Global Ship Lease (GSL) stands out as a financially solid, deeply undervalued shipping play with improving earnings and favorable macro tailwinds.

If the stock breaks out above the Cup-& Handle pattern, it could be an attractive long opportunity.

For value-focused traders, the combination of low multiples, strong fundamentals, and technical setups makes GSL hard to ignore.

Global Ship Lease has nearly fully chartered its fleet—96% for 2025 and 80% for 2026—giving it strong cash flow visibility amid market turbulence.

On to the technical side:

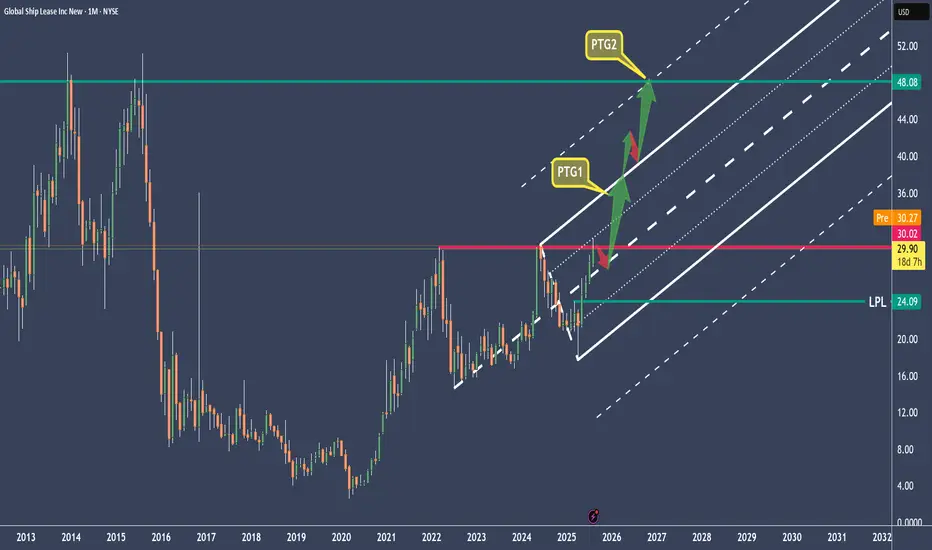

From 2022 until now, the stock has traded within a large range of 14.62 – 29.90 and is now facing, for the third time, a breakout from the currently formed cup & handle pattern.

In anticipation of today’s breakout on news, I take this as my starting gun to begin building a position. I will be monitoring the stock closely intraday and trading accordingly.

Within the fork, we can see the price hitting the 1/4 line and getting slightly sold off. Ideally, we’d see a pullback to the CL or below. In the longer term, provided the fundamentals support the price, I would build larger positions at the LPL (Last Pivot Low).

The target for this stock is at least the U-MLH as PTG1 = 50% target at $36, and next the WL1 (PTG2) as the 100% target at around $48.

It goes without saying that this trade is not a quickie.

Good luck, and thanks for a like!

If the stock breaks out above the Cup-& Handle pattern, it could be an attractive long opportunity.

For value-focused traders, the combination of low multiples, strong fundamentals, and technical setups makes GSL hard to ignore.

Global Ship Lease has nearly fully chartered its fleet—96% for 2025 and 80% for 2026—giving it strong cash flow visibility amid market turbulence.

On to the technical side:

From 2022 until now, the stock has traded within a large range of 14.62 – 29.90 and is now facing, for the third time, a breakout from the currently formed cup & handle pattern.

In anticipation of today’s breakout on news, I take this as my starting gun to begin building a position. I will be monitoring the stock closely intraday and trading accordingly.

Within the fork, we can see the price hitting the 1/4 line and getting slightly sold off. Ideally, we’d see a pullback to the CL or below. In the longer term, provided the fundamentals support the price, I would build larger positions at the LPL (Last Pivot Low).

The target for this stock is at least the U-MLH as PTG1 = 50% target at $36, and next the WL1 (PTG2) as the 100% target at around $48.

It goes without saying that this trade is not a quickie.

Good luck, and thanks for a like!

🔱 FOLLOW & BOOST ME 🔱

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

🔱 FOLLOW & BOOST ME 🔱

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

✅ Learn to make money

✅ Earn while learning

🔱 All Freebies: howtochart.com/free4you

👉 Detailed Chart Analysis: youtube.com/@howtochart

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.