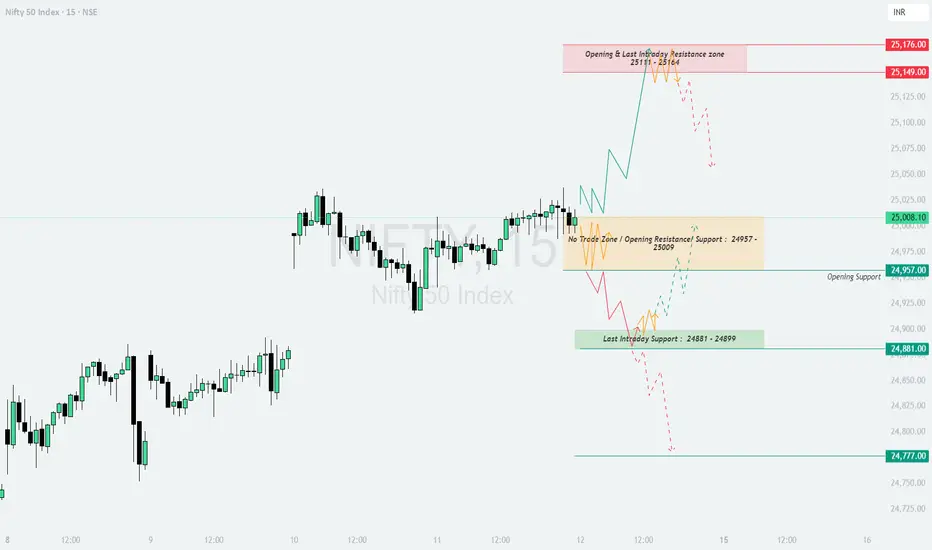

NIFTY TRADING PLAN – 12-Sep-2025

📈 Current Spot: 25,008

🔑 Key Levels to Watch:

Opening & Last Intraday Resistance Zone: 25,111 – 25,124

Intermediate Resistance: 25,176

No Trade Zone / Neutral Area: 24,957 – 25,009

Opening Support: 24,957

Last Intraday Support: 24,881 – 24,899

Major Support: 24,777

🔹 Scenario 1: Gap-Up Opening (100+ Points above 25,108)

📌 Educational Insight: Large gap-ups near resistance often trap late buyers. Smart traders wait for confirmation of strength above resistance before entering long trades.

🚨 Risk Tip: In case of a failed breakout, switch to defensive mode and avoid averaging calls. Focus on reversals toward support zones for better entries.

🔹 Scenario 2: Flat Opening (Between 24,957 – 25,009)

📌 Educational Insight: Sideways openings are best handled with patience. Overtrading in the “No Trade Zone” often results in whipsaws.

🚨 Risk Tip: Use smaller position sizes and strict stop-loss when trading flat openings. Better to wait for clear breakouts than to force trades.

🔹 Scenario 3: Gap-Down Opening (100+ Points below 24,908)

📌 Educational Insight: Gap-downs into strong support zones often create oversold bounces. Always look for confirmation before entering short trades.

🚨 Risk Tip: Instead of naked put buying after gap-downs, consider spreads (Bear Put Spread) to balance premium decay.

📝 Summary & Conclusion

Bullish above: 25,111 → Targets: 25,124 / 25,176

Neutral Zone: 24,957 – 25,009 (avoid overtrading)

Bearish below: 24,881 → Next support: 24,777

📌 Focus on the Resistance Zone 25,111 – 25,124 for bullish breakouts and Support Zone 24,881 – 24,899 for bearish breakdowns.

💡 Options Tip: Always align with the trend. Avoid OTM strikes in choppy zones; prefer ATM/ITM for directional moves.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This plan is for educational purposes only. Please do your own analysis or consult a financial advisor before making any trading decisions.

📈 Current Spot: 25,008

🔑 Key Levels to Watch:

Opening & Last Intraday Resistance Zone: 25,111 – 25,124

Intermediate Resistance: 25,176

No Trade Zone / Neutral Area: 24,957 – 25,009

Opening Support: 24,957

Last Intraday Support: 24,881 – 24,899

Major Support: 24,777

🔹 Scenario 1: Gap-Up Opening (100+ Points above 25,108)

- [] If Nifty opens above 25,108, it will directly test the Resistance Zone 25,111 – 25,124.

[] Sustaining above this zone with strong momentum can extend the rally toward 25,176, which will be a crucial profit-booking zone. - Failure to hold above 25,111 – 25,124 may trigger a pullback back into the No Trade Zone (25,009 – 24,957).

📌 Educational Insight: Large gap-ups near resistance often trap late buyers. Smart traders wait for confirmation of strength above resistance before entering long trades.

🚨 Risk Tip: In case of a failed breakout, switch to defensive mode and avoid averaging calls. Focus on reversals toward support zones for better entries.

🔹 Scenario 2: Flat Opening (Between 24,957 – 25,009)

- [] If Nifty opens flat in the No Trade Zone, wait for a breakout or breakdown to confirm direction.

[] A breakout above 25,009 opens the door to test 25,111 – 25,124 resistance, and eventually 25,176 if strength persists. - A breakdown below 24,957 will shift focus to 24,881 – 24,899, where buyers may attempt to defend.

📌 Educational Insight: Sideways openings are best handled with patience. Overtrading in the “No Trade Zone” often results in whipsaws.

🚨 Risk Tip: Use smaller position sizes and strict stop-loss when trading flat openings. Better to wait for clear breakouts than to force trades.

🔹 Scenario 3: Gap-Down Opening (100+ Points below 24,908)

- [] If Nifty opens below 24,908, it will put pressure on the Last Intraday Support Zone (24,881 – 24,899).

[] Breaking below this zone decisively can drag prices toward the next strong support at 24,777. - If the index defends 24,881 – 24,899 and rebounds, a short-covering move back toward 24,957 – 25,009 is possible.

📌 Educational Insight: Gap-downs into strong support zones often create oversold bounces. Always look for confirmation before entering short trades.

🚨 Risk Tip: Instead of naked put buying after gap-downs, consider spreads (Bear Put Spread) to balance premium decay.

📝 Summary & Conclusion

Bullish above: 25,111 → Targets: 25,124 / 25,176

Neutral Zone: 24,957 – 25,009 (avoid overtrading)

Bearish below: 24,881 → Next support: 24,777

📌 Focus on the Resistance Zone 25,111 – 25,124 for bullish breakouts and Support Zone 24,881 – 24,899 for bearish breakdowns.

💡 Options Tip: Always align with the trend. Avoid OTM strikes in choppy zones; prefer ATM/ITM for directional moves.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This plan is for educational purposes only. Please do your own analysis or consult a financial advisor before making any trading decisions.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.