It’s been a while since I’ve posted an idea and for anyone who follows my posts, unfortunately I timed my trades poorly with the bearish pivot so I have taken a step back, and am now seeing some interesting developments happening in the market.

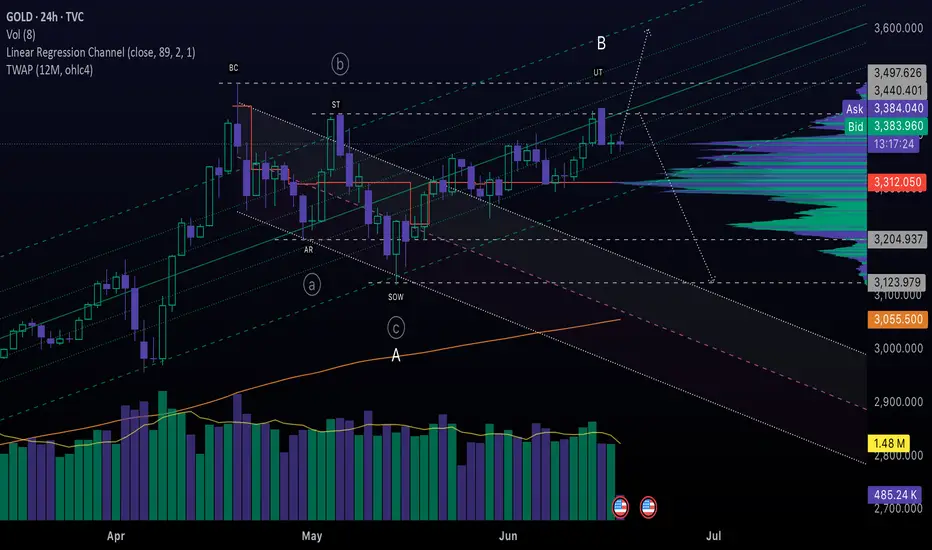

For now, I’ll keep it brief. I wanted to post a quick analysis on GOLD ahead of the rate decision using elements of the Wyckoff method and Elliott Wave. If you asked me a month ago where I thought Gold was heading, I would have said ATH - and while that can still happen, I’m seeing weakness on today’s chart that is worthy of attention.

GOLD ahead of the rate decision using elements of the Wyckoff method and Elliott Wave. If you asked me a month ago where I thought Gold was heading, I would have said ATH - and while that can still happen, I’m seeing weakness on today’s chart that is worthy of attention.

For starters, The A wave established the pullback in a typical 3-wave pattern that mostly stayed within the channel. The bullish breakout was tested twice, so I would interpret it as bullish - however the subsequent flat movement and rejection at resistance suggests that the rise from May 14th could be losing steam.

The current price ($3,382) is at a neutral level. From here, we could see several scenarios play out; a false bullish breakout, a true bullish breakout, or a break below the channel to retest demand. Breaking out of the channel could signal a Change of Character (CHoCH), and could indicate that smart money is distributing in a flat pattern. If the price breaks down key level of support would be at the Sign of Weakness (SOW), which has confluence with the extended lines of the Wave A channel.

If Gold is set to rise to ATH, I still think it will need to pull back to find large buying volume in the middle of the Wyckoff channel (white rays) first. We will see what happens today, but it’s starting to look like the bears may have the upper hand here.

For now, I’ll keep it brief. I wanted to post a quick analysis on

For starters, The A wave established the pullback in a typical 3-wave pattern that mostly stayed within the channel. The bullish breakout was tested twice, so I would interpret it as bullish - however the subsequent flat movement and rejection at resistance suggests that the rise from May 14th could be losing steam.

The current price ($3,382) is at a neutral level. From here, we could see several scenarios play out; a false bullish breakout, a true bullish breakout, or a break below the channel to retest demand. Breaking out of the channel could signal a Change of Character (CHoCH), and could indicate that smart money is distributing in a flat pattern. If the price breaks down key level of support would be at the Sign of Weakness (SOW), which has confluence with the extended lines of the Wave A channel.

If Gold is set to rise to ATH, I still think it will need to pull back to find large buying volume in the middle of the Wyckoff channel (white rays) first. We will see what happens today, but it’s starting to look like the bears may have the upper hand here.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.