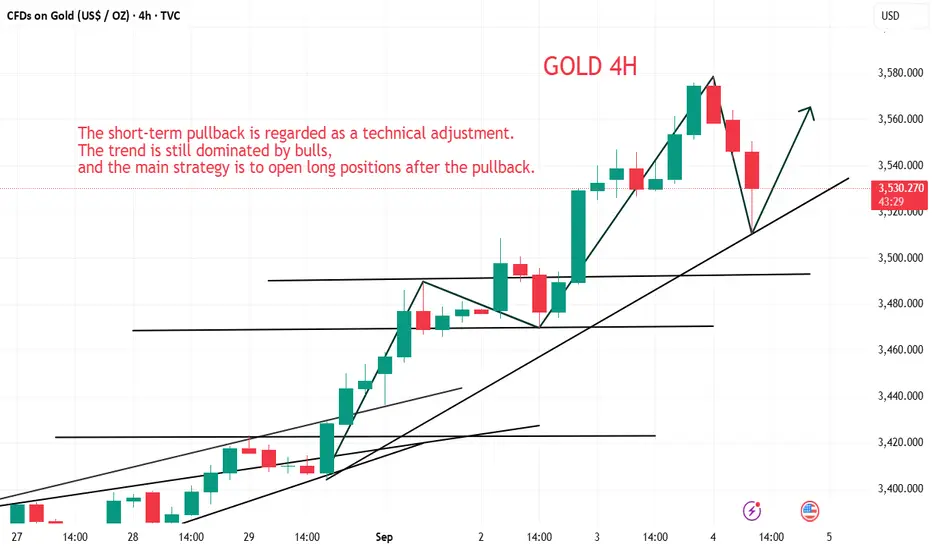

Driven by expectations of a Federal Reserve rate cut and market risk aversion, spot gold prices have rallied for seven consecutive trading days, approaching $3,580 per ounce, setting a new all-time high. A short-term correction has now begun, reaching a low of around $3,510 and currently trading around $3,530. The market remains strong, and any short-term corrections are a normal process. I believe gold will continue its upward trend after this correction.

Next, we need to monitor the ADP data and speeches by Fed officials, which are crucial factors guiding gold's short-term direction. If gold breaks down further due to the impact of these data and news, breaking below the $3,500 support level, then the expected extent of the correction should be lowered, and short positions should be opened at resistance levels.

Gold Strategy Sharing

Before the ADP data is released, focus on technical analysis: view any short-term corrections as technical adjustments. The trend remains overwhelmingly bullish, so consider opening long positions during these corrections. Focus on the support range of 3510 to 3520 to open a long position, with the target of 3530 to 3550 and 3570.

Next, we need to monitor the ADP data and speeches by Fed officials, which are crucial factors guiding gold's short-term direction. If gold breaks down further due to the impact of these data and news, breaking below the $3,500 support level, then the expected extent of the correction should be lowered, and short positions should be opened at resistance levels.

Gold Strategy Sharing

Before the ADP data is released, focus on technical analysis: view any short-term corrections as technical adjustments. The trend remains overwhelmingly bullish, so consider opening long positions during these corrections. Focus on the support range of 3510 to 3520 to open a long position, with the target of 3530 to 3550 and 3570.

If you have questions about the direction of gold, crude oil, Bitcoin, and Ethereum, you can follow me.

I share my trading ideas and strategies daily for your reference. Feel free to follow my updates.

I share my trading ideas and strategies daily for your reference. Feel free to follow my updates.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

If you have questions about the direction of gold, crude oil, Bitcoin, and Ethereum, you can follow me.

I share my trading ideas and strategies daily for your reference. Feel free to follow my updates.

I share my trading ideas and strategies daily for your reference. Feel free to follow my updates.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.