📡 META – Institutional Buy Setup Active | VolanX Protocol Update

🧠 Price Intelligence Framework: WaverVanir DSS

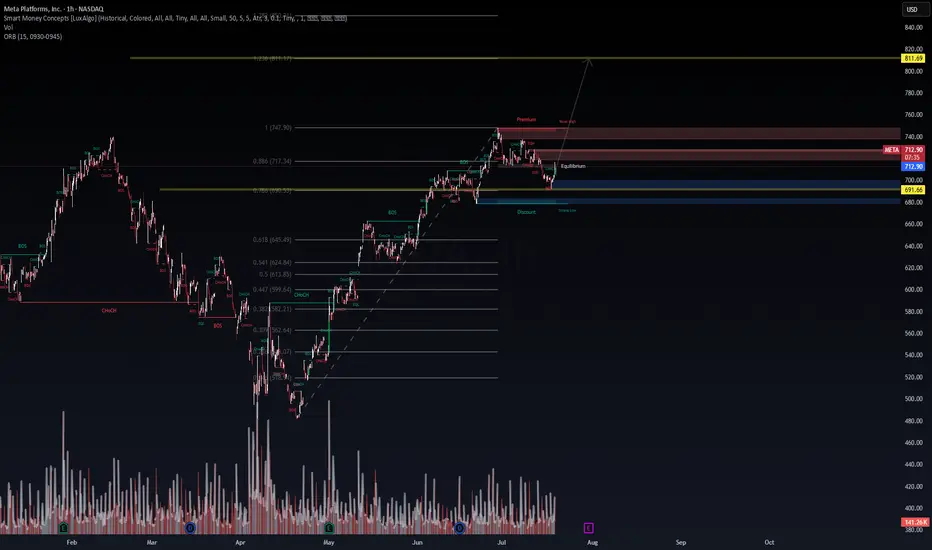

The institutional model forecasts META to reach $760.64 in the next 15 trading days with a 95% confidence interval between $748.81 – $762.83. Signal is confirmed by 9/9 bullish model consensus.

🔍 Smart Money Concepts (SMC)

Price is rebounding from Equilibrium Zone (~$712.98) after discount mitigation. Liquidity structure favors bullish continuation toward:

🎯 Target 1: $727.63

🎯 Target 2: $760.64

🏁 Extended Target: $811.69 (1.272 extension)

📉 Risk Parameters (From DSS):

Entry: $713.36

Stop: $684.68 (4.0% risk)

Risk/Reward: 1.65:1

Volatility: 1.54% (low)

Capital Allocation: 25% of strategy layer

📈 Options Flow Validation:

Unusual activity observed across $720–$750 calls (Jul 25–Aug 22). Institutions are loading positions aggressively with >$2M notional in call sweeps.

Thesis: META is in an SMC bullish structure with alignment from AI forecasting, liquidity mapping, and options flow. VolanX Protocol confirms directional probability with low variance risk.

📌 Watch zone: $760 → $811

📌 Increased momentum if $717.34 (0.886 Fib) breaks cleanly

📌 Invalidation on close below $684

#META #VolanX #WaverVanir #SmartMoneyConcepts #OptionsFlow #TradingView #AITrading #InstitutionalSignals #Fibonacci #BreakoutSetup #LSTMForecast #TechnicalAnalysis

🧠 Price Intelligence Framework: WaverVanir DSS

The institutional model forecasts META to reach $760.64 in the next 15 trading days with a 95% confidence interval between $748.81 – $762.83. Signal is confirmed by 9/9 bullish model consensus.

🔍 Smart Money Concepts (SMC)

Price is rebounding from Equilibrium Zone (~$712.98) after discount mitigation. Liquidity structure favors bullish continuation toward:

🎯 Target 1: $727.63

🎯 Target 2: $760.64

🏁 Extended Target: $811.69 (1.272 extension)

📉 Risk Parameters (From DSS):

Entry: $713.36

Stop: $684.68 (4.0% risk)

Risk/Reward: 1.65:1

Volatility: 1.54% (low)

Capital Allocation: 25% of strategy layer

📈 Options Flow Validation:

Unusual activity observed across $720–$750 calls (Jul 25–Aug 22). Institutions are loading positions aggressively with >$2M notional in call sweeps.

Thesis: META is in an SMC bullish structure with alignment from AI forecasting, liquidity mapping, and options flow. VolanX Protocol confirms directional probability with low variance risk.

📌 Watch zone: $760 → $811

📌 Increased momentum if $717.34 (0.886 Fib) breaks cleanly

📌 Invalidation on close below $684

#META #VolanX #WaverVanir #SmartMoneyConcepts #OptionsFlow #TradingView #AITrading #InstitutionalSignals #Fibonacci #BreakoutSetup #LSTMForecast #TechnicalAnalysis

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.