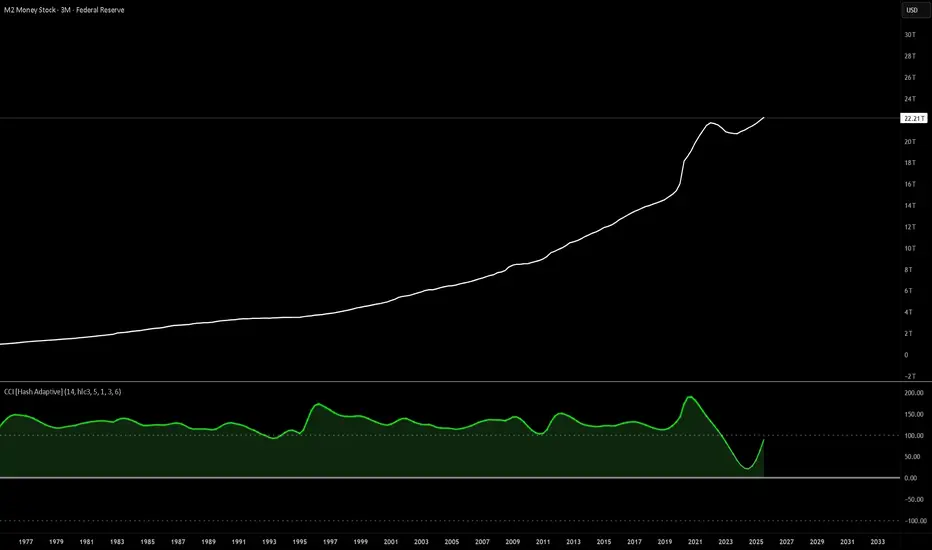

M2 is the bluntest liquidity proxy we’ve got. That white line only really goes one way—and when it accelerates, risk assets don’t argue, they re-rate.

Check the CCI under the chart: triple-digit prints that are frankly absurd for a macro series. That’s the liquidity impulse screaming. When CCI rolls positive and stays there, you tend to get multiple expansion; when it rolled negative in ’22–’23, you got de-rating and chop.

Why it matters (mechanics in one breath):

more dollars chasing the same assets → higher nominal prices, lower real yields → fatter DCFs, easier credit → buybacks/issuance → persistent bid. It’s not about narratives; it’s about liquidity.

Check the CCI under the chart: triple-digit prints that are frankly absurd for a macro series. That’s the liquidity impulse screaming. When CCI rolls positive and stays there, you tend to get multiple expansion; when it rolled negative in ’22–’23, you got de-rating and chop.

Why it matters (mechanics in one breath):

more dollars chasing the same assets → higher nominal prices, lower real yields → fatter DCFs, easier credit → buybacks/issuance → persistent bid. It’s not about narratives; it’s about liquidity.

Quant research firm developing proprietary indicators, trading automation, and risk frameworks for digital & macro markets. Free indicator channel (telegram) t.me/hashcapitalresearchchannel I hashadaptive.com

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Quant research firm developing proprietary indicators, trading automation, and risk frameworks for digital & macro markets. Free indicator channel (telegram) t.me/hashcapitalresearchchannel I hashadaptive.com

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.