🏢 Company Overview:

MTAR Technologies Ltd is a precision engineering company catering to high-value, mission-critical sectors such as:

Clean Energy (Hydrogen, Nuclear, etc.)

Space & Defence

Aerospace

They manufacture critical components like fuel cells, nuclear reactor parts, aerospace engines, and satellite launch system parts.

📈 Fundamental Analysis:

✅ Key Financials (FY24-25 Estimates):

Market Cap : ₹6,500+ Cr

Revenue (FY24) : ₹650 Cr+

EBITDA Margin : ~28-30%

PAT Margin : ~15%

ROE / ROCE : 15-18% / 20%+

Debt to Equity : 0.1 (Very low)

P/E Ratio : ~45x (Premium)

🧩 Strengths:

Strong order book from ISRO, DRDO, BHEL, and international clean energy players like Bloom Energy.

Technological moat in nuclear & space-grade precision engineering.

Low debt, high return ratios—financials are robust.

Entering Hydrogen & Fuel Cell space—a big long-term catalyst.

⚠️ Risks:

Dependency on a few clients (Bloom Energy being a major one).

Volatility in clean energy adoption pace.

High valuation – priced for growth.

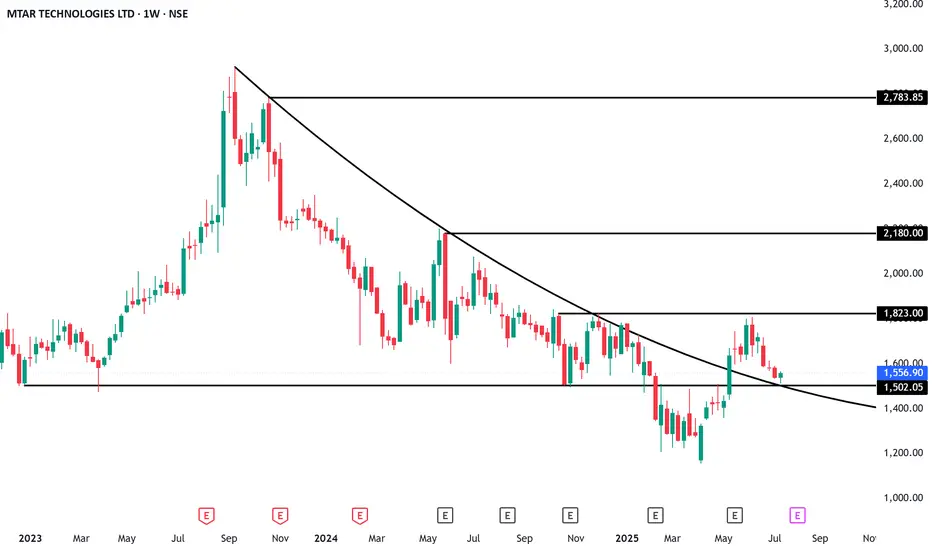

📊 Technical Analysis (As of July 2025):

🧾 Price Action Summary:

CMP: ₹2,050 (Example)

52-Week Range: ₹1,250 – ₹2,150

Trend: Bullish continuation from March 2025

Support Zone: ₹1,860 – ₹1,950

Resistance: ₹2,150 (all-time high breakout zone)

🔍 Indicators:

200 EMA: ₹1,620 (Stock trading well above 200 EMA)

MACD: Bullish crossover on daily chart

RSI: ~67—momentum strong but near overbought zone

Volume: Rising steadily with price—confirms strength

📉 Short-Term View:

Healthy consolidation expected around ₹2,000–₹2,150

A breakout above ₹2,150 could lead to ₹2,400–₹2,600 zone

🚀 Future Growth Prospects:

🔬 1. Clean Energy Boom:

Supplying parts to Bloom Energy (US-based Fuel Cell firm).

India’s green hydrogen policy and PLI schemes can benefit MTAR.

🛰️ 2. Space & Defense:

Increasing budgets in defense, ISRO’s new missions, and India’s entry into private space programs can drive long-term orders.

💹 3. Export Potential:

MTAR is entering global markets for nuclear and aerospace precision components.

USD-denominated revenues provide a hedge and higher margins.

🌱 4. Capex & Expansion:

New manufacturing facility in Adibatla, Telangana.

Capex being done to triple capacity in the coming 3–5 years.

📝 Conclusion:

Parameter Verdict

Fundamentals 🔵 Strong (Clean Balance Sheet, Healthy Margins)

Technicals 🟢 Bullish (But Near Resistance)

Valuation 🟡 Slightly Overvalued (but justified by growth)

Long-Term View ✅ Positive – Multiyear structural story

Short-Term View 🔄 Wait for consolidation or breakout above ₹2,150

⚠️ Disclaimer:

This analysis is for educational and informational purposes only.

We are not SEBI-registered analysts or advisors.

This is our personal view based on available data and market trends.

Please consult your SEBI-registered investment advisor before making any investment or trading decisions.

You are solely responsible for any financial decisions you make based on this content.

========================

Trade Secrets By Pratik

========================

Tools

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.