"Gold Price Faces Strong Resistance – Is a Drop Coming?"

Technical Analysis of XAUUSD

1. Overall Market Structure

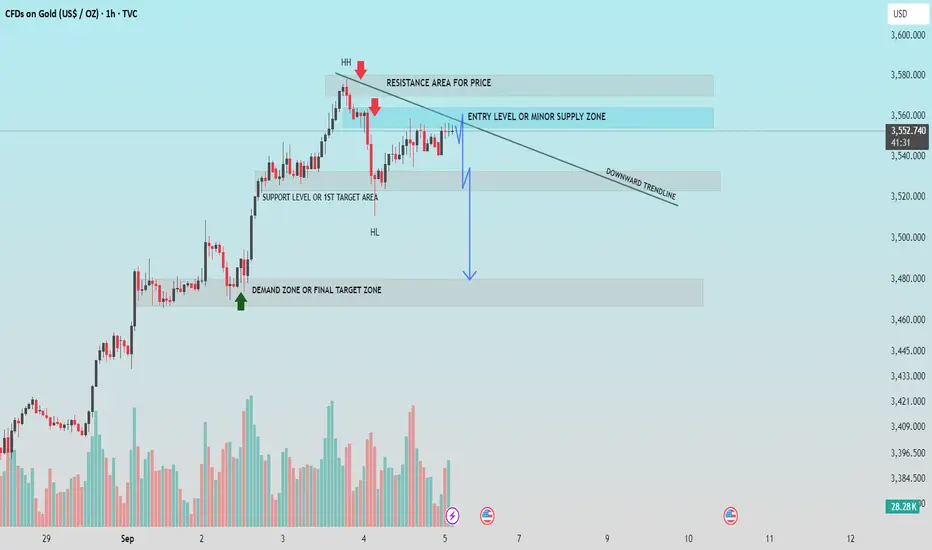

Gold is currently in a corrective phase after forming a Higher High (HH) at the recent resistance zone. The market has since shown weakness, breaking below a minor support and forming a Lower High (LH), indicating a potential trend reversal or deeper pullback.

2. Resistance Zone

The area around 3550–3565 is a strong resistance zone that acted as a selling area after price made a sharp move down. This zone also aligns with the downward trendline, increasing its significance as a potential entry point for sellers.

3. Entry Level / Minor Supply Zone

The price is currently consolidating near a minor supply zone and close to the downward trendline. This is an important decision point: if price respects this level, sellers may step in to push the price lower toward the next support.

4. Support Levels & Targets

* First Target (Support Zone): Around 3520–3530, which was a previous structure support.

* Final Target (Demand Zone): Around 3470–3480, a strong demand zone where buyers previously reacted.

5. Downward Trendline

The downward trendline is confirming the short-term bearish bias. Until price breaks and closes above this trendline, the momentum favors sellers.

6. Trade Setup & Bias

* Bias: Bearish (Sell Setup)

* Entry Zone: Near 3550–3560 (at supply zone & trendline)

* Targets:

* TP1: 3520

* TP2: 3480

* Stop Loss: Above 3570 to protect against false breakouts.

If this helpful for you, press the like button.

1. Overall Market Structure

Gold is currently in a corrective phase after forming a Higher High (HH) at the recent resistance zone. The market has since shown weakness, breaking below a minor support and forming a Lower High (LH), indicating a potential trend reversal or deeper pullback.

2. Resistance Zone

The area around 3550–3565 is a strong resistance zone that acted as a selling area after price made a sharp move down. This zone also aligns with the downward trendline, increasing its significance as a potential entry point for sellers.

3. Entry Level / Minor Supply Zone

The price is currently consolidating near a minor supply zone and close to the downward trendline. This is an important decision point: if price respects this level, sellers may step in to push the price lower toward the next support.

4. Support Levels & Targets

* First Target (Support Zone): Around 3520–3530, which was a previous structure support.

* Final Target (Demand Zone): Around 3470–3480, a strong demand zone where buyers previously reacted.

5. Downward Trendline

The downward trendline is confirming the short-term bearish bias. Until price breaks and closes above this trendline, the momentum favors sellers.

6. Trade Setup & Bias

* Bias: Bearish (Sell Setup)

* Entry Zone: Near 3550–3560 (at supply zone & trendline)

* Targets:

* TP1: 3520

* TP2: 3480

* Stop Loss: Above 3570 to protect against false breakouts.

If this helpful for you, press the like button.

Pesanan dibatalkan

no confirmation found.💸FREE FOREX Signals in Telegram : t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

💸FREE FOREX Signals in Telegram : t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.