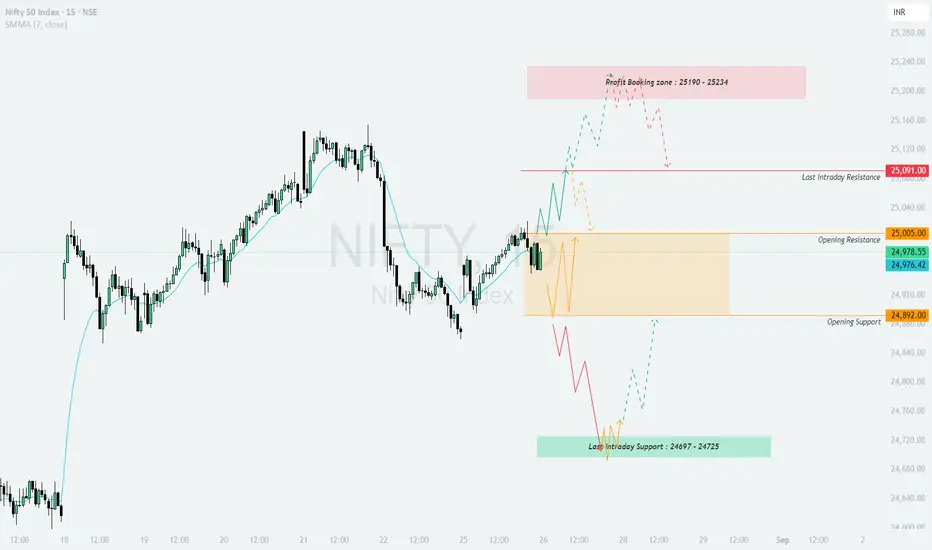

📊 NIFTY TRADING PLAN – 26-Aug-2025

On 25-Aug-2025, Nifty closed at 24,978, positioned between critical levels. The key support and resistance zones for tomorrow are:

Opening Support: 24,892

Opening Resistance: 25,005

Last Intraday Resistance: 25,091

Profit Booking Zone: 25,190 – 25,234

Last Intraday Support: 24,697 – 24,725

Now let’s go through possible scenarios.

🔼 1. Gap-Up Opening (100+ points above 25,091)

If Nifty opens above 25,091, it directly enters the bullish zone.

📌 Plan of Action:

👉 Tip: On gap-ups, avoid aggressive buying at open. Wait for retracements near support to enter for better risk–reward.

➖ 2. Flat Opening (Around 24,892 – 25,005)

A flat start around the opening support–resistance zone will be a deciding factor for intraday trend.

📌 Plan of Action:

👉 Tip: For options traders, flat openings are best for straddle/strangle adjustments. Capture volatility once direction confirms.

🔽 3. Gap-Down Opening (100+ points below 24,892)

If Nifty opens below 24,892, it will show bearish pressure right from the start.

📌 Plan of Action:

👉 Tip: After a gap-down, use put spreads instead of naked puts to manage risk in case of sharp reversals.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 25,091 → 25,190–25,234 (Profit Booking Zone).

🟧 Flat around 24,892–25,005 = Wait for breakout/breakdown confirmation.

🔴 Below 24,892 → 24,725–24,697 (Buyer’s defense zone).

Key Pivot: 24,892 – 25,005 zone for intraday trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading/investment decisions.

On 25-Aug-2025, Nifty closed at 24,978, positioned between critical levels. The key support and resistance zones for tomorrow are:

Opening Support: 24,892

Opening Resistance: 25,005

Last Intraday Resistance: 25,091

Profit Booking Zone: 25,190 – 25,234

Last Intraday Support: 24,697 – 24,725

Now let’s go through possible scenarios.

🔼 1. Gap-Up Opening (100+ points above 25,091)

If Nifty opens above 25,091, it directly enters the bullish zone.

📌 Plan of Action:

- [] Watch for sustainability above 25,091 in the first 15–30 minutes. If sustained, the index can march towards the Profit Booking Zone 25,190 – 25,234.

[] In this zone, expect some consolidation or profit booking. Fresh long positions should be cautious here.

[] If 25,234 is taken out convincingly, it may lead to another strong rally, but chasing at higher levels 🚫 is risky.

[] Failure to sustain above 25,091 may result in a pullback toward the 25,005 – 24,892 zone.

👉 Tip: On gap-ups, avoid aggressive buying at open. Wait for retracements near support to enter for better risk–reward.

➖ 2. Flat Opening (Around 24,892 – 25,005)

A flat start around the opening support–resistance zone will be a deciding factor for intraday trend.

📌 Plan of Action:

- [] If Nifty sustains above 25,005, it will likely attempt a breakout towards 25,091 → 25,190–25,234 zone.

[] Failure to hold 24,892 will open downside towards 24,725 – 24,697 (Last Intraday Support). - In flat openings, the first 30 minutes are crucial. Let the index pick direction before entering.

👉 Tip: For options traders, flat openings are best for straddle/strangle adjustments. Capture volatility once direction confirms.

🔽 3. Gap-Down Opening (100+ points below 24,892)

If Nifty opens below 24,892, it will show bearish pressure right from the start.

📌 Plan of Action:

- [] Below 24,892, the index can test the Last Intraday Support Zone: 24,725 – 24,697.

[] Buyers may attempt to defend this support, so expect a bounce opportunity here (good for scalpers).

[] If 24,697 is broken with volume, further downside continuation may occur.

[] Avoid panic shorts at the open — wait for a retest of resistance before entering for safer trades.

👉 Tip: After a gap-down, use put spreads instead of naked puts to manage risk in case of sharp reversals.

🛡️ Risk Management Tips for Options Traders

- [] Risk only 1–2% of your capital per trade.

[] Always trade with a defined stop-loss. Do not average losing positions.

[] Avoid over-leveraging, especially in weekly expiry sessions ⚡.

[] Prefer spreads (Bull Call, Bear Put, Iron Condors) to reduce premium decay impact. - Track India VIX 📉 before entering — high VIX means bigger moves, low VIX means range-bound.

📌 Summary & Conclusion

🟢 Above 25,091 → 25,190–25,234 (Profit Booking Zone).

🟧 Flat around 24,892–25,005 = Wait for breakout/breakdown confirmation.

🔴 Below 24,892 → 24,725–24,697 (Buyer’s defense zone).

Key Pivot: 24,892 – 25,005 zone for intraday trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading/investment decisions.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.