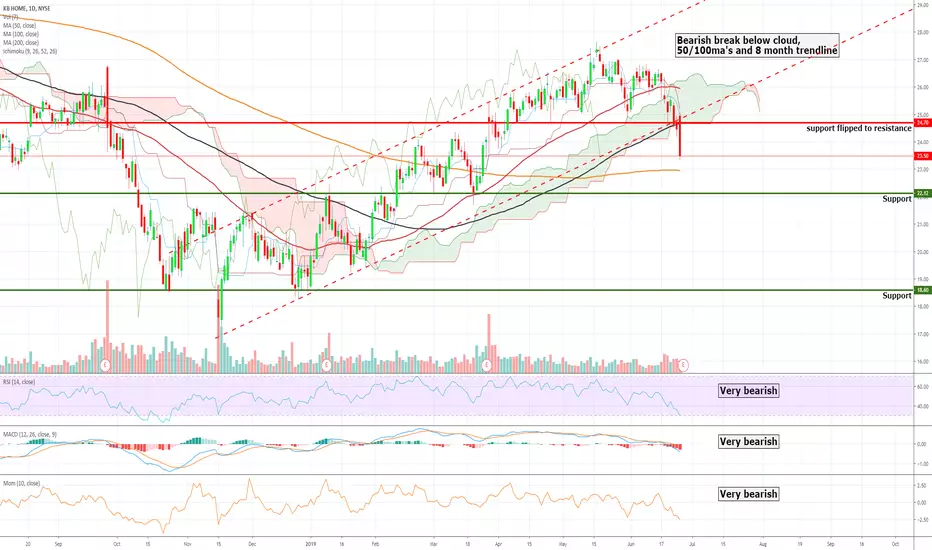

As earnings approach for KB Home tomorrow, sentiment and optimism is very low as a result of the earnings call from Lennar this mornings. Despite LEN beating on earnings things turned nasty on the earnings call and the stock has now reversed by 10% since the pre market.

LEN pointed out some major headwinds which freaked out investors, included were skilled labour shortage and costs, raw material costs as a result of the trade war and the fact that consumers are moving towards lower cost homes thus cutting the margins. Indecision regarding rate levels has also resulted in consumers waiting to see if better value credit will be available later in the year, thus housing starts have fallen. Putting all those factors together it is difficult to see how KBH could do anything but fall further in price.

LEN pointed out some major headwinds which freaked out investors, included were skilled labour shortage and costs, raw material costs as a result of the trade war and the fact that consumers are moving towards lower cost homes thus cutting the margins. Indecision regarding rate levels has also resulted in consumers waiting to see if better value credit will be available later in the year, thus housing starts have fallen. Putting all those factors together it is difficult to see how KBH could do anything but fall further in price.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.