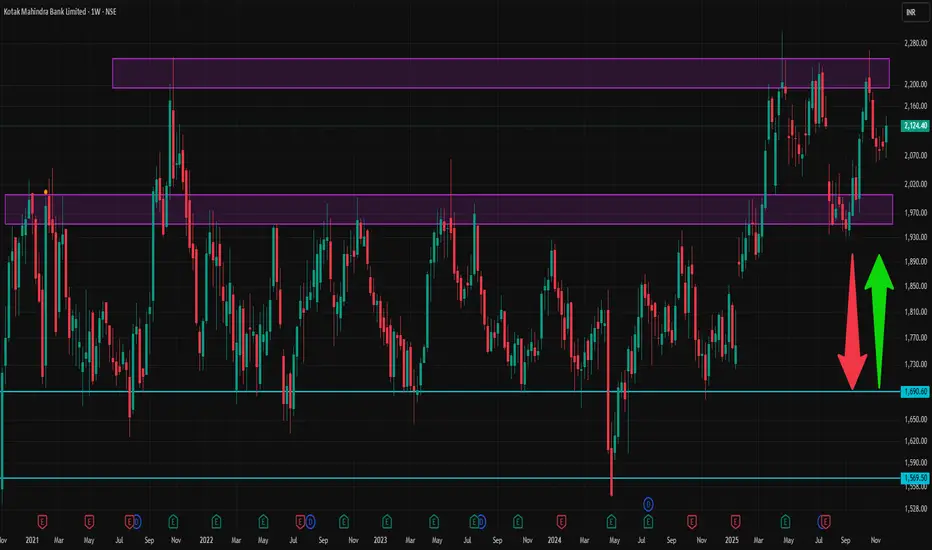

✅ Current snapshot

Latest share price ≈ ₹ 2,124.40 on NSE/BSE

52-week high ~ ₹ 2,301.90, 52-week low ~ ₹ 1,723.75.

Key fundamentals: P/E ~ 22–23, Book Value ~ ₹ 844, PB ~ 2.5–2.7, dividend yield modest.

⚠️ What could upset the short-term view

Broader market weakness (macro-economic, interest-rate moves, global cues) could drag down banking stocks including Kotak.

Negative corporate/asset-quality news or sector-specific headwinds could hamper even good fundamentals.

Volatility: as with any financial-sector stock, sentiment can swing quickly based on news flow (regulatory announcements, RBI policies, etc.).

Latest share price ≈ ₹ 2,124.40 on NSE/BSE

52-week high ~ ₹ 2,301.90, 52-week low ~ ₹ 1,723.75.

Key fundamentals: P/E ~ 22–23, Book Value ~ ₹ 844, PB ~ 2.5–2.7, dividend yield modest.

⚠️ What could upset the short-term view

Broader market weakness (macro-economic, interest-rate moves, global cues) could drag down banking stocks including Kotak.

Negative corporate/asset-quality news or sector-specific headwinds could hamper even good fundamentals.

Volatility: as with any financial-sector stock, sentiment can swing quickly based on news flow (regulatory announcements, RBI policies, etc.).

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.