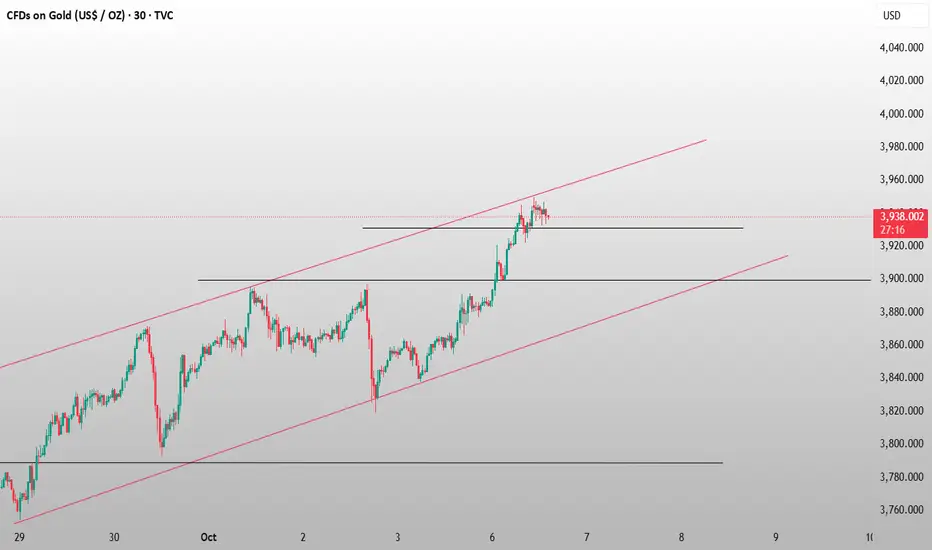

Gold is falling after rising and focusing on the support of 3930

Gold continues its ascent, reaching new highs, posting seven consecutive weeks of strong weekly gains – a rare trend.

This surge is driven by factors such as the US shutdown, growing expectations of interest rate cuts, and geopolitical conflicts. Today's market opened with a surge, and this acceleration suggests continued upward momentum and an unstoppable bullish momentum. Gold's one- and four-hour charts are all bullish, with the moving averages diverging upward in a bullish pattern. Technically, the bulls have broken through the neckline, signaling another upward move.

Our short position entered at 3946 is currently making good profits. Pay attention to the support below 3930. If it falls below this level, we can look at the 3920 line. Keep an eye on support at 3930; a break below this level could see the 3920 level.

For specific trading decisions, please follow my live updates. I will update my trading ideas and strategies daily. If you lack a plan or strategy for gold trading and are struggling to achieve consistent profits, you can refer to and follow my updates for guidance and help avoid mistakes.

This surge is driven by factors such as the US shutdown, growing expectations of interest rate cuts, and geopolitical conflicts. Today's market opened with a surge, and this acceleration suggests continued upward momentum and an unstoppable bullish momentum. Gold's one- and four-hour charts are all bullish, with the moving averages diverging upward in a bullish pattern. Technically, the bulls have broken through the neckline, signaling another upward move.

Our short position entered at 3946 is currently making good profits. Pay attention to the support below 3930. If it falls below this level, we can look at the 3920 line. Keep an eye on support at 3930; a break below this level could see the 3920 level.

For specific trading decisions, please follow my live updates. I will update my trading ideas and strategies daily. If you lack a plan or strategy for gold trading and are struggling to achieve consistent profits, you can refer to and follow my updates for guidance and help avoid mistakes.

Dagangan aktif

Gold was blocked at 3950 and fell back, and fell back to the 3933 line several times, which is in line with our expectation of shorting gold. Since gold is relatively strong in the short term, if you follow my short signal to trade, you can first reduce your holdings to lock in profits and pay attention to the support below 3930. If it falls below this position, you can look at the 3920 line. If the price fails to fall below the resistance level after repeated attempts, you can actively open a long position.Dagangan ditutup: sasaran tercapai

If the gold price breaks through 3950, 4000 is just around the corner.Join my telegram channel for free- t.me/GoldBitcoinSharing Want receive more profitable signals for Crypto & Forex market, write me

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Join my telegram channel for free- t.me/GoldBitcoinSharing Want receive more profitable signals for Crypto & Forex market, write me

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.