As investors gear up for this week's consumer and producer price data, Nasdaq ended Monday's session with slight declines, fueling anticipation regarding the Federal Reserve's potential interest rate adjustments in the upcoming months.

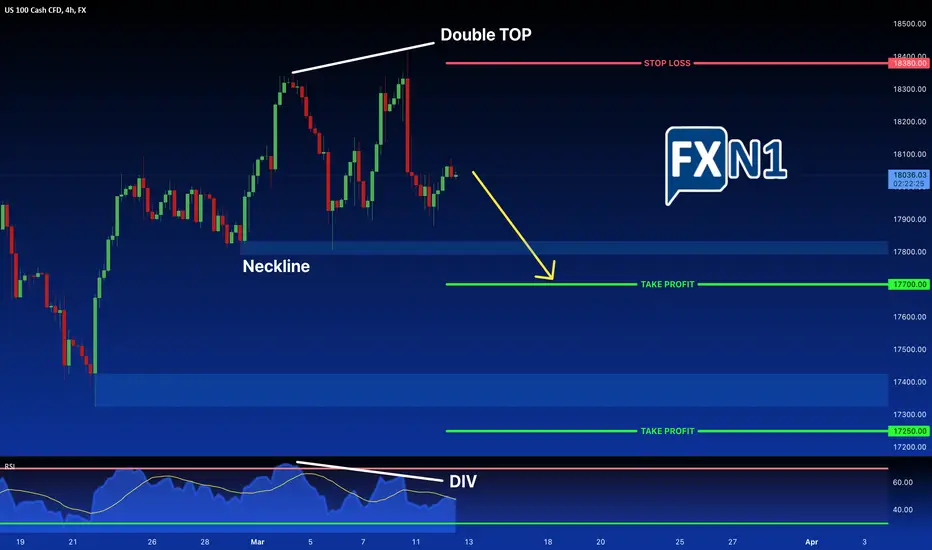

Technically, Nasdaq exhibited a double top formation around the 18400 level, accompanied by RSI indicator divergence. Analysts are eyeing a potential breakdown of the neckline around 17800, with targets set at 17700 and below.

Expectations are high for U.S. consumer price data for February, projecting a monthly increase of 0.4% and a 3.1% rise on an annual basis. The release of this data is poised to significantly impact the markets and potentially confirm the outlined technical analysis.

Last month, the stock market's rally witnessed a slowdown as robust economic indicators emerged, prompting traders to delay their expectations for the first Fed rate cut from March to June.

Technically, Nasdaq exhibited a double top formation around the 18400 level, accompanied by RSI indicator divergence. Analysts are eyeing a potential breakdown of the neckline around 17800, with targets set at 17700 and below.

Expectations are high for U.S. consumer price data for February, projecting a monthly increase of 0.4% and a 3.1% rise on an annual basis. The release of this data is poised to significantly impact the markets and potentially confirm the outlined technical analysis.

Last month, the stock market's rally witnessed a slowdown as robust economic indicators emerged, prompting traders to delay their expectations for the first Fed rate cut from March to June.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Penerbitan berkaitan

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Penerbitan berkaitan

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.