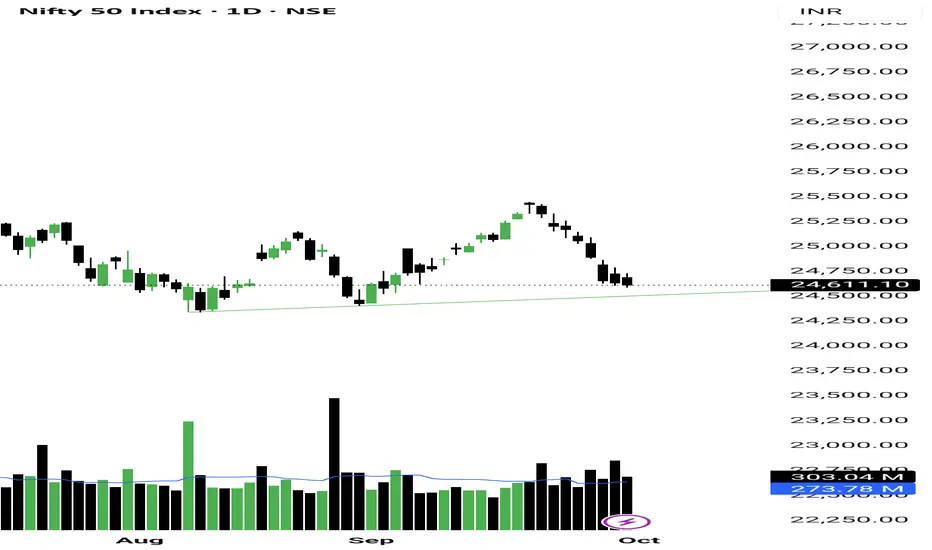

This is the 2nd straight session where  NIFTY price closed below the day low but buyers’ volume was higher.

NIFTY price closed below the day low but buyers’ volume was higher.

Red candle + green volume = a clear institutional accumulation footprint.

On top of that, the retailers index is going down, which confirms the view even more.

Normally, after yesterday’s strong buyers’ volume, we should have seen a bounce in the index today. But thanks to the weekly + monthly expiry, price was suppressed.

That suppression means one thing – the market can pop out anytime.

Remember the 3-step process I shared before:

1. Accumulation

2. Manipulation

3. Distribution (uptrend)

Right now we’re in the accumulation phase. A manipulation phase cannot be ruled out – it could come as a direct drop or a bounce with sell-on-rise characteristics. So, watch closely over the next 2–3 days.

Personally, I think from next week we’ll enter the 3rd phase – distribution or simply, the uptrend. Until then, accumulating dips whenever buyers’ volume is up is the right strategy. That’s exactly what I’m doing.

Now for tomorrow:

– Pivot is at 24644, PP is 0.13%

– If index opens above the pivot and holds on the hourly chart, we can see a sharp move to 24760 / 24880

– Downside support is at 24570

Sector-wise, PSU Banks and Metals are looking strong.

I’m holding HINDZINC and added

HINDZINC and added  REDINGTON today. I won’t be adding more until market breadth improves.

REDINGTON today. I won’t be adding more until market breadth improves.

That’s all for today. Take care. Have a profitable tomorrow.

---

📊 Levels at a glance:

Pivot: 24644

Support: 24570

Resistance 1: 24760

Resistance 2: 24880

Pivot Percentile: 0.13% (sharp move possible)

Bias: Accumulation phase, buy dips on buyers’ volume uptick

Sectors to watch: CNXPSUBANK ,

CNXPSUBANK ,  CNXMETAL

CNXMETAL

Red candle + green volume = a clear institutional accumulation footprint.

On top of that, the retailers index is going down, which confirms the view even more.

Normally, after yesterday’s strong buyers’ volume, we should have seen a bounce in the index today. But thanks to the weekly + monthly expiry, price was suppressed.

That suppression means one thing – the market can pop out anytime.

Remember the 3-step process I shared before:

1. Accumulation

2. Manipulation

3. Distribution (uptrend)

Right now we’re in the accumulation phase. A manipulation phase cannot be ruled out – it could come as a direct drop or a bounce with sell-on-rise characteristics. So, watch closely over the next 2–3 days.

Personally, I think from next week we’ll enter the 3rd phase – distribution or simply, the uptrend. Until then, accumulating dips whenever buyers’ volume is up is the right strategy. That’s exactly what I’m doing.

Now for tomorrow:

– Pivot is at 24644, PP is 0.13%

– If index opens above the pivot and holds on the hourly chart, we can see a sharp move to 24760 / 24880

– Downside support is at 24570

Sector-wise, PSU Banks and Metals are looking strong.

I’m holding

That’s all for today. Take care. Have a profitable tomorrow.

---

📊 Levels at a glance:

Pivot: 24644

Support: 24570

Resistance 1: 24760

Resistance 2: 24880

Pivot Percentile: 0.13% (sharp move possible)

Bias: Accumulation phase, buy dips on buyers’ volume uptick

Sectors to watch:

TrendX INC

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

TrendX INC

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.