Most traders anchor their sentiment to the official declarations of a recession. But here’s the catch: by the time policymakers and institutions announce “we are in a recession”, the contraction has almost always run its course.

If you are waiting for an official announcement we are in a recession in order to get out, It will be too late. You will likely be selling to the smart money buying for the eventual rise.

The game is rigged against the novice trader relying on generally available news.

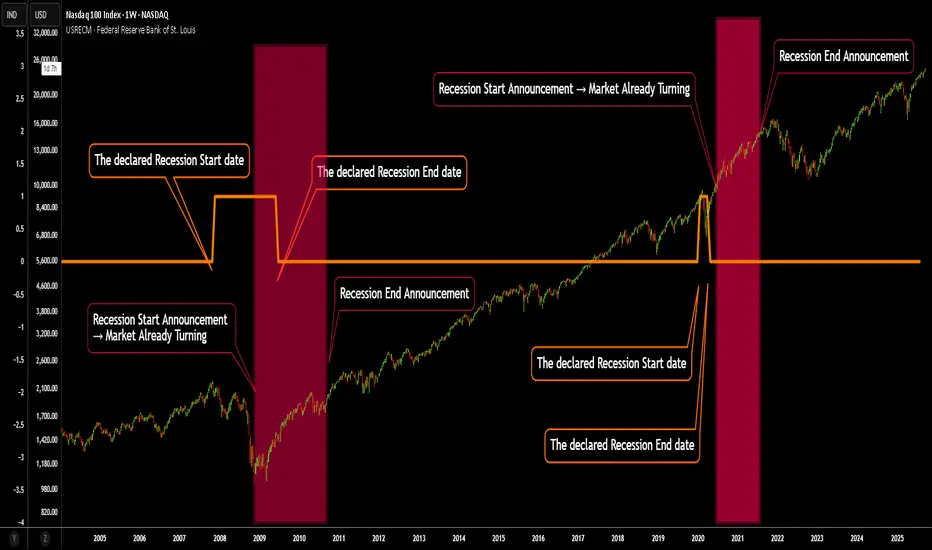

On the chart:

The orange line marks the actual recession periods identified by economic data.

The red background shading highlights when the recession was officially recognized and reported.

Notice the lag: announcements consistently come after the worst is already behind us. Historically, these “recognition windows” line up closer with market bottoms than with tops.

👉 The key takeaway:

When you hear that a recession has been declared, it’s often not a sell signal — it’s closer to a buy signal. By then, the market has already priced in the pain, and recovery is underway.

This perspective flips conventional wisdom on its head: don’t fear the announcement — see it as confirmation that the worst is behind us. And do not wait for it to tell you we are going in to a recession, look at what the smart money is doing, what insiders are doing, what the banks are doing. Many thin that lower interest rates means a boost to business. But they are wrong.

Banks will charge as much as they think the economy can sustain. If Interest rates are rising, they know that business will be doing better. Falling interest rates tells you the banks know they can not get away with charging more and the economy is tanking.

If you are waiting for an official announcement we are in a recession in order to get out, It will be too late. You will likely be selling to the smart money buying for the eventual rise.

The game is rigged against the novice trader relying on generally available news.

On the chart:

The orange line marks the actual recession periods identified by economic data.

The red background shading highlights when the recession was officially recognized and reported.

Notice the lag: announcements consistently come after the worst is already behind us. Historically, these “recognition windows” line up closer with market bottoms than with tops.

👉 The key takeaway:

When you hear that a recession has been declared, it’s often not a sell signal — it’s closer to a buy signal. By then, the market has already priced in the pain, and recovery is underway.

This perspective flips conventional wisdom on its head: don’t fear the announcement — see it as confirmation that the worst is behind us. And do not wait for it to tell you we are going in to a recession, look at what the smart money is doing, what insiders are doing, what the banks are doing. Many thin that lower interest rates means a boost to business. But they are wrong.

Banks will charge as much as they think the economy can sustain. If Interest rates are rising, they know that business will be doing better. Falling interest rates tells you the banks know they can not get away with charging more and the economy is tanking.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.