b]📊 NIFTY 50 INTRADAY PLAN – 14 JULY 2025 (15-Min Chart Study)

Educational insights for all opening scenarios: Gap-Up, Flat, and Gap-Down.

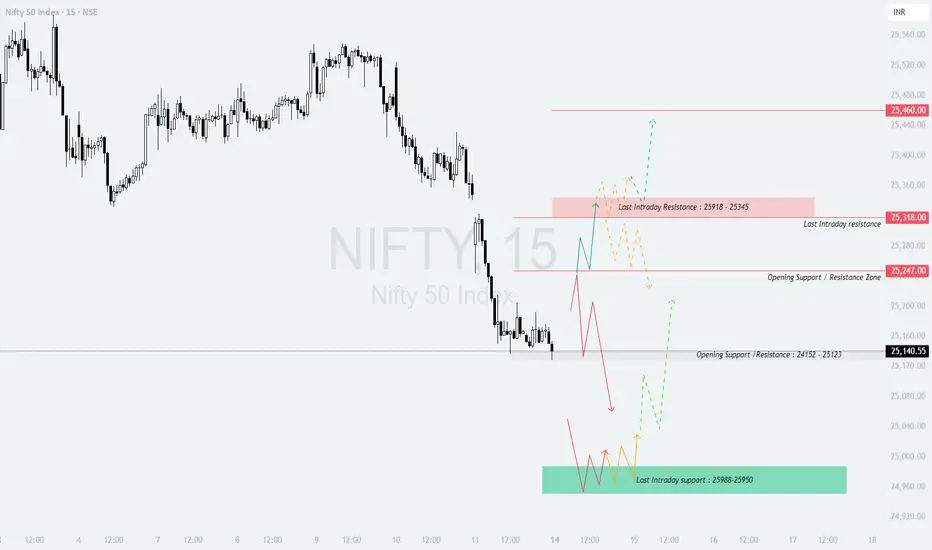

📌 KEY LEVELS TO MONITOR

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,247) 📈

Bias: Bullish continuation possible

📊 SCENARIO 2: FLAT OPENING (Near 25,140 – 25,152) 🔄

Bias: Neutral-to-bearish bias

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,050) ⚠️

Bias: Bearish with bounce attempt from lower supports

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

📌 SUMMARY & CONCLUSION

Educational insights for all opening scenarios: Gap-Up, Flat, and Gap-Down.

📍 Previous Close: 25,140.55

📌 Gap opening threshold considered: 100+ points

⏱️ Tip: Let the first 15–30 minutes settle before entering trades based on levels.

📌 KEY LEVELS TO MONITOR

- []Resistance Zone: 25,460

[]Last Intraday Resistance: 25,318

[]Opening Support / Resistance Zone: 25,247

[]Opening Support / Resistance Zone: 25,152 – 25,123 - Last Intraday Support Zone: 25,088 – 25,050

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,247) 📈

Bias: Bullish continuation possible

- []If Nifty opens above 25,247, watch for continuation towards 25,318 (Last Intraday Resistance).

[]Sustainable strength above 25,318 can lead to 25,460. That’s the upper profit booking zone.

[]If price shows exhaustion candles near 25,460, avoid fresh longs. Instead, look for selling opportunities with tight stop-loss.

[]Options Traders: Prefer ATM or slightly ITM calls; avoid chasing far OTM CE after gap-up. Time decay will be sharp in such cases.

📊 SCENARIO 2: FLAT OPENING (Near 25,140 – 25,152) 🔄

Bias: Neutral-to-bearish bias

- []If the market opens around 25,140 – 25,152, focus on whether the 25,152 – 25,123 zone holds as support or flips as resistance.

[]If price holds above 25,152, there’s potential for a bounce towards 25,247.

[]If price breaks and sustains below 25,123, expect a gradual drift towards the Last Intraday Support: 25,088 – 25,050.

[]Avoid quick trades here — observe the first 30 minutes’ range before committing capital.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,050) ⚠️

Bias: Bearish with bounce attempt from lower supports

- []If Nifty opens below 25,050, immediate attention should be given to Last Intraday Support: 25,088 – 25,050.

[]If that zone breaks, next major support becomes psychological round numbers or extreme supports which may form intraday.

[]Aggressive selling should only be considered if prices show no reaction around this zone. Watch for hammer or reversal patterns before taking contra long trades.

[]Options Traders: Avoid buying deep OTM puts after a large gap-down as premiums often get inflated due to IV spikes.

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

- []Focus on ATM or ITM strikes to reduce theta impact on both CE and PE buying.

[]Apply Stop-Loss based on 15-minute candle closes instead of absolute price ticks to avoid noise.

[]If VIX is high, hedge with vertical spreads instead of naked options buying.

[]Strictly maintain a 1–2% max risk of your capital per trade.

[]Avoid over-trading after 2:45 PM as theta erosion accelerates in options.

[]Keep tracking Bank Nifty as well for broader market cues.

📌 SUMMARY & CONCLUSION

- []Bullish Trigger: Above 25,247 → Target 25,318 – 25,460

[]Neutral Zone: 25,140 – 25,152 → Wait and watch zone

[]Bearish Trigger: Below 25,123 → Watch 25,088 – 25,050 for bounce

[]Keep your discipline intact and avoid emotional trades. - Options premium decay is real — always respect time and structure.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please do your own analysis or consult with a financial advisor before making trading decisions.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.