📊 NIFTY TRADING PLAN — 20 NOV 2025

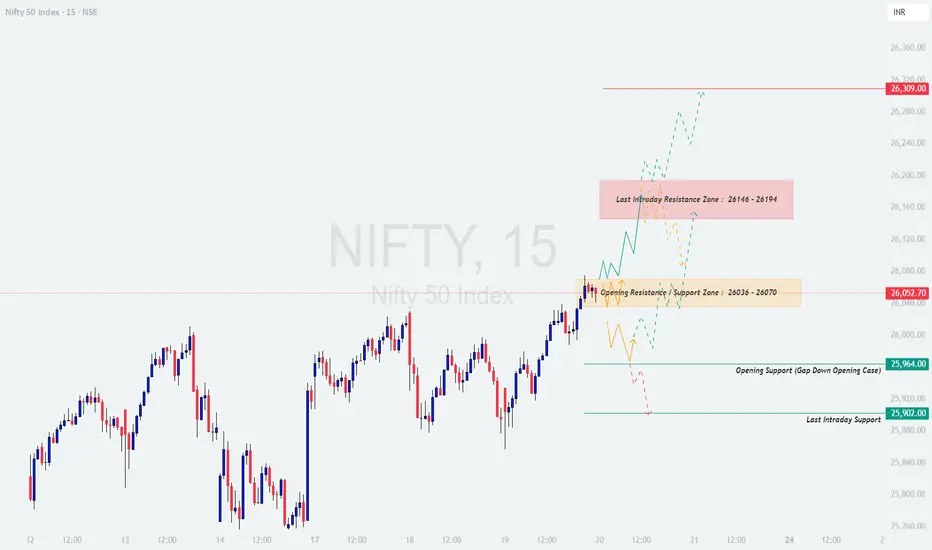

(Reference: 15-min chart structure & key intraday levels)

Nifty closed around 26,052, sitting just above the Opening Resistance / Support Zone (26,036 – 26,070). Price action is now heading toward a crucial supply area above 26,140–26,194, and short-term structure suggests volatility around the opening price.

Here are the major actionable levels for 20 Nov 2025:

🟧 Opening Resistance / Support Zone: 26,036 – 26,070

🟥 Last Intraday Resistance Zone: 26,146 – 26,194

🟥 Major Resistance: 26,309

🟩 Opening Support (Gap-down case): 25,964

🟩 Last Intraday Support: 25,902

Below is the complete plan for all opening scenarios 👇

🟢 SCENARIO 1 — GAP-UP OPENING (100+ Points)

If Nifty opens around 26,150–26,200, this places price directly inside or just under the Last Intraday Resistance Zone (26,146–26,194).

📘 Educational Note:

Gap-ups work best only when price makes higher lows after the open. A flat or weak first candle at resistance often signals exhaustion.

🟧 SCENARIO 2 — FLAT OPENING (Near 26,020–26,070)

A flat open places Nifty inside the Opening Resistance / Support Zone (26,036–26,070) — a decision region.

💡 Educational tip:

Flat openings are ideal for trend identification. The first 15-min candle usually gives strong directional clues — don’t rush in.

🔻 SCENARIO 3 — GAP-DOWN OPENING (100+ Points)

A gap-down below 25,970 puts price directly into the Opening Support zone (25,964).

📘 Educational Note:

Gap-downs into support often give the strongest reversal trades of the day — but only after confirmation.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 💡

⚠️ Golden Rule:

Your objective is to survive long enough to catch the big moves — protect your capital first.

📌 SUMMARY

Bullish above → 26,070

Target zone → 26,110 → 26,146 → 26,194 → 26,309

Bearish below → 25,964

Target zone → 25,902 → 25,860 → 25,820

Key No-Trade Areas:

— 26,036–26,070 (Flat opening zone)

— 26,150–26,194 (High-risk supply zone)

🧾 CONCLUSION

Nifty is trading near a heavy resistance cluster, and the market’s reaction to the 26,070 level will define the day’s trend.

The cleanest and safest trades will come from:

✔️ Breakout & retest above 26,070

✔️ Reversal from 25,964

✔️ Momentum breakout above 26,194

Avoid trading inside choppy zones and let the market reveal its direction.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please consult a certified financial advisor before making any trading or investment decisions.

(Reference: 15-min chart structure & key intraday levels)

Nifty closed around 26,052, sitting just above the Opening Resistance / Support Zone (26,036 – 26,070). Price action is now heading toward a crucial supply area above 26,140–26,194, and short-term structure suggests volatility around the opening price.

Here are the major actionable levels for 20 Nov 2025:

🟧 Opening Resistance / Support Zone: 26,036 – 26,070

🟥 Last Intraday Resistance Zone: 26,146 – 26,194

🟥 Major Resistance: 26,309

🟩 Opening Support (Gap-down case): 25,964

🟩 Last Intraday Support: 25,902

Below is the complete plan for all opening scenarios 👇

🟢 SCENARIO 1 — GAP-UP OPENING (100+ Points)

If Nifty opens around 26,150–26,200, this places price directly inside or just under the Last Intraday Resistance Zone (26,146–26,194).

- []If price sustains above 26,194 for 10–20 minutes with strong volume →

⭐ Upside targets → 26,245 → 26,280 → 26,309

[]If price rejects 26,146–26,194, expect a correction toward:

➡️ 26,100 → 26,070

[]A bullish retest at 26,070 with reversal candles offers a safe long entry.

[]Avoid buying immediately at open — gap-ups near resistance often trap traders.

📘 Educational Note:

Gap-ups work best only when price makes higher lows after the open. A flat or weak first candle at resistance often signals exhaustion.

🟧 SCENARIO 2 — FLAT OPENING (Near 26,020–26,070)

A flat open places Nifty inside the Opening Resistance / Support Zone (26,036–26,070) — a decision region.

- []A clean breakout above 26,070 →

Targets → 26,110 → 26,146 → 26,194

[]If price breaks below 26,036, expect a drop to:

➡️ 25,964 (Opening Support)

[]Avoid trading inside the 26,030–26,070 zone until direction is clear.

[]Best trades will be:

— Breakout → Retest → Continuation

— Support bounce from 25,964

💡 Educational tip:

Flat openings are ideal for trend identification. The first 15-min candle usually gives strong directional clues — don’t rush in.

🔻 SCENARIO 3 — GAP-DOWN OPENING (100+ Points)

A gap-down below 25,970 puts price directly into the Opening Support zone (25,964).

- []If 25,964 holds with bullish wick rejection →

Upside targets → 26,020 → 26,070 → 26,110

[]If price breaks 25,964 decisively, next support zone:

➡️ 25,902 (Last Intraday Support)

[]A strong bounce from 25,902 can provide an excellent low-risk long entry.

[]If 25,902 breaks with momentum, downside expands to:

➡️ 25,860 → 25,820

📘 Educational Note:

Gap-downs into support often give the strongest reversal trades of the day — but only after confirmation.

💼 RISK MANAGEMENT TIPS FOR OPTION TRADERS 💡

- []Avoid trading the first 5–10 minutes after market opens.

[]Use ATM or ITM options for directional trades.

[]Define your stop loss BEFORE entering — never adjust it emotionally.

[]Avoid averaging in losing positions.

[]When VIX is low → option buying works better.

[]When VIX is high → prefer hedged option selling strategies. - Book partial profits — don’t wait for full target if momentum weakens.

⚠️ Golden Rule:

Your objective is to survive long enough to catch the big moves — protect your capital first.

📌 SUMMARY

Bullish above → 26,070

Target zone → 26,110 → 26,146 → 26,194 → 26,309

Bearish below → 25,964

Target zone → 25,902 → 25,860 → 25,820

Key No-Trade Areas:

— 26,036–26,070 (Flat opening zone)

— 26,150–26,194 (High-risk supply zone)

🧾 CONCLUSION

Nifty is trading near a heavy resistance cluster, and the market’s reaction to the 26,070 level will define the day’s trend.

The cleanest and safest trades will come from:

✔️ Breakout & retest above 26,070

✔️ Reversal from 25,964

✔️ Momentum breakout above 26,194

Avoid trading inside choppy zones and let the market reveal its direction.

⚠️ DISCLAIMER

I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please consult a certified financial advisor before making any trading or investment decisions.

Dagangan ditutup: sasaran tercapai

Charts don’t lie — and neither do my levels. Accuracy delivered.Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.