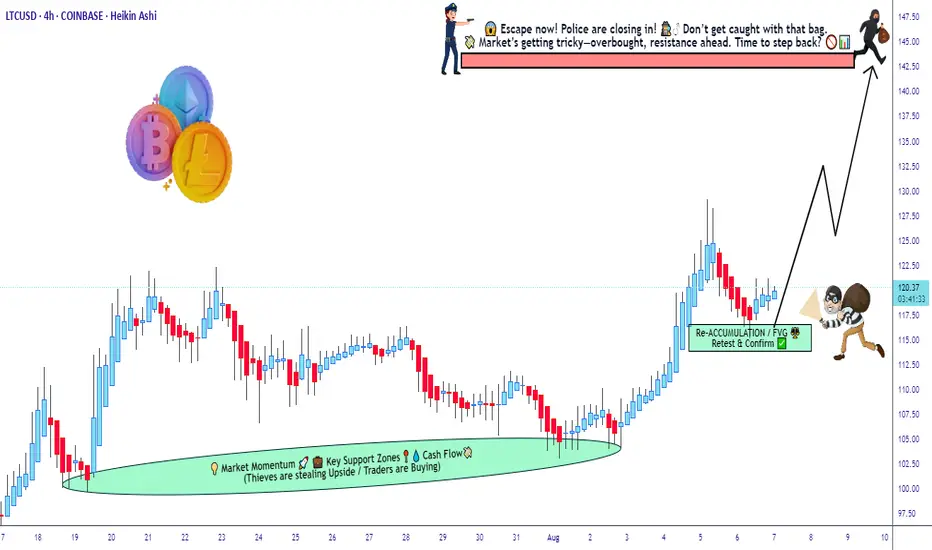

🎯 LTC/USD HEIST ALERT: BULLISH LAYER HEIST PLAN! 💎🚁

PLUNDER PLAN: BULLISH

Thief entering the LTC/USD market with calculated stealth—multi-layered buy-limit entries, master-level layering strategy 🌪️💰

👾 ENTRY STRATEGY:

Stack multiple limit orders at staggered price levels (layering like a patient 🐍 thief)

Enter at any price, staying ready to pounce at key zones, using alerts for breakouts

🛑 STOP LOSS:

Fixed SL at 110.00 USD

Keep tight risk control—stop’s your escape hatch!

🏹 TARGET:

Primary profit target: 143.00 USD

Use trailing stop-loss to lock gains early if momentum fades

🧠 THIEF TRADER TACTICS:

Limit orders only—no chasing

Enter the trend, don’t fight it—avoid shorts during bullish bias

For scalpers: swift layered fills

For swing traders: build position patiently

💎 RISK MANAGEMENT:

Every limit order has a stop-loss

Total risk should be controlled—ideal risk‑reward if full strategy plays out

🔍 MARKET CONTEXT:

Bullish outlook supported by confluence of:

macro themes, sentiment swings, on‑chain flows, and intermarket setups

Layered entries optimize risk while capturing upside

⚠️ Avoid trading during high‑volatility news events

Trailing stops = lock profit & evade chaos

📣 CALL TO ACTION:

💥 If you feel the energy, smash that Like and Follow, comment your plan, and join the crew. Let’s rob the market level by level 🔓🎯

Stay sharp, stay sneaky — see you at the target 🔐

— Thief Trader 🐱👤💵🚀

PLUNDER PLAN: BULLISH

Thief entering the LTC/USD market with calculated stealth—multi-layered buy-limit entries, master-level layering strategy 🌪️💰

👾 ENTRY STRATEGY:

Stack multiple limit orders at staggered price levels (layering like a patient 🐍 thief)

Enter at any price, staying ready to pounce at key zones, using alerts for breakouts

🛑 STOP LOSS:

Fixed SL at 110.00 USD

Keep tight risk control—stop’s your escape hatch!

🏹 TARGET:

Primary profit target: 143.00 USD

Use trailing stop-loss to lock gains early if momentum fades

🧠 THIEF TRADER TACTICS:

Limit orders only—no chasing

Enter the trend, don’t fight it—avoid shorts during bullish bias

For scalpers: swift layered fills

For swing traders: build position patiently

💎 RISK MANAGEMENT:

Every limit order has a stop-loss

Total risk should be controlled—ideal risk‑reward if full strategy plays out

🔍 MARKET CONTEXT:

Bullish outlook supported by confluence of:

macro themes, sentiment swings, on‑chain flows, and intermarket setups

Layered entries optimize risk while capturing upside

⚠️ Avoid trading during high‑volatility news events

Trailing stops = lock profit & evade chaos

📣 CALL TO ACTION:

💥 If you feel the energy, smash that Like and Follow, comment your plan, and join the crew. Let’s rob the market level by level 🔓🎯

Stay sharp, stay sneaky — see you at the target 🔐

— Thief Trader 🐱👤💵🚀

Dagangan aktif

Dagangan ditutup: sasaran tercapai

Partial money looted💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.