✅ Current Market Status:

Closing Price: ₹24,972.50

Change: –95.20 points

Percentage Change: –0.38%

Day’s Range: ₹24,905.60 – ₹25,095.10

52-Week Range: ₹19,638.30 – ₹25,194.60

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹24,900 – Intraday low and key psychological level

Support 2: ₹24,750 – Previous breakout zone

Support 3: ₹24,500 – Short-term trendline base

📌 Resistance Zones:

Resistance 1: ₹25,100 – Day’s high and minor barrier

Resistance 2: ₹25,200 – All-time high

Resistance 3: ₹25,500 – Next potential rally target if breakout succeeds

🕯️ Candlestick Pattern:

Recent Candle: Bearish candle after range-bound session

Price Action: Failed to sustain above ₹25,100

Implication: Weakness around highs, possible pullback toward support

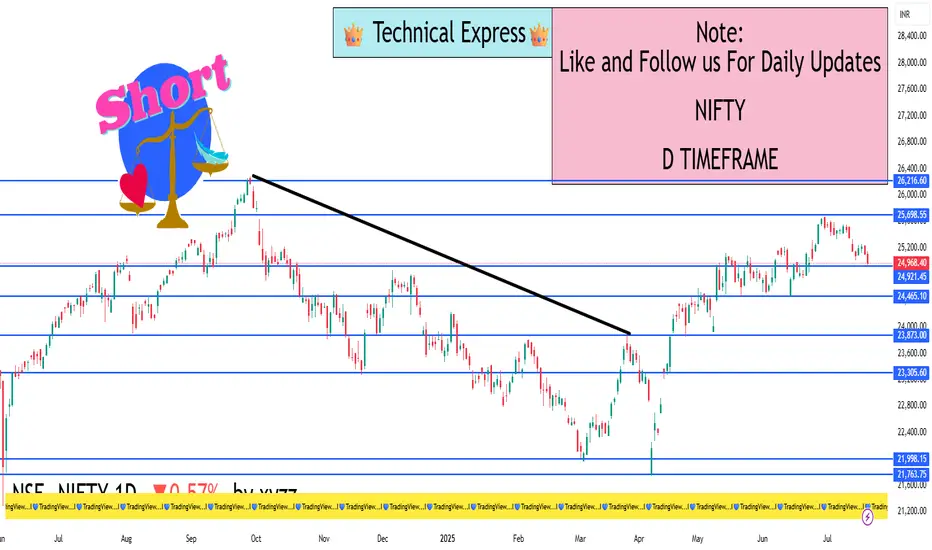

📊 Market Structure Summary:

Nifty formed a double top near ₹25,200, indicating exhaustion

Currently testing ₹24,900 – if broken, next support is ₹24,750

A breakout will only be valid above ₹25,200 with strong volume

🧠 Institutional Behavior:

Likely profit booking near highs

No major signs of heavy accumulation

May re-enter above ₹25,200 or below ₹24,500 for value buying

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Watch Levels: ₹24,900 (support) and ₹25,200 (resistance)

✅ Buyers: Wait for breakout above ₹25,200

⚠️ Sellers: Watch for breakdown below ₹24,900 or ₹24,750

Closing Price: ₹24,972.50

Change: –95.20 points

Percentage Change: –0.38%

Day’s Range: ₹24,905.60 – ₹25,095.10

52-Week Range: ₹19,638.30 – ₹25,194.60

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹24,900 – Intraday low and key psychological level

Support 2: ₹24,750 – Previous breakout zone

Support 3: ₹24,500 – Short-term trendline base

📌 Resistance Zones:

Resistance 1: ₹25,100 – Day’s high and minor barrier

Resistance 2: ₹25,200 – All-time high

Resistance 3: ₹25,500 – Next potential rally target if breakout succeeds

🕯️ Candlestick Pattern:

Recent Candle: Bearish candle after range-bound session

Price Action: Failed to sustain above ₹25,100

Implication: Weakness around highs, possible pullback toward support

📊 Market Structure Summary:

Nifty formed a double top near ₹25,200, indicating exhaustion

Currently testing ₹24,900 – if broken, next support is ₹24,750

A breakout will only be valid above ₹25,200 with strong volume

🧠 Institutional Behavior:

Likely profit booking near highs

No major signs of heavy accumulation

May re-enter above ₹25,200 or below ₹24,500 for value buying

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Watch Levels: ₹24,900 (support) and ₹25,200 (resistance)

✅ Buyers: Wait for breakout above ₹25,200

⚠️ Sellers: Watch for breakdown below ₹24,900 or ₹24,750

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.